"Our plant is back to a two-shift operation and we see a very strong recovery."

That's Jochen Goller, the head of German car brand BMW's China operations. He gave an interview to CGTN Europe to explain how and why the firm is reopening its plants and offices in the country after several weeks of lockdown. You can read the full interview below.

The global oil market remains cautious after the leading U.S. price barometer fell into minus figures for the first time in history yesterday. The rout was sparked by a shortage of storage space in the U.S. thanks to the dip in demand. Sea-based crude has not faced the same issue, which is why not all global oil markets have crashed in the same way.

Amid the pandemic and shutdowns, lockdowns and foreclosures, Silicon Valley pioneer Apple has said it will expand to at least 53 new markets across Africa and the Middle East, with flexible pricing structures, though no date for the move has yet been revealed.

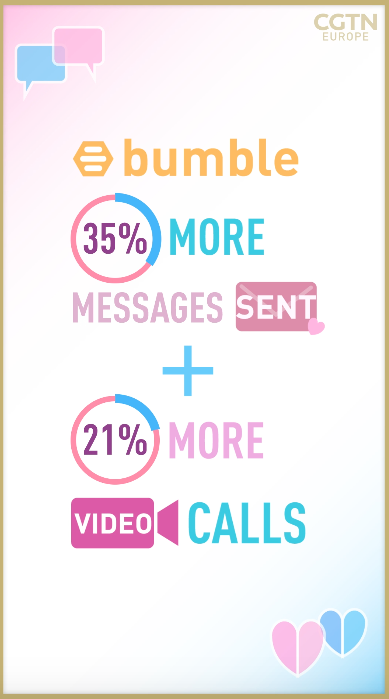

And have you wondered how online and mobile dating platforms have been faring since the pandemic struck? You're in luck, though I can't promise love, as my colleagues Giulia and James have put together graphics showing how popular apps are actually booming – scroll down to take a look.

Happy reading,

Patrick Atack

Digital business correspondent

P.S. Did you know we send this briefing by email, too? You can sign up to

receive it here.

The international oil markets are in turmoil after West Texas Intermediate, the U.S. benchmark, crashed to a historic -$40 before a slight recovery. Since WTI fell into the negative, other oil measures have also fallen, but not as far.

Tech giant Apple has announced its biggest planned expansion in nearly a decade, opening up the ** App Store to 20 nations across Africa and the Middle East** , and its streaming service will be expanded to 53 new markets.

Poland's finance minister Tadeusz Kościński has supported the French proposal to create a $541 billion pandemic recovery fund, but he suggested the funds are raised by the introduction of new taxes and by penalizing tax havens , rather than reallocated funds from the current budget.

China's central bank cut its benchmark lending rate for a second time this year in a bid to lower the borrowing costs for businesses and cushion the coronavirus blow. The one-year loan prime rate, mainly influencing business loans, was cut by 20 basis points to 3.85 percent from 4.05 percent.

Fashion retailer Cath Kidston has placed its brick-and-mortar shops into administration, while selling its digital and wholesale operations to Baring Private Equity in a move designed to keep the brand alive as retailers struggle amid the lockdown.

South Korean imports fell by nearly 30 percent in the first 20 days of April, reversing a near-10 percent rise in March. It comes as a reminder of the longer-term challenges faced by international economies with many parts of supply chains under lockdown.

Car company Nissan will close its headquarters in Japan for 16 days from next Monday to reduce the number of staff commuting, even though the Japanese government said manufacturing businesses may remain open .

French car maker PSA is the latest group to post falling sales figures in the first quarter of 2020. The firm, which owns the Peugeot, Citroen, DS, Opel, and Vauxhall brands, said sales fell by 15 percent , though it maintained its forecast of a five percent rise in operating profit from 2019-21.

Swedish vehicle brand Volvo said it signed a deal with German counterpart Daimler to produce fuel cells for heavy commercial vehicles . It is a preliminary agreement.

European Commissioner Thierry Breton said the EU coronavirus recovery package may need to be as big as $1.7 trillion , or 10 percent of the bloc's collective GDP. Leaders of the member states will meet again on Thursday to discuss the plan.

Why is there more cash than ever in Europe? Wolfram Seidemann told CGTN Europe it's the same in any crisis.

03:42

Jochen Goller, president of BMW Group in China, spoke to CGTN Europe about the effect of the pandemic lockdown on the company, and its plans for localized supply chains.

Let's first talk about the coronavirus. How has the epidemic affected BMW in China?

I mean, obviously it had some very serious effects. However, first of all, we came from a very good year last year and also January started well. And then in February, of course, with the epidemic hitting, what happened is our business was closed, our plants were closed and we took immediate measures.

So, in total, we had a shutdown for almost two weeks in the office and the plant. But then I think the measures from the government really helped fighting the epidemic. And, meanwhile, actually, we're really very confident because around 95 percent of our dealers are open in Shenyang. Our plant is back to a two-shift operation and we see a very strong recovery of the business, including showroom traffic and also sales.

Some say COVID-19 could push companies to stop relying on China and to move supply chains out of China. What does BMW think about this?

Well, I think it's the opposite, because China is by far our largest market. And the supply follows demand. And we have more than 400 suppliers in China. We're actually going to localize even more. Now we're starting the new T-C plant in Shenyang, basically doubling the capacity. And later this year, we're going to open the second phase of our high-voltage battery assembly line, producing the battery packs for our new-energy vehicles. So we're investing in both. We're investing in additional products and, of course, in new technologies.

In other words, you would not change your supply chain strategies?

No, I think we have a continuous growth plan. And, personally, I think that what is happening currently might accelerate some of the localization, because you need to be present in your biggest market.

It's reported that BMW will have a majority stake with the Chinese joint venture Brilliant Auto. And that contract was extended to 2040. Your joint venture with Great Wall is also making progress. What makes BMW so confident in the Chinese market?

I think it is two aspects. First of all, when you look at the automotive market, the long-term perspective was and is still very strong. You have an ownership of around 170 cars per 1,000 households. In America and in Europe it's between 800 and 600. So you have a big potential. Number two is there's a continuous 'opening up' policy from the government. Two years ago, some big changes on the policies were announced. That is when we agreed with our joint-venture partner on the equity. And we are going to invest $3.2 billion over the coming years into new plant facilities and upgrading our facilities.

简体中文

简体中文