"What's going to happen now, because all of this state aid dumping, is that the well-run, financially strong airlines going into this the strongest are going to come out the weakest."

Ryanair's Michael O'Leary vented his anger about the funds given to many global airlines, as he broke the news that the budget Irish carrier would keep the majority of its planes on the ground for the foreseeable future and would cut 15 percent of its workforce.

But there's good news, if not instant help, for Ryanair customers – O'Leary confirmed those who wanted cash refunds instead of vouchers would get them.

The other top story today is the losses recorded by oil major Exxon Mobil – $610 million in the first quarter of 2020.

But not all big businesses had a bad day, with U.S. plane manufacturer Boeing making $10 billion more than it initially expected in a bond sale this week. And cosmetics firm Estee Lauder also did better than expected in the first quarter, with online sales helping to bolster losses on the high street.

Meanwhile, as the French football authorities confirmed its season would not restart and the English Premier League said it was "considering the first tentative moves" out of lockdown, CGTN's Cheng Lei talked to Aleksander Čeferin, the president of European football's governing body, UEFA, about the future of the sport. See the interview below.

Happy reading,

Patrick Atack

Digital business correspondent

**P.S. Did you know we send this briefing by email, too? **

You can sign up to receive it here.

The announcement by Wizz Air that some flights would soon resume has been dampened by Ryanair, another European budget carrier, which today said it would keep 99 percent of aircraft grounded, while cutting at least 3,000 jobs. The airline's CEO, Michael O'Leary, said despite a backlog, customers who "want a cash refund... will receive a cash refund."

Oil major Exxon Mobil has revealed first-quarter losses of $610 million, a huge swing from $2.4 billion profits in the same period of 2019. CEO Darren Woods blamed the COVID-19 pandemic, but said the company would not cut its 87 cent-per-share dividend, even as capital spending and operating costs were both slashed.

U.S. plane maker Boeing yesterday raised $25 billion through sales of company bonds. With maturities ranging from from 2023 to 2060, they yielded more than its July bond sale. The embattled manufacturer said the capital means it will no longer apply for federal state aid.

Cloud computing services such as Google's Meet and Microsoft's Teams have had huge jumps in user numbers, but the big-money transactions that are the real earners for the tech giants behind the workplace software are flatlining. New contracts for server space, for example, have stagnated amid supply-chain worries.

3M, which produces industrial goods including several face masks, said it has sued five sellers who allegedly targeted government officials with offers to sell N95 respirators that did not exist. One case claimed to have up to five billion respirators, and had falsely affiliated themselves with 3M.

Estee Lauder, the parent firm of cosmetics brands such as M.A.C., has beaten profit expectations as sales fell nearly 11 percent. Although most retailers are closed amid the global lockdown, the firm said it benefited from online sales.

Consumer prices in Tokyo dropped, year-on-year, for the first time in three years as domestic production also fell, sparking fears of a return to deflation. "The government will work with the central bank to ensure Japan absolutely does not slip back into deflation," economy minister Yasutoshi Nishimura said in response.

French national rail company SNCF said it expects to feel a $3.3 million revenue loss by the time some lockdown conditions are to be lifted from 11 May. The state-run transport company said it lost at least $1 million in December, as strikes in protest at President Emmanuel Macron’s pension reforms cut its services.

Online retailer Amazon has told its global workforce that staff who can work from home "are welcome to do so until at least 2 October 2," according to a statement from the firm. The sales and delivery giant has already faced legal trouble in France over alleged lack of protection for its warehouse staff.

Bangladesh said it will reopen its garment factories, a key pillar of the South Asian nation's economy, despite fears it may put workers in danger of catching COVID-19. The Bangladesh Garment Manufacturers and Exporters Association said $3.5 billion in orders had already been lost.

As tourism drops globally, the loss of revenue has meant many wildlife park workers in Kenya have lost their jobs. The knock-on effect has been a rise in poaching, according to Conservation International.

02:30

Aleksander Čeferin is president of European football's governing body, UEFA, and is also a vice-president at FIFA, the sport's global body. He spoke to CGTN's Cheng Lei to discuss football restarting amid a global pandemic and what the future holds for the global game.

How do you see the pandemic affecting football clubs, financial discipline?

Of course, we will have in mind that we have a 'force majeure' now, that we have a special situation and that clubs simply cannot act exactly the same as in, let's say, normal times.

We will all have losses, all the stakeholders. UEFA will have hundreds of millions of lost dollars just because of postponing the Euros [the European Championships were slated to be played this summer]. If I might say, it's not about football. Now we see that solidarity is the only future for the world.

And what do you think of pay cuts for athletes?

First of all, the relation of player and club is not in UEFA's jurisdiction. It's absolutely up to the players and up to the clubs to agree if they want to agree about the pay cut or not.

So, you've proposed that perhaps more content should go online. Is that the way forward for football?

Look, football will be the old good football quite soon. I'm sure about it. We don't want to change it.

But we will have to play without spectators until this pandemic ends, until governments allow us to do differently. But football is football. It is just one football. And we cannot do it without spectators. We cannot do it differently. We cannot do it indoors. Football should stay football. And we all love it exactly because it's like that.

And what do you think of the fact that all the leagues have pretty much stopped but Belarus is still continuing, although it has just postponed the women's league?

Where national competition is played

– I mean, national leagues

– we don't have much say there. For me, it's a bit strange, the approach: 'let's see if it backfires.' But let me say that I wouldn't take that risk. But they decided differently. And let's see how this ends.

And what about FIFA's vision for international football in the future? What do you think of that?

Yeah, I'm the vice-president of FIFA. But the most important thing is that we improve the digital part. We have to come closer to children from 10 to 20 who want to watch it on mobile phones.

Your country's quite advanced, I must say, technologically and everything else. So I think this is the future.

In fact, some of our viewers actually wanted to ask you if in the future UEFA will engage more with China?

We're engaging more and more with China. We have Alipay as a sponsor. We have Hisense as a sponsor and good partners. And we are preparing a project in cooperation with Alibaba, where we will engage much, much more in China.

I think the Chinese market, we all know, is very interesting. But Chinese people love football. I can see that. And UEFA's football is the best football by far in the world. So I'm very optimistic and this pandemic will not stop us doing it.

So will there be games played in China?

I hope so.

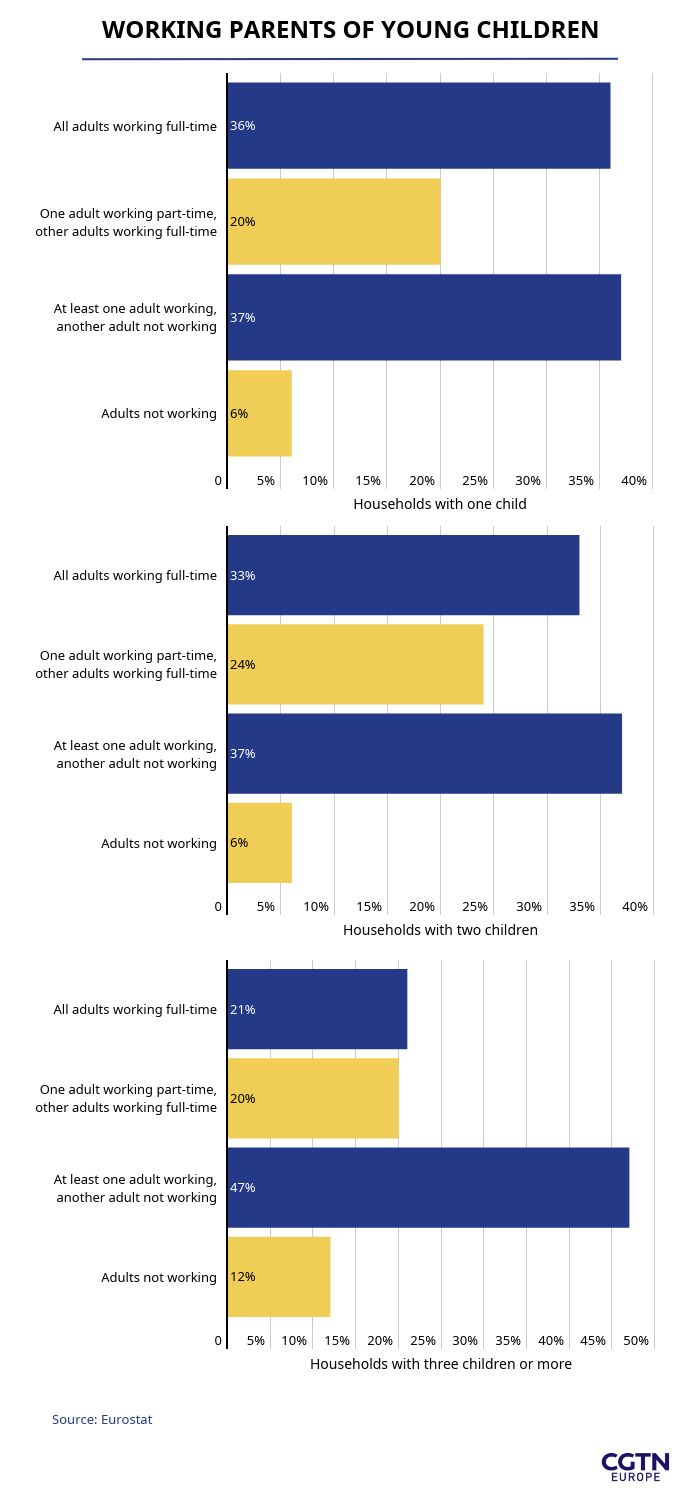

With the majority of people across Europe currently working from home, today's graph looks at how many adults are likely to be balancing work with childcare ** – and how the breakdown changes in households with more than one child. These data look at homes with at least one child under the age of six.**

简体中文

简体中文