(THE NEW YORK TIMES) The Netflix fourth-quarter results paint two different pictures of the company: one achieving record global growth, the other facing a slowdown in the United States, where its already high penetration is making it increasingly difficult to add new subscribers.

The companyannounced Tuesdaythat it had topped expectations in adding a record 5.59 million total streaming members during the quarter, for a total 74.76 million across the globe. The success of the original series “Narcos” and “Marvel’s Jessica Jones” helped to fuel growth. Netflix said that it expected to add 6.1 million members during the current quarter.

In the United States, however, Netflix missed growth forecasts, adding just 1.56 million subscribers, a decline from the 1.9 million it added during the same period the previous year.

The company said that increasing its subscriber base in the United States was becoming harder. Netflix said growth challenges in the United States include the transition to new chip-based credit and debit cards that made it more difficult for members to renew their subscriptions and forthcoming price increases for the service.

“The next 50 million is a little bit harder than the first 50 million in terms of growth,” David Wells, the Netflix chief financial officer, said during an earnings call.

Total profit slid to $43.2 million, a 48 percent drop for the quarter from the same period a year earlier. Netflix has warned investors that it would run at break-even profitability through the end of 2016 as it pushed to make its service available across the globe. The company has said that it would deliver material global profits starting in 2017.

Total revenue was $1.8 billion in the fourth quarter, up 22.8 percent from the same period during the previous year.

Shares of Netflix rose more than 7 percent in after-hours trading on Tuesday. In the last year, Netflix shares have climbed about 125 percent as investors bet on the company’s continued rapid growth both in the United States and throughout the world.

Netflix must tread carefully. Some on Wall Street have raised questions about whether the company will be able to keep up its growth trajectory. Analysts have raised concerns about subscriber growth in the United States, content costs, international expansion and competition from Amazon, Hulu and YouTube.

This year is shaping up to be an important one for Netflix. This month, the company announced that it had introduced its service to more than 130 countries, making it available in nearly every country across the world, except China.

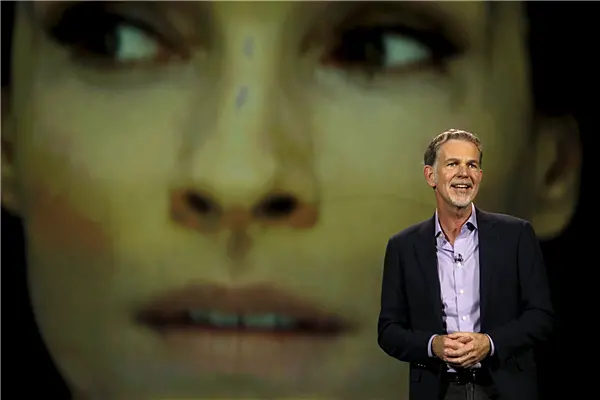

In a letter to shareholders, Reed Hastings, chief executive of Netflix, said the company was primarily aiming at “outward-looking, affluent consumers with international credit cards and smartphones,” with its global expansion.

“You can think of them in shorthand as iPhone owners,” he added during the call.

Netflix updated itslong-term viewon Tuesday, stating that this year it expected to spend more than $6 billion in cash on programming, more than $1 billion on marketing and more than $800 million on technology and development.

The company plans to introduce more than 600 hours of original series, films and other content — up from 450 hours in 2015.

Netflix recently has facedloud criticism from traditional TV rivalsfor not disclosing viewership numbers and overspending on content. Some media executives also have expressed concern that licensing shows to Netflix damages TV ratings and ad revenues.

Mr. Hastings shot back on Tuesday, stating that Netflix didn’t need to release program-level ratings because it does not sell advertising. “We release ‘ratings’ for Netflix as a whole every quarter with our membership growth report (75 million and counting!),” he said in the letter. “It is member viewing and satisfaction that propels our growth.”

简体中文

简体中文