By APD writer Alice

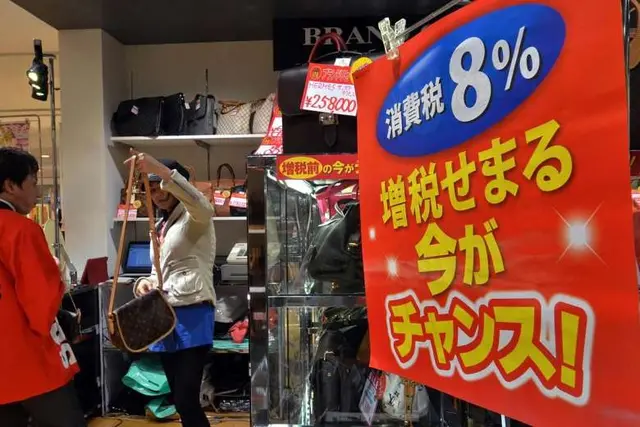

As the consumption tax hike nears, Japanese consumers and businesses are worried about the confusion that might erupt from differing rates for similar goods.

To make things worse, businesses may not have enough new cash registers that can handle the two-tiered transactions.

While the tax rate will rise to 10 percent from 8 percent from Oct. 1, the rate levied on some goods, such as food and nonalcoholic beverages, will remain the same under the dual system.

Japan’s National Tax Agency has guidelines on its website listing examples of what qualifies for the lower rate, but the reality is expected to be less than clear-cut.

One example is posed by mirin, the sweet cooking wine that’s indispensable to Japanese cuisine. Mirin itself will be taxed at 10 percent because it is alcoholic, but mirin products sold as seasoning will be taxed at 8 percent due to their lower alcohol content.

Another complicated example is sushi.

Meals at conveyor-belt sushi restaurants, like other food and drink consumed while dining out, will be taxed at 10 percent. But if sushi is purchased as takeout, it will be taxed at 8 percent. Any leftover sushi taken home will be taxed at 10 percent.

Other restaurant chains are trying to take steps to prevent tax gap confusion as well.

Among them are the Italian chain Saizeriya Co., beef-on-rice bowl vendor Matsuya Foods Co. and Kentucky Fried Chicken Japan Ltd., which have decided to set their prices for both eat-in and takeout at the same level by adjusting before-tax prices.

But rival beef bowl chain Yoshinoya Co. and Starbucks Coffee Japan Ltd. plan to let their prices hinge on whether food is eaten on-site or taken out.

Hamburger chain McDonald’s meanwhile is still preparing for the change.

For non-weekly newspapers, the print editions will be taxed at 8 percent for subscribers and 10 percent for those bought at convenience stores or read online.

As consumer interest in the two-tiered tax plan rises, the tax agency this spring started dispatching staff to public lectures hosted by consumer groups across the country to explain the details and the possible scenarios expected to be play out at checkout counters after its introduction.

As of May, some 40 percent of small businesses had yet to introduce cash registers that can handle the new tax regime, according to a survey by the Japan Chamber of Commerce and Industry (JCCI).

“Some small business owners took a wait-and-see posture, out of suspicion that Prime Minister Shinzo Abe may delay the tax hike again,” a JCCI official said.

The 2-point hike was originally set to take place on October 2015, following the first stage to 8 percent from 5 percent in April 2014. But the second stage of its doubling has been postponed twice: to April 2017 and then October this year.

A senior JCCI official said preparations at small businesses are progressing with just a month to go. The regional chambers are also sending staff to businesses to urge them to replace their cash registers, the official added.

However, makers of new cash registers have been overwhelmed by orders, and there are fears that orders placed now will not be filled by Oct. 1.

(ASIA PACIFIC DAILY)

简体中文

简体中文