International Business Machines Corp. said profit margins shrank for the fourth quarter in a row, underscoring the technology company’s challenge in shifting to more subscription-based software and cloud services.

Key Points

Operating gross profit margin in the third quarter was 48 percent, down 2.1 percentage points from the same period a year earlier. This missed the average analyst estimate of 50.1 percent.

Sales were $19.23 billion, down 0.3 percent from the previous year, beating the average analyst estimate of $19 billion. While this is the closest IBM has gotten to revenue growth in more than four years, it’s still the 18th quarter of sales declines.

Profit, adjusted for certain items, was $3.29 a share, better than the average analyst estimate of $3.23, according to estimates compiled by Bloomberg.

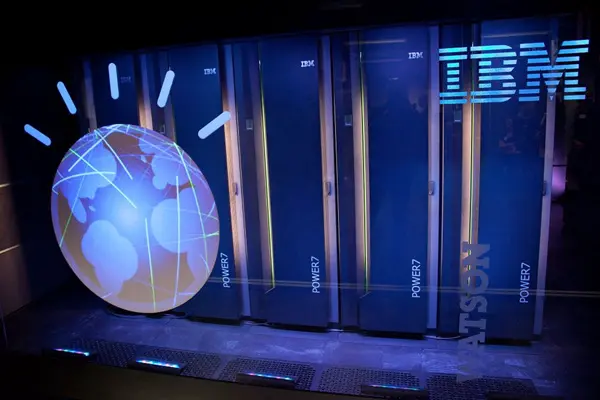

The strategic imperatives group -- which includes businesses such as artificial intelligence, cloud computing and data analytics -- reported revenue of $8 billion in the quarter, up 16 percent from a year earlier.

IBM CEO Ginni Rometty. Photo:businessinsider.com

IBM shares fell 3 percent in extended trading to $150.21. They closed little changed at $154.77.

The Big Picture

Since Chief Executive Officer Ginni Rometty took the top post in 2012, investors have been waiting for her to turn the computer services company around and find growth in newer businesses -- like cloud and artificial intelligence -- to offset declines in legacy hardware, software and services units. The move is taking longer than some investors would like. IBM has been spending more on infrastructure and development, as well as on acquisitions, which has dented profitability in recent quarters. The company now has 49 data centers, having added two new ones in the third quarter in South Korea and Norway, Chief Financial Officer Martin Schroeter said on a conference call.

“We have some pretty heavy investment levels going into the cloud and cognitive businesses, and we’ll continue to make those,” Schroeter said in an interview. Less-profitable businesses accounted for more of IBM’s total revenue in the third quarter, which pressured margins, according to Schroeter. The data center investments and this change in revenue sources accounted for more than three-quarters of the margin decline in the quarter, he said.

(BLOOMBERG)

简体中文

简体中文