Chinese electric vehicle maker NIO will offer $1.3 billion in convertible notes that can be swapped for its surging American depositary receipts (ADRs) "to further strengthen its cash and balance sheet positions," the company said late Monday.

NIO's ADRs jumped as much as 14 percent to $66.99 on the New York Stock Exchange (NYSE), making its market capitalization at $104 billion, which is bigger than the combined value of traditional automakers General Motors and Ford.

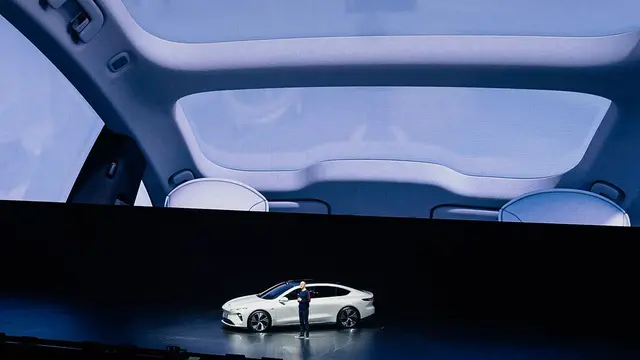

The company on Saturday unveiled its first sedan ET7 with self-driving technology features and larger battery pack. The price will start at 448,000 yuan (about $69,000) before subsidies, and deliveries will start from the first quarter of next year.

The ET7 is also seen as a potentially direct rival to Tesla's Model 3. The bigger battery pack will give NIO's vehicles a claimed range of 625 miles (roughly 1,000 kilometers), while the base model of Tesla's Model 3 can travel 263 miles on a single charge.

A convertible note is a fixed-income security that yields interest payments, and it can be converted into equity shares. NIO's convertible notes are split into two tranches, $650 million due in 2026 and $650 million due the year after.

Founded in 2014, the company filed for an initial public offering on the NYSE in September 2018. Its ADRs have gained about 1,700 percent in the past year, compared with gains around 16 percent for the SP 500 index.

(CGTN)

简体中文

简体中文