When Gogoro first came out of hiding at the Consumer Electronics show in 2015, the attention was all on the slick electric scooter that the company unveiled. Rightly so, too. Nothing quite looks like a Gogoro Smartscooter, not even the gas ones it’s trying to supplant.

Gogoro was, at that trade show, trying to lay the foundation for an energy storage and distribution solution based around small, portable batteries that just happened to power the Smartscooter.

Now, with a $300 million of newly announced investment money on the way, the company finally seems ready to take that leap.

Today the company announced a partnership with Japanese corporation Sumitomo that will bring Smartscooters to Japan, but will also help Gogoro expand beyond scooters, and beyond its home country of Taiwan.

But first, the scooters.

Gogoro and Sumitomo are collaborating on a new scooter sharing service called GoShare, which will launch on the resort island of Ishigaki in November and will spread to “other cities and markets” in 2018.

This is different from the scooter rental services Gogoro launched in Berlin and Paris (with Bosch subsidiary Coup) in that it will include the company’s battery swapping stations, as well as a slightly different business model.

Those battery stations could support “compact four-wheel vehicles in the future,” Gogoro says, as well as other applications, though the companies didn’t elaborate beyond that.

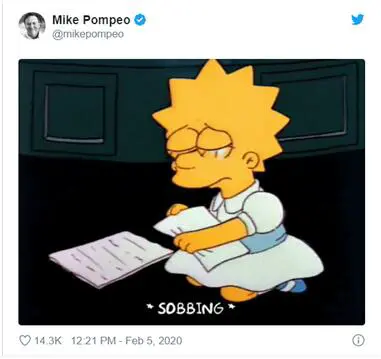

Gogoro CEO Horace Luke at The Verge’s office.

This all might sound small, but especially on the heels of such a large investment round, it’s a significant step in that original, broad vision that Gogoro laid out in 2015. Speaking to The Verge ahead of the company’s latest announcements, CEO Horace Luke detailed the company’s recent growth, and hinted at how the companies involved in this investment round could shape what that expansion looks like.

Formerly the chief innovation officer of HTC, Luke is easily excitable when it comes to talking about futuristic technologies.

To start, Gogoro’s geographic presence will grow mostly in nearby Asian markets, with Singapore, India, and China as obvious candidates. Luke said that Temasek, one of the four new investors, is “very well-connected in Southeast Asia, and very well-connected in India,” markets which he labeled as good fits for Gogoro’s network of electric scooters and battery swapping stations.

Luke points to the increased appetite for the Gogoro Smartscooter 2 as a good sign that, chosen smartly, certain markets are hungry for a sharp, affordable electric scooter. In the 22 months that Gogoro spent shipping the first Smartscooter, around 23,000 were sold, according to the company.

But from the announcement of the Smartscooter 2 at the end of May, to the end of June, he says there were 13,000 preorders. Of the cities Gogoro is in, Luke says the company makes up about 92 percent of the electric scooters sold.

And electrics have grown to an average of around 6 percent of the overall scooter market since Gogoro got started.

Luke says Gogoro’s first customers “were very brave” for buying a scooter that depended on infrastructure that was still being built. And he attributes that dramatic ramp in potential sales of the second version to reassurance afforded by the now-established network of battery swapping stations. “Day one that that new group of users was looking at 350 stations ready to go,” Luke says. “I think that that really shows that the network is mature enough and ready enough that people, when they subscribe to the Gogoro vision, they don't have to worry about [charging] anymore.”

While Gogoro has piloted scooter rental services in Berlin and Paris, major Western cities aren’t as high priority and will likely only see Gogoro in a rental capacity in the future. (And another effort in Amsterdam stalled because the Bosch offer came along, according to Luke.) Part of that is the difference in scooter culture writ large.

In many places around Asia, Luke says scooters are like shoes. “You don't wear somebody else's shoes. In Taiwan it's like that, in Vietnam it's like that, in Thailand it's like that and emerging markets, mainly, are like that.”

But, he admits, “there's the part of the world that really needs a fractional ownership experience or a fractional user experience. And we think that that is places like Berlin and Paris and other major cities across Europe.”

Luke also just sounds more intently focused on bringing its full offering to countries that face broad, often severe problems with pollution, energy, and poverty, like India, or China. “People [in these countries] are demanding transportation so that they can live a modern life, but yet they cannot afford a better vehicle,” he says.

He also thinks electric vehicles are nearing an inflection point, “especially with the [Tesla] Model 3 proving that per kilometer is cheaper to go by electric” than gas, and that it “will happen even faster with two wheels.”

“But here comes the problem,” he says. “That's great that the revolution is coming, but unless you want to turn every block into a parking lot to charge these vehicles, it's really hard. So we what we do is we focus on the infrastructure solution that enables this revolution to happen.”

That focus has allowed Gogoro to distribute around 100 megawatt hours worth of batteries across more than 400 stations in Taiwan, a number Luke says he wants to double by the end of next year.

But Gogoro’s trying to be mindful of that growth. “We think our batteries can solve a lot of problems, but we can't abuse it,” Luke says.

Part of that will involve leaning on Sumitomo, which has a history with battery recycling. But Gogoro’s stations also dynamically charge the batteries depending on things like time of day, or how often people use them in each neighborhood, in order to maximize the life of each one.

“Two to three weeks [after deploying a station], I don't even know what the pattern is anymore because that machine is only doing things for its own neighborhood and on its own dime,” Luke says.

That intelligence, as well as the simple setup — Gogoro typically installs the stations in just a few weeks at supermarket-style locations, which already have a nearby transformer and are better equipped to handle the energy load — are big reasons why Luke thinks the company is finally ready to expand its energy solution into another country for the first time.

It’s not immediately clear what Gogoro’s batteries and network will be used for, though new vehicles seems like an obvious step. (Luke says Gogoro’s had discussions with more traditional manufacturers. “We can help them leapfrog and get jump right to the solution right away.”) So does basic energy storage, like acting as an overflow for solar panels.

In that respect, it doesn’t sound all too different from what Tesla does with its cars, home storage solution, and solar panels — though Luke obviously sees it differently. “Tesla built the network in order to sell the cars,” he says. “We built the vehicle in order to sell the network.”

(THE VERGE)

简体中文

简体中文