As

the two largest global economies – China and the United States of

America – are trying to reach to each other’s throat with new taxes and

quota system in goods exchange, the rest of the world, especially the

Asian economies, are biting their nails fearing that further push of the

trade belligerence could result in the debacle of the regional as well

as the international trade.

Much

worse to this, the stock markets around the globe tumbled last week

giving base to these fears, Germany’s DAX, France’s CAC, Britain’s FTSE,

USA’s DOW Jones and S&P/500 as well as Japanese Nikkei, South

Korea’s Kospi, Hong Kong’s Hang Seng, China’s Shanghai Composite,

Australia’s S&P/ASX and all went red.

The

US trade deficit with China reached $375 billion in 2017 and the Trump

administration has been mulling over tariffs on Chinese goods worth $60

billion alleging the latter for the intellectual property theft. US

President Donald J. Trump has been long accusing the Asian giant of

unfair trade practices.

According

to the White House, the US government has prepared a list of 1,000

products as a target of at least 25 percent tariffs. Earlier this month,

the world’s largest economy has implemented 25 percent and 10 percent

tariffs on all steel and aluminum imports but has exempted its closer

allies such as the European Union of the new provision.

At

the same time, China has also been planning retaliatory actions of

imposing 15 percent tariff on 120 goods worth $1 billion and 25 percent

on eight goods worth about $2 billion. The second largest economy has

clearly indicated that any US decision or activity that creates hurdles

in China’s international trade would be ‘revenged’ thus sending fears

not only to the tech giants such as Apple and Microsoft but also the

farmers in the States because half of its soya bean export finds its way

to China.

These

circumstances have drawn concerns in Nepal whether it would be affected

should there be a trade war between the two largest economies. Trade

expert Purushottam Ojha says the trade war between China and the USA

won’t have severe repercussion on Nepal immediately as its share in the

global trade is very nominal. “However, if the situation prolonged, it

may harm Nepal since such activities undermine the norms of the World

Trade Organization (WTO) and obstruct free movement of goods in the

international market,” said Ojha, who is also the former secretary of

Ministry of Commerce.

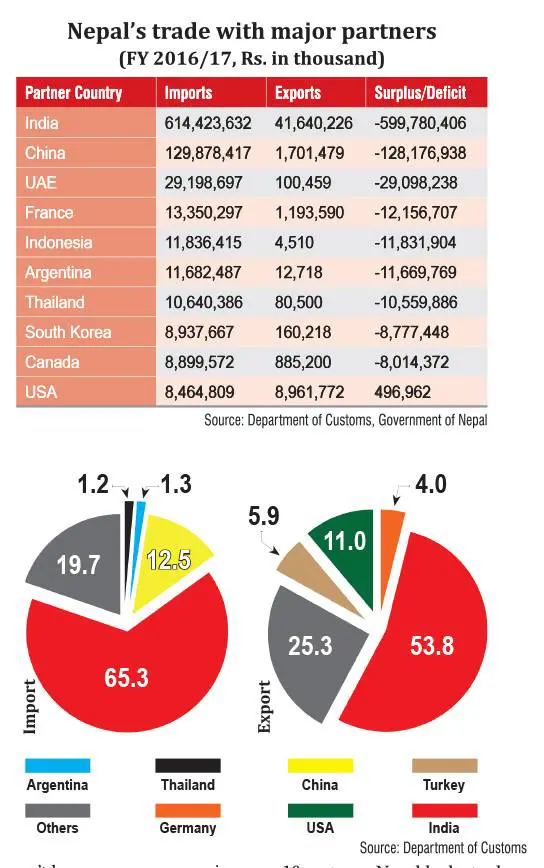

The

USA has been providing duty-free entry of about 5,000 Nepali goods

under the Generalized System of Preference (GSP) programme. It passed

the Trade Facilitation and Trade Enforcement Act in 2016, to implement a

Nepal country-specific programme until 2025 December which provides

long-term certainty to Nepali exporters and US buyers. In the last

fiscal 2016/17, the US was the only country, among the largest 10

partners, Nepal had a trade surplus with.

Similarly,

the northern neighbour has been offering duty-free entry of more than

8,000 Nepali products to China, and it is also the second largest trade

partner. Nepal is facing Rs. 128 billion trade deficit with China. It

exported goods worth Rs. 1.70 billion to China and imported goods of Rs.

129 billion in the last fiscal year.

Trade

expert and Executive Chairman of the South Asia Watch on Trade

Economics and Environment (SAWTEE) Dr. Posh Raj Pandey said that as both

China and USA are targeting each other and the row is more focused on

steel, aluminium, and construction, the trouble won’t affect Nepal, but

there are chances that India, which is one of the largest trade partners

of the USA and has trade surplus with the latter, might be affected in

the long run. In that case, Nepal might face glitches in its

international trade.

Ojha

also said that the possible trade war could distort the WTO provisions,

and if such thing happened, every country around the globe, including

Nepal, might be affected by it. Especially, the small economies and the

Least Developed Countries (LDCs) that have been enjoying the duty-free

entry of their products to the large economies in Europe, North America

and elsewhere will experience the heat.

简体中文

简体中文