The majority of Australian voters are opposed to an increae in the nation's Goods and Services Tax (GST) from 10 percent to 15 percent, a poll result showed on Monday.

Construction, real estate development, financial services and consumer services will be included in China's corporate tax reform program.

According to the Times of India, the government of India plans to halve pending tax disputes as it looks to make the tax administration citizen-friendly.

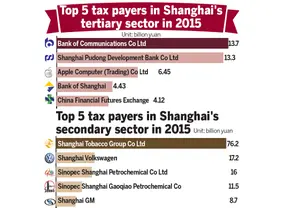

The gap between the tertiary and the secondary industry has widened further in the past 12 months, with the former accelerating its development pace.

The Australian Taxation Office (ATO) has on Thursday revealed that near 600 of Australia's top earning companies did not pay any tax in 2014.

Australia's state and territory leaders have agreed with a proposal for indefinite detention of convicted terrorists, a similar measure used for convicted paedophiles unless they can prove they have reformed.

The Government's new travel tax is to come in on January 1, adding $21.57 to the price of a round trip air fare to and from this country.

Taking up the G20 presidency in 2016, China will advance the implementation of the newly approved Base Erosion and Profit Shifting (BEPS) Action plan, said Chinese Finance Minister Lou Jiwei during the on-going World Bank Group and International Monetary Fund Annual Meetings in Lima on Friday.

For businessman Abdul Mazid paying taxes was always a hassle. As a law-abiding citizen, Mazid was willing to pay his taxes but his problem was that he does not know how to compute his taxes and where to pay.

The Japanese government is discussing the idea of lengthening tax incentives for cars that are eco-friendly by one year, to tentatively end in March 2017 in a refresh bid to boost slumping domestic sales, local media reported Wednesday.

The State Council, China's cabinet, on Wednesday decided to extend tax breaks to more small businesses, recognition of their roles in generating jobs and growth.

China's tax watchdog on Monday promised to improve the export-tax rebate service in a bid to facilitate foreign trade.

The Greek government's proposal for a debt deal with lenders to avoid a looming bankruptcy and Grexit was submitted late Thursday night to the institutions and the Greek parliament.

A large accounting firm has released a report, saying multinational corporations need to move fast to counter bad media publicity rather then pay more tax.

The European Commission on Wednesday said a new EU approach to corporate taxation is needed to successfully address tax abuse after an orientation debate between the college of commissioners.

Australia's treasurer, Joe Hockey, announced on Tuesday a financial crime taskforce to fight tax dodgers and organized crime.

The plans of Australia's treasurer to get multinationals, such as Google and Apple, to pay more tax may violate international tax treaties, the country's parliamentary budget office has found.