They are two of Britain's biggest consumer-facing businesses - and could soon be under common ownership.

Telefonica, the Spanish owner of O2 in the UK, has confirmed that it is in talks to merge the business with the cable and broadband giant Virgin Media.

A combination of the two would create a business with annual sales of more than £11bn and tens of millions of UK customers.

O2, which sponsors the England rugby team and the music venues of that name, boasts more than 34 million connections to its network.

Apart from the core O2 brand, it also partners with mobile virtual network operators Sky Mobile - which has common ownership with Sky News - giffgaff and Lyca Mobile, as well as owning half of Tesco Mobile.

Virgin Media, which is owned by the US giant Liberty Global, has some 5.3 million broadband customers - many of whom also buy mobile and pay-television services from the company.

The pair have insisted that the deal is only at present in the "negotiation phase, with no guarantee, at this point, of its precise terms or its probability of success".

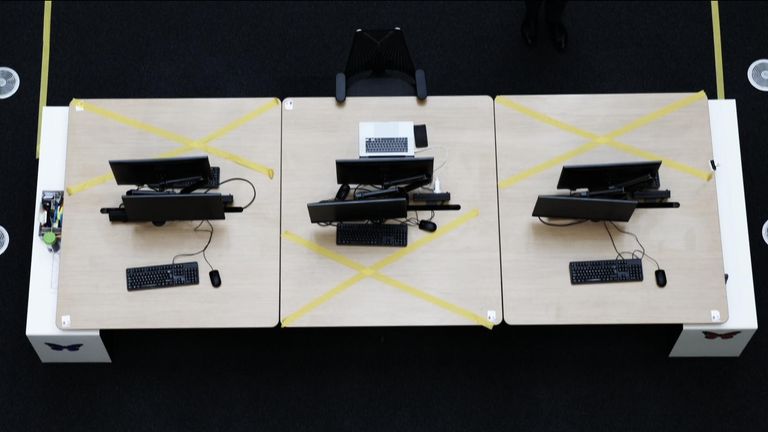

Image:Virgin Media has 5.3 million broadband customers

Should a takeover be consummated, though, it will represent a further consolidation in the UK's broadband, pay-television, mobile and fixed-line market.

The business emerging from the deal would also be a more potent competitor for BT, the UK's biggest broadband and fixed line telecoms provider and owner of the mobile network EE, as well as other major players such as Vodafone and Sky, the owner of Sky News.

News of the talks comes five years after Telefonica agreed to sell O2 in the UK for £10.25bn to its mobile rival, Three UK, but that deal was scuppered the following year by EU competition regulators.

It later sought to float O2's UK business on the stock market only to see that move hampered by stock market uncertainty ahead of Brexit.

The expectation in the industry is that the combined business would be structured as a 50/50 joint venture with Liberty Global paying a cash sum to Telefonica to reflect the difference in values between O2 and Virgin Media.

A deal is seen as having a better chance of passing completion hurdles because it is not a straightforward merger between two big mobile operators, as was the case with the proposed combination between O2 and Three UK, but - as with BT's takeover of EE in 2015 - would be a tie-up between a big mobile operator and a big fixed-line and broadband provider.

The proposed combination would have plenty of advantages to the owners of both businesses.

Telefonica, which bought O2 for £17.7bn in 2006, has been looking to offload some or all of O2 for a while in order to reduce its €37.7bn (£32.6bn) worth of borrowings.

A tie-up would also give O2 UK its own broadband arm which, in the past, has been seen as a weakness.

Partnering with Virgin Mobile, which has billions of pounds worth of tax losses dating back to its past ownership of loss-making cable companies NTL and Telewest, would also offer O2 the opportunity to cut its tax bill significantly - freeing up more money to invest in the costly roll-out of 5G services.

Meanwhile Liberty Global, which also owns a 10% stake in the broadcaster ITV, is armed with cash following the €18.4bn (£15.9bn) sale of its European cable operations

to Vodafone

.

There would be several attractions for it in combining Virgin Media with O2.

One would be the substantial savings for it in owning its own mobile network rather than, at present, paying £200m to other network operators - currently EE and shortly to be Vodafone - for capacity on which to run Virgin Mobile.

Image:O2 boasts more than 34 million connections to its network

Cost savings with the merger of back office operations at the two companies would also be substantial.

And O2 would also make Virgin Media a more attractive consumer proposition than at present at a time when Openreach, a wholly-owned subsidiary of BT, is investing billions of pounds in the rollout of full fibre broadband - a rollout which, when complete, will chip away at Virgin Media's competitive advantage.

Analysts at UBS, the investment bank and broker, said a combination of O2 UK and Virgin Media would be "underpinned by a solid operational fit".

They added: "With the exception of BT, no UK player has yet managed to put together a 'future-proof' asset base combining wide-reaching networks and market shares both in fixed [line] and mobile."

A merger, apart from the fact that the talks are only at an early stage, is not yet a done deal.

Three UK, having been barred from buying O2, might seek a partnership of its own with Virgin Media.

Or, alternatively, it might be jolted into bidding for TalkTalk Telecom as it seeks to shore up its own position in fixed-line and broadband.

The latter's shares rose amid speculation it may now become a target.

The bigger question, however, is how Vodafone will respond.

It has just signed a deal under which Virgin Mobile would be able to use its network for five years from 2021, while it would be able to sell broadband services in the UK accessing Virgin Media's cable network.

A tie-up between the latter and O2 would leave Vodafone, long seen as a potential merger partner for Virgin Media, with a more powerful converged competitor.

So it is perfectly possible that Vodafone could seek to gatecrash this deal.

The process of getting back to work

The City's legions of M&A bankers and lawyers will also be watching closely to see how the Competition and Markets Authority responds.

Before COVID-19 struck, the CMA - under its new chairman Lord Tyrie, the former Conservative MP Andrew Tyrie - was adopting a more robust approach to intervening in mergers and takeovers.

It might well be expected to on this occasion and especially now the coronavirus crisis has highlighted the importance to millions of British households of having good mobile and broadband connectivity and of the value of comprehensive home entertainment packages.

And yet, as the country emerges from lockdown, the UK government will be anxious for British businesses to be in as strong a shape as possible.

That might especially be the case when it comes to the important infrastructure providers critical in boosting the UK's woeful productivity record.

In the meantime, having completed its own fixed and mobile merger a while ago, BT can look on knowing its market position is comparatively secure.

It has a five-year headstart on its putative competitor.

简体中文

简体中文