Today, Uber

followed

Lyft in reporting its Q1 2021 earnings this week. And like its rival, its results

take a little bit of work to understand. So, this afternoon, we’re going to parse them as a pair so that we both understand what’s going on at the ride-hailing and food-delivery giant.

Let’s start with the big numbers: Uber’s revenue missed sharply, while its profitability beat expectations.

Let’s start with the big numbers: Uber’s revenue missed sharply, while its profitability beat expectations. In numerical terms, Uber reported $2.9 billion in revenue for the three-month period, sharply under the $3.28 billion investors

had expected

. However, while the street had anticipated that the company would post a $0.54 loss per share, Uber’s GAAP results actually came to a far more modest $0.06 per-share loss.

How did investors vet Uber’s performance? The company’s stock is off around 4% in after-hours trading.

Surprised by the revenue miss? Shocked by the profit beat? Startled by the sharp drop in the value of Uber’s stock? Let’s unpack the numbers.

Uber’s quarter

A number of things impacted Uber’s quarter. The first, of course, was COVID-19. The pandemic shows up in a host of ways across Uber’s results, but most critically it continued to negatively impact Uber’s ride business and positively impact its delivery business.

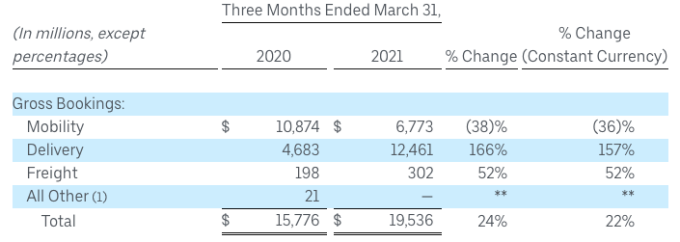

Turning to numbers, here’s the company’s *gross bookings *data, which includes both segments:

Image Credits: Uber

A few things to note. First, Uber’s total platform spend went up in aggregate on a year-over-year basis. That’s good. And as we look at the year-over-year changes, that delivery’s growth compared to the year-ago period was nearly legendary. (Postmates is in there, so take that into account.) The ride-hailing business’s decline feels somewhat modest in comparison. And we’d note that Uber’s freight efforts are very nearly material.

简体中文

简体中文