Powered by new growth engines and reforms, the Chinese

economy has maintained a strong performance despite downward pressure

and uncertainties.

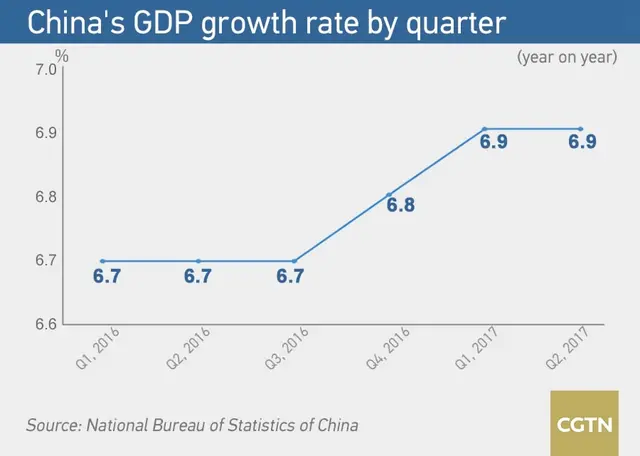

China's GDP grew by 6.9 percent

year-on-year in the second quarter of 2017, flat from the first.

Compared with the quarterly growth rates of 6.7, 6.7, 6.7 and 6.8

percent respectively last year, the world's second largest economy shows

a more robust momentum this year.

The latest figures released by the National Bureau of

Statistics (NBS) on Monday leave little doubt that China will meet its

annual growth target of "about 6.5 percent."

"I'm

pretty optimistic," Jeremy Stevens, an economist at Standard Bank, told

CGTN. "I don't think growth will go below 6.5 percent for either of the

next two quarters."

Decoding Chinese economy

Stevens called the performance of China's economy in the first half of 2017 "pretty impressive."

This

impressiveness is not only highlighted by the growth rate, but also

achievements in economic restructuring and improvement of people's

livelihood.

The figures show that consumption has contributed more to growth while the service sector has expanded its share in the economy.

In

the first six months of 2017, retail sales of consumer goods grew by

10.4 percent year-on-year, up from 10 percent for the first quarter.

The

service sector grew by 7.7 percent, outpacing a 3.5-percent increase in

the primary industries and 6.4-percent in the secondary industries. By

the end of June, the service sector already accounted for 54.1 percent

of the overall economy.

Some 7.35 million new jobs

were created in China's urban regions from January to June, 180,000 more

than the same period last year, while per capita disposable income grew

by 8.8 percent, higher than the GDP growth rate of 6.9 percent.

According to NBS spokesperson Xing Zhihong, the steady

growth was the result of progresses in supply-side structural reform and

new development concepts.

In a commentary published

on People's Daily's social media account on Monday, reporter Lu Yanan

echoed Xing's words, attributing the impressive economic performance to

the country's new growth engines and deepening reforms.

"According

to estimates by some experts, new engines already contribute to 30

percent of China's economic growth," Lu wrote. "The new engines such as

sharing economy, platform economy and high-tech industries have

activated consumption, boosted job growth and facilitated the upgrade of

traditional industries, becoming the locomotive of the future of

China's economy."

A smooth shift from traditional growth engines to new ones needs more "dividends" of reforms, she added.

Reforms and risks ahead

China's faster-than-expected GDP growth has given policymakers room for deeper reforms, a Reuters article said on Monday.

Chinese

officials will have more room to rein in financial risks by

deleveraging and controlling debt levels, the report explained.

At

the fifth National Financial Work Conference last week, Chinese Premier

Li Keqiang noted that deleveraging should be pushed forward in an

"active yet prudent" way, indicating a fine balance between deleveraging

and maintaining growth.

"Given a reasonably healthy

economy, we will see similarly contractive measures into the future,"

Brock Silvers, managing director of Kaiyuan Capital, told CGTN on

Saturday.

While expressing his confidence that China's economic

performance in the first two quarters "has laid a solid foundation for

achieving the annual target," the NBS spokesperson also warned of

uncertainties and instabilities in the world as well as prominent

long-term structural contradictions at home.

Xing's concern is shared by some economists.

"In

general, we expect GDP growth to remain robust in the second half but

slower than the first half, due to the high base," Citi economists said

in a research note. "Looking ahead, uncertainty remains on investment

and trade."

Chen Yanbin, a researcher at Renmin University of

China, said at an economic forum on Monday that the Chinese economy

would still face downward pressure in the second half of the year.

The

pressure could come from a cool-down of the housing market, a slowdown

of fixed asset investment growth, an increase of production costs for

enterprises, a rise of financing costs for the real economy amid

deleveraging as well as external uncertainties.

Chen

suggested lowering overall taxes for residents and enterprises, which

could further invigorate the economy. He also said a slightly more

relaxed monetary policy could contribute to economic stability.

简体中文

简体中文