A Chinese regulator taking direct control of a debt-ridden financial entity under some extreme circumstances can stabilize the transition and prevents a wolf from becoming a wolfpack, said a CPPCC member about Anbang takeover on Thursday.

One of the priorities for the Chinese government is to contain financial risks, “especially risks in those large finance holding companies”, because they could run “contagious” risks causing the market to collapse.

Therefore, if such a company becomes unstable, or a threat to the overall financial sector, the regulator has to step in, said Hu Xiaolian at a press conference on the sidelines of the first session of the 13th Chinese People's Political Consultative Conference (CPPCC) National Committee in Beijing.

The Chinese government seized control of Anbang Insurance Group in February, which was sudden but not altogether surprising, as the once acquisitive insurer had been under tightening government scrutiny for months.

Hu Xiaolian, also chairwoman of the Export and Import Bank of China, indicated that those seized companies have four major problems-high leverage, weak corporate governance, fragile balance sheet, and schemes to circumvent regulation.

The government takeover of Anbang will last for one year, and the company will be managed by a group of officials from the China Insurance Regulatory Commission (CIRC), the People’s Bank of China and other key financial regulators and government bodies.

To protect the rights and interests of the insurer’s customers and stakeholders, Anbang keeps operating as usual before undertaking an equity restructuring.

Chinese authorities have been cracking down on riskier investment products sold by some insurers and probes into whether they are providing covert funding to local governments.

SOEs are a top priority in deleveraging push

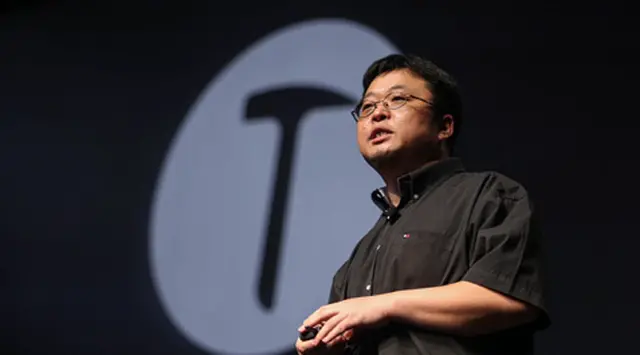

Yang Weimin speaks at a press conference on the sidelines of the first session of the13th CPPCC National Committee, March 8 ,2018, in Beijing.

Asked about how China is reining in debt in the broader economy, Yang Weimin, deputy director of the Office of the Central Leading Group on Financial and Economic Affairs, said at a press conference that state-owned enterprises (SOEs) continue to be a top priority in the country’s deleveraging campaign as they have higher debt ratios.

“Debt is always paired with GDP-debt as the numerator and GDP the denominator. As long as we keep the debt growth rate lower than the GDP growth rate, the debt-to-GDP ratio will decrease and the debt risk will be effectively controlled,” noted Yang.

The total debt is the combined debt for (non-financial) corporations, governments and households. The corporate sector, SOEs in particular, accounts for a large proportion of the total debt that China holds.

The country’s policy makers have long recognized the problem in the debt-fueled corporate sector and embarked on a series of measures, like debt-for-equity swap programs, elimination of zombie companies, overcapacity cut, and hard budget constraints on SOEs to contain the rise of risky credit.

Consequently, corporate leverage dropped to 154.8 percent in the third quarter of 2017 from 157.7 percent in the first quarter, according to China's Quarterly Deleveraging Report published by the National Institution for Finance & Development (NIFD) in late November.

While the central government debt still has room to scale up, Yang pointed out the risk arising from the rapidly built up local government debt, off-budget borrowing in particular, adding that Beijing has made efforts to impose fiscal discipline on localities to whittle down on their outstanding debt.

(CGTN)

简体中文

简体中文