By APD writer Ajith D Perera

Key Information about Sri Lanka’s external debt

Sri Lanka declared a unilateral debt moratorium on 12th th April 2022 , suspending its foreign debt servicing with the exception of payments to Multilateral Development Banks (MDBs).With this debt moratorium Sri Lanka’s ability to borrow foreign funds came to standstill.

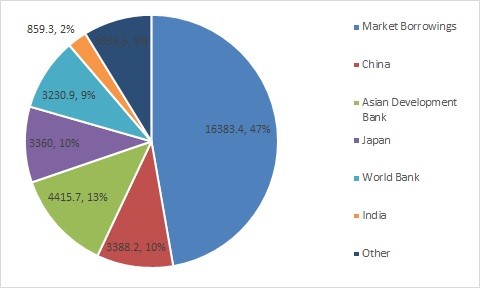

Sri Lanka ‘s external debt reached 47.7Bn in Sep 2022.Sri Lanka’s highest creditor is the group of Private lenders ( Paris Club ) , followed by Asian Development Bank, China, Japan ,India and World Bank. Sri Lanka's total debt to China is $7.3 billion ( in all forms ) and around 15 percent of its total public external debt as of 2022. At the Discussions between IMF and Sri Lanka it was conveyed to Sri Lanka that Sri Lanka needs to get the commitment from major creditors such as ADB, Japan , China and India for facilitation of the restructuring process. IMF officials very specifically advised Sri Lanka that “Sri Lanka needs to engage proactively with China on a debt restructuring,” even as talks with the Fund continue in parallel.

When Sri Lanka first started the process with IMF views taken by Chinese officials were different. Immediately after the April 12th announcement, China’s Ambassador to Sri Lanka Qi Zhenhong said that “China has done its best to help Sri Lanka not to default but sadly they went to the IMF and decided to default. The debt restructuring definitely will have an impact on future bilateral loans. “He also mentioned that countries that colonized Sri Lanka have more obligations to help at this juncture.” This statement came soon after the rejection of a request made by Sri Lankan government in March 2022 to reschedule its loans. China instead offered refinancing facility -a new $1 billion loan to help repay part of the existing loans.

Why China offered a fresh loan ?

There is good reason to pay attention to this, given that China’s approach to debt relief or restructuring in other countries facing debt distress is materially different from that of other lenders. Looking at those examples, it is reasonable to assume that China would seek bespoke negotiations and preferential treatment.

However, China has been reluctant to offer generous debt restructuring on interest-bearing loans. It worries that allowing such a restructure to any one country could fuel moral hazard. China Exim bank and China Development Bank typically treat restructuring or cancellation on a case-by-case basis. These two banks are funded by state and are profit-making institutions functioning under a geopolitical strategy of the Chinese government and the aegis of the People’s Bank of China (PBOC), which – as the largest shareholder of these banks – will ultimately face the largest losses from any debt restructuring.

**What’s China’s approach to Debt restructuring ? **

China provides debt relief and restructure through different ways – One such mechanism is part of the G-20 Debt Service Suspension Initiative (DSSI), through the Forum on China-Africa Cooperation (FOCAC). Another mechanism is by way of ad-hoc relief, and contributing to the IMF’s Catastrophe Containment and Relief Trust (CCRT). According to some reports through the DSSI, China has given debt service suspensions of around $1.3 billion in 23 countries (16 of which are in Africa).

Wind of Change in Chinese attitude on Sri Lanka’s Debt restructuring.

At a press conference in June 2022 a Chinese Foreign Ministry spokesperson said that Sri Lanka should “boost its own effort, protect the stability and credibility of the investment and financing partners and ensure the stability and credibility of its investment and financing environment.” That was followed by a Foreign Ministry spokesperson asserting in a press briefing on July 15 that “China is ready to work with relevant countries and international financial institutions to continue to play a positive role in supporting Sri Lanka in overcoming difficulties, easing its debt burden and realizing sustainable development,” and that Chinese banks are “ready to negotiate with Sri Lanka.”

The recent shifts in tone by Chinese authorities may signal a greater willingness than before to engage in a cooperative process, and a changing attitude toward Sri Lanka’s plans to pursue a harmonized, multilateral approach. Nevertheless, understanding how China has typically dealt with debt renegotiation in other developing economies could provide insights on the likely path for Sri Lanka.

China’s approach to Debt restructuring

In the past China has deferred annual instalments and granted maturity extension of the principal loans. These are the most likely strategies that China would adopt to ease the debt burden of recipients. For instance, in Kenya, China agreed to an interest rate cut and maturity extension of a $4 billion loan for a Kenyan railway project, effectively bringing down annual debt service costs. But it imposed a penalty of 20 additional years of interest charges. In Pakistan earlier this year, China agreed to extend the maturity of $4.2 billion in debt taken for energy projects under the China-Pakistan Economic Corridor (CPEC).

Observing how China approaches and deals with other countries in debt distress shows that Beijing prefers to negotiate bilaterally, offer bespoke debt relief terms, and has mixed feelings at participating in multilateral debt discussions. Their case-by-case approach influenced by geo political considerations,. It’s very unlikely that China would agree to write off commercial loans granted to countries.

Today China is the world’s largest bilateral lender, with most of it to developing economies and now a growing share of it coming under renegotiation. Some reports suggest that since 2001as much as $118 billion in Chinese overseas loans have come under renegotiation.

Compliances and challenges on the part of Sri Lanka

China by practice seems to have imposed special conditions such as closed door discussions on debt renegotiation with bilateral lenders. China agreed to limited coordination with other bilateral lenders in the past and these arrangements are made on case to case basis. (Country and type of lender and the loan and extensive confidentiality clauses. (Especially contracts after 2014 by China Exim Bank). This might be an obstacle for Sri Lanka where a concerned citizen can file a court case under the Right to Information Act for a full disclosure of all documents related to negotiation of debts with China.

Recently, activists in Kenya filed a court petition seeking full transparency of contracts pertaining to the Chinese built Mombasa–Nairobi Standard Gauge Railway (SGR) railway in response to the Kenyan government’s refusal to publicize the contents, on the grounds of Chinese non-disclosure agreements.

Another obstacle could be unless Sri Lanka temporarily be reclassified as “low-income “cannot be eligible for consideration under the G-20 DSSI or the G-20 Common Framework beyond DSSI. However China can always consider Sri Lanka as a special case for debt relief.

However Any attempt by Sri Lanka to offer (or for China to request) highly preferential treatment would not only draw the dissatisfaction of other bilateral and commercial creditors but entangle and delay the overall debt restructure pathway.

In fact different approaches by creditors no doubt may create a complex restructuring process which naturally demands diligence and diplomacy on the part of Sri Lanka to handle the situation tactfully. Sri Lanka lacks previous experience in debt restructuring and should ensure that proper experts are being brought to advise Sri Lankan team.

Sri Lanka has to push for China to join a multilateral creditors committee or to offer the co-chair instead of Japan to co-chair it, and supports a concerted effort for bilateral debt restructuring talks. Undoubtedly, the China’s response to Sri Lanka’s case will not only set the guidelines for China-Lanka relations for the future but will also be a case study for developing countries around the world.

China’s latest stance on Debt Restructuring of Sri Lanka

China has formally informed the IMF that China will grant a 2 year moratorium for all Chinese debts. However still there is no response from IMF whether they accept it as good enough response from China. The IMF expect all creditors to write off part of debts or accumulated interest etc so that all creditors bear the part of cost.

Response of parties including the US, Japan, India and the IMF in terms of the Sri Lanka's debt negotiations and their stance to China

India and Japan have already agreed to support debt restructuring process and even though USA is not a major bilateral creditor of Sri Lanka many private money lenders do operate from USA. On one occasion the ambassador of USA in Sri Lanka said as Sri Lanka engages in debt restructuring and financial reforms, it is absolutely critical that all creditors are treated equitably and comparably. That is one of the very important components that many countries who undergo an IMF program have to comply. Clearly a message to Sri Lankan authorities not to give any preferential treatment to any country which includes China. Ambassador further said If China wants to show the world that they are a true friend of Sri Lanka this is the time to show their friendship. The Ambassador also requested China not to be the spoiler in Sri Lanka’s debt restructuring process. These utterances –using a third party issue to criticize another country are somewhat strange and certainly against diplomatic etiquette. Further addressing the gathering at the Pathfinder Indian Ocean Security Conference USA Ambassador said The United States recognizes that much of our planet’s future will be written here in the Indo-Pacific and Sri Lanka is at the heart of the Indo Pacific to play a leading role.

Its true Sri Lanka greatly appreciate the friendship of USA for over 70 years. USA is one of the first countries to provide instant relief packages to Sri Lanka during the pandemic. However USA can help Sri Lanka better in terms of debt restructuring since USA is the single largest shareholder of the IMF with a veto power over majority policy decisions. In fact most of those private creditors of Sri Lanka’s debt stock are registered business entities in USA. Its noteworthy to mention that the first court case was filed by a USA based lender no sooner Sri Lanka declared its suspension of debt repayment to the world.

As explained at the beginning of this write up The China has a different approach to debt restructuring and this approach has often been misinterpreted by Western powers and other external forces who are now making a big cry on world media. The negative publicity given by western media on Chinese debt often create a dissensions between China and the civil societies of aid recipients and finally lead to social and political upheavals in the aid recipient countries. In fact the worrying factor or the prime concern for western powers is Sri Lanka’s strategic location and the nearby sea lanes where half of the world’s container shipments and two thirds of the world’s oil shipments are passing annually. Globally the emergence of China as the world’s leading exporter, becoming the biggest bilateral donor in the world, Internationalization of RMB,China’s stance on Russia –Ukraine conflict, massive development projects such as port city handled by China in Sri Lanka, securing the operational rights over Hambanthota port have a strong negative connotation attached to western interest.

The clouds of political hypocrisy coupled with the growing western interest in Indian Ocean could be seen and of course the things may perhaps create a more complex situation for Sri Lanka’s debt restructuring process.

(Debt Stock as of end April 2021 by Major Lenders, US$ million-Source- Department of External Resources )

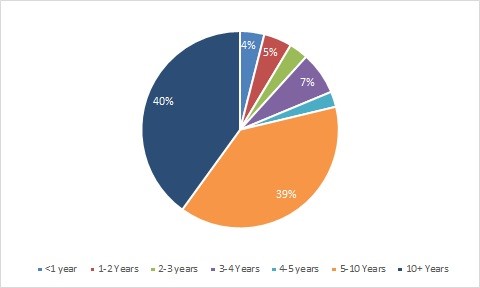

Maturity Structure of the Debt Stock as of end April 2021 -US$ million-Source- Department of External Resources )

(Non-residential holdings of Treasury Bills/Bonds and outstanding debt of State Owned Enterprises (SOEs) are not included)

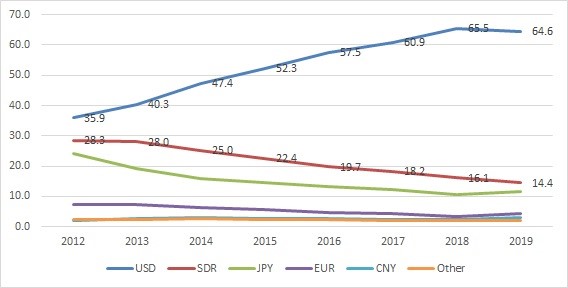

Debt Stock (by Major Currencies, US$ million)

Debt Stock (by Major Currencies, US$ million)

简体中文

简体中文