A poster promoting discounts is placed outside a store at a shopping center in Beijing, China, December 14, 2018. /Reuters

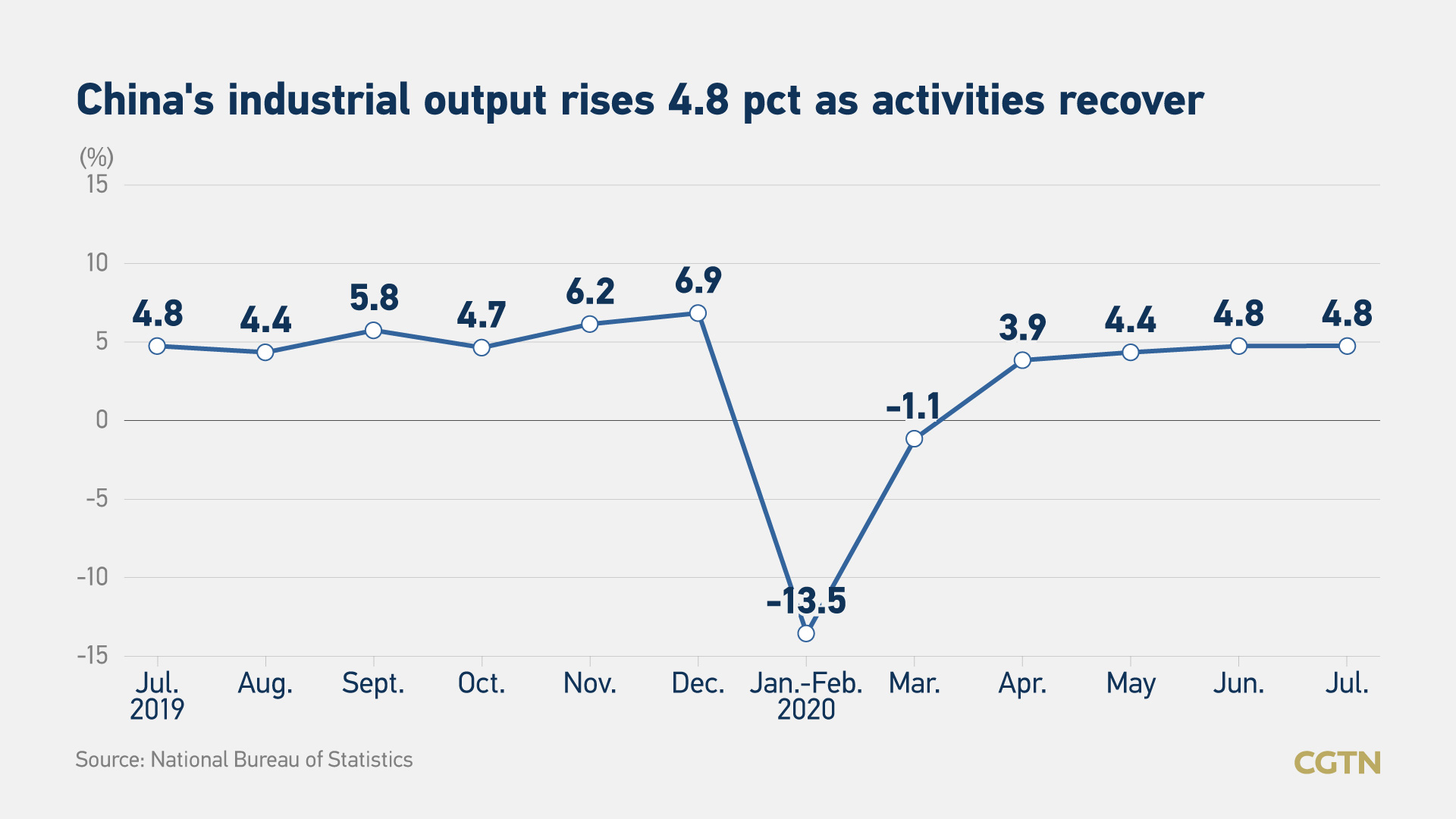

China's economy continued its rebound trajectory into the second half of 2020. Its added value of major industrial enterprises went up by 4.8 percent year on year in July, flat with the growth registered in the previous month, the National Bureau of Statistics (NBS) said Friday.

Industrial production, the main gauge of manufacturing and mining output in the world's second largest economy, furthered its four-month growth streak following a contraction in the first quarter.

As the world's major economies successively plunge into recession, the recent data suggests its economy is generally recovering quicker, as the first hit by COVID-19 and one of the first to recover.

Market sales of consumer goods gradually improved in the first seven months and reached 20.4 trillion yuan, down by 9.9 percent year over year, or 1.5 percentage points slower than the decline in the first half.

Foreign direct investment into the Chinese mainland, in actual use, expanded 15.8 by percent year on year to 63.47 billion yuan in July alone, marking the fourth consecutive month for the country to witness positive growth in FDI.

The FDI inflow from January through to July was better than expected, reversing a losing streak in the first half, Zong Changqing, an official with the Ministry of Commerce, told a news briefing Thursday.

A breakdown of data showed FDI inflow in the service industry hiked by 11.6 percent from January to July to 414.59 billion yuan from the same period last year, accounting for 77.4 percent of the total.

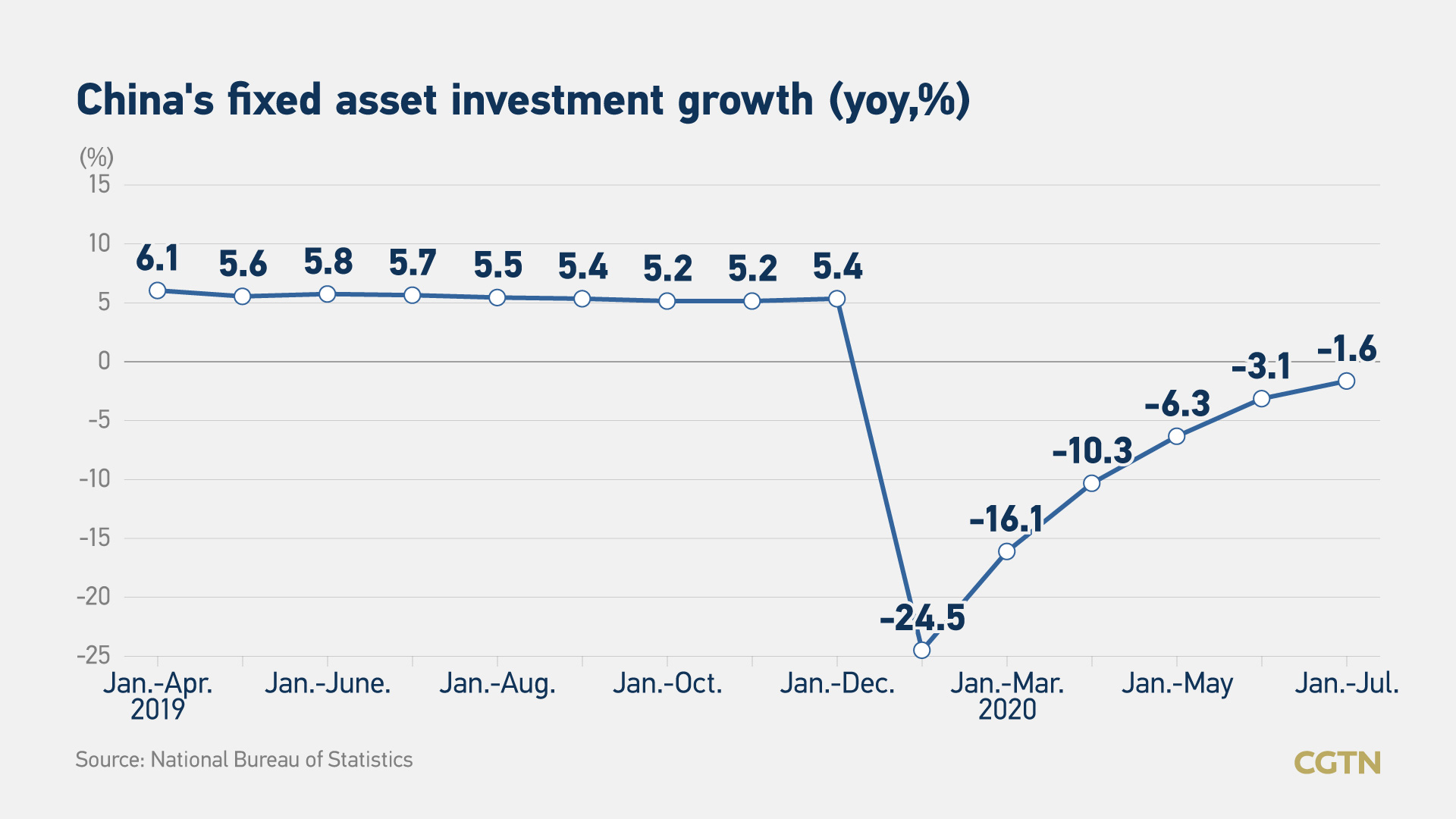

Friday's economic data also showed fixed asset investment fell by 1.6 percent in the first seven months of the year, narrowing remarkably from a 3.1-percent decline in the first half of the year. Investment in real estate development went up by 3.4 percent in the January-July period.

The surveyed unemployment rate in urban areas stood at 5.7 percent in July, on par with June, and the surveyed unemployment rate among those aged from 25 to 59 stood at 5.0 percent last month. In the first seven months, 6.71 million jobs were created in urban areas, 1.96 million fewer than the comparative period a year ago.

NBS pointed out that, on the whole, the national economy continued to recover steadily in July, with major economic indicators undergoing sustainable improvement. Nonetheless, the COVID-19 pandemic is still spreading across the globe, structural, institutional, and cyclical contradictions coexist at home, couple with numerous difficulties and challenges.

"In the past, China's economy relied heavily on external demand, but now China mainly hinges on its domestic demand. For the development of China and the United States, the economic complementarity between them is still relatively strong."

"We still hope to maintain equality, pursue mutual benefit and peaceful development, and jointly promote world economic growth. Cooperation benefits China and the United States, while conflicts hurt both, and struggle is detrimental to the entire world," it elaborated.

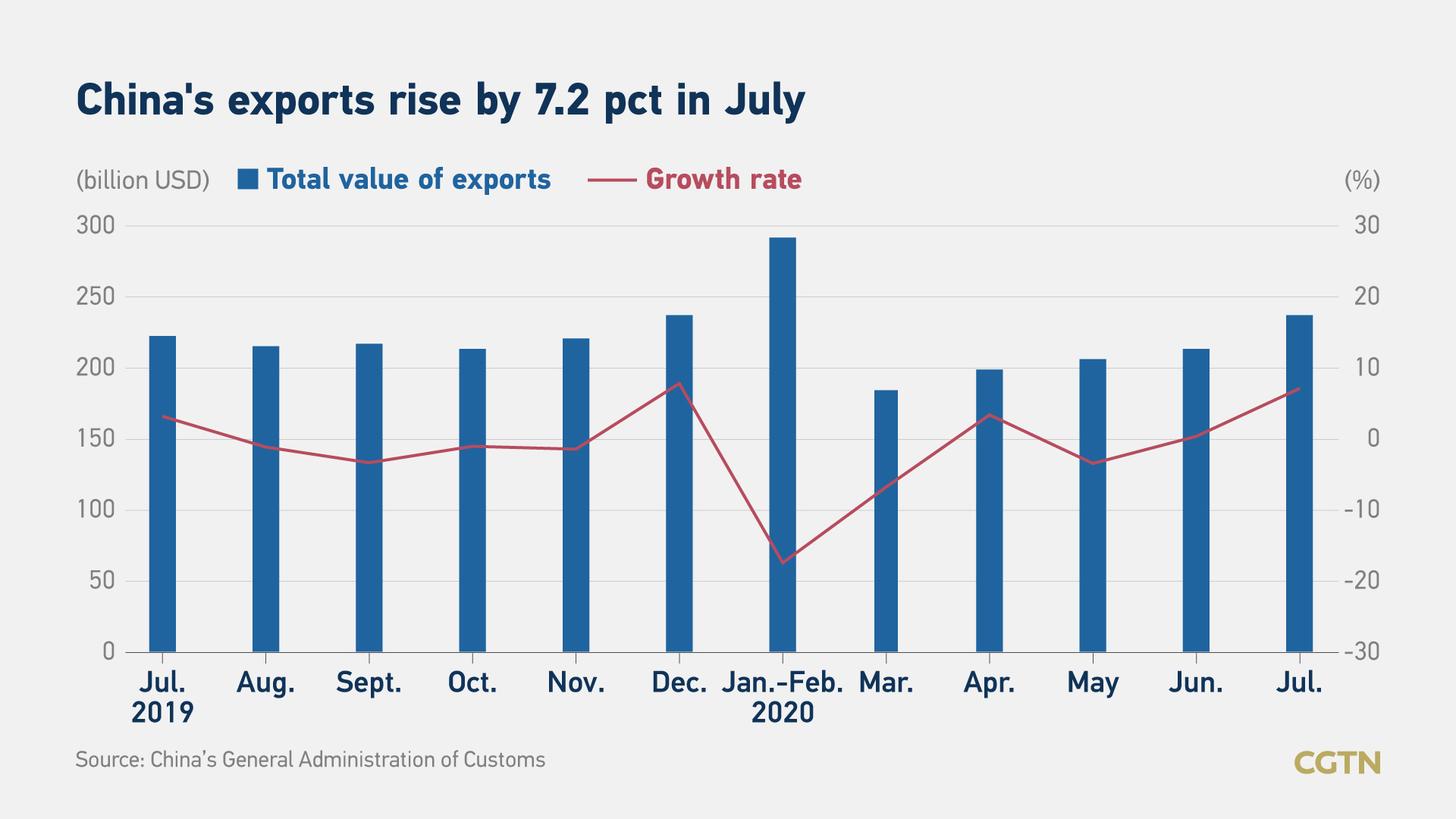

In spite of the COVID-19 pandemic choking global demand and clouding world recovery, China's exports data in July saw an astonishing surge beyond expectations.

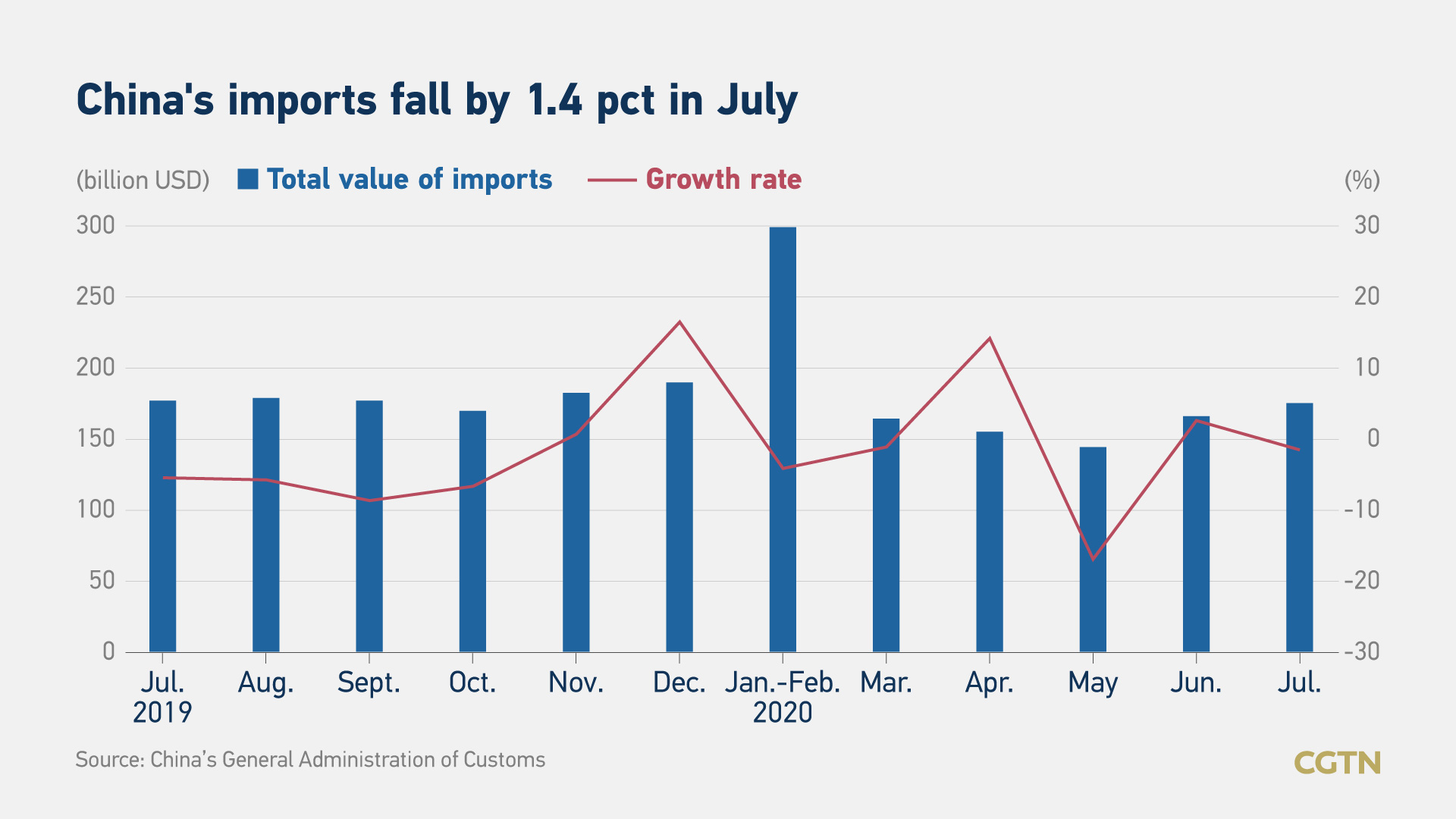

In U.S. dollar terms, exports edged up 7.2 percent to the tune of 237.6 billion U.S. dollars and imports saw a slight tumble of 1.4 percent from the year-earlier period to settle on 175.3 billion U.S. dollars, according to the General Administration of Customs.

The private sector further played a major role in spurring on the steady growth of foreign trade. In the first seven months of this year, the private sector contributed 7.83 trillion yuan or 45.6 percent of the total trade, up by 3.8 percentage points from the same period last year.

"Now that exports are much better than expected, as long as the resumption of overseas production is accelerating, China's exports should be able to stabilize at a positive growth range," Reuters cited Tang Jianwei, chief researcher of the Bank of Communications.

"Of course, we must also pay attention to whether the epidemic will bounce back and that trade frictions are still showing signs of escalation," the expert added.

Reuters said Friday that China's recovery had been gathering pace after the epidemic paralyzed huge swathes of the economy as pent-up demand, government stimulus and surprisingly resilient exports propel a rebound, which analysts say have reduced the urgency for more monetary stimulus.

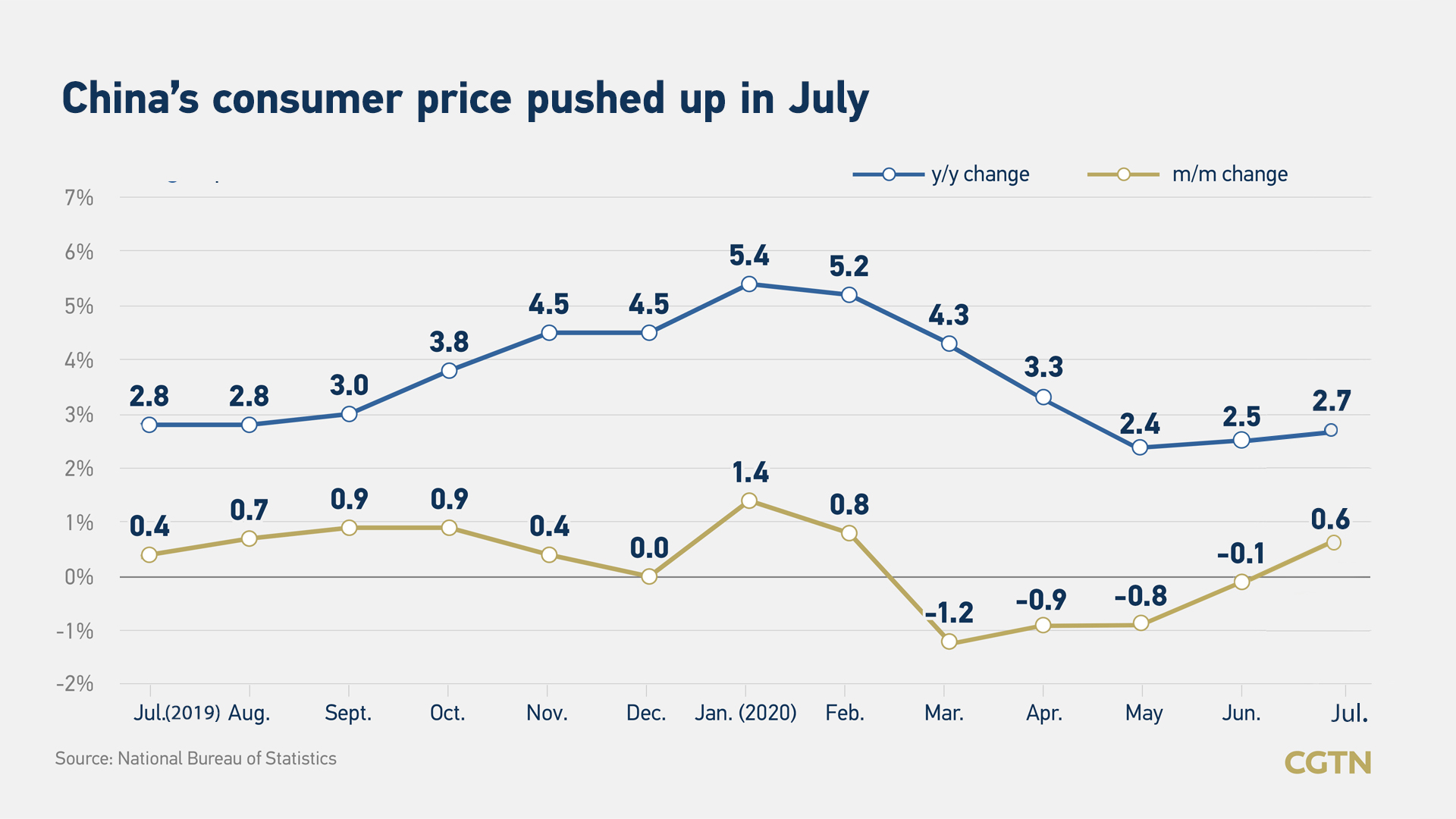

China's consumer inflation sailed further into growth territory by climbing 2.7 percent year on year in July mainly out of food prices, while factory deflation eased driven by a rise in global oil prices and as industrial activity clawed back toward pre-coronavirus levels.

"We expect CPI inflation to resume its downtrend soon in coming months and drop to around one percent at year-end," said Lu Ting, chief China economist at Nomura, "due mainly to the higher base from surging pork prices."

The producer price index, which measures costs for goods at the factory gate, shed by 2.4 percent from a year earlier in July, compared with a 2.5-percent decline tipped in a Reuters poll of analysts and a 3.0-percent retreat in June.

"The rise in PPI inflation was driven by higher prices of oil and other major raw materials as the global economy, including the Chinese economy, recovered from the worst phase of the pandemic," said Lu, adding that it "could rise further in coming months on a global recovery."

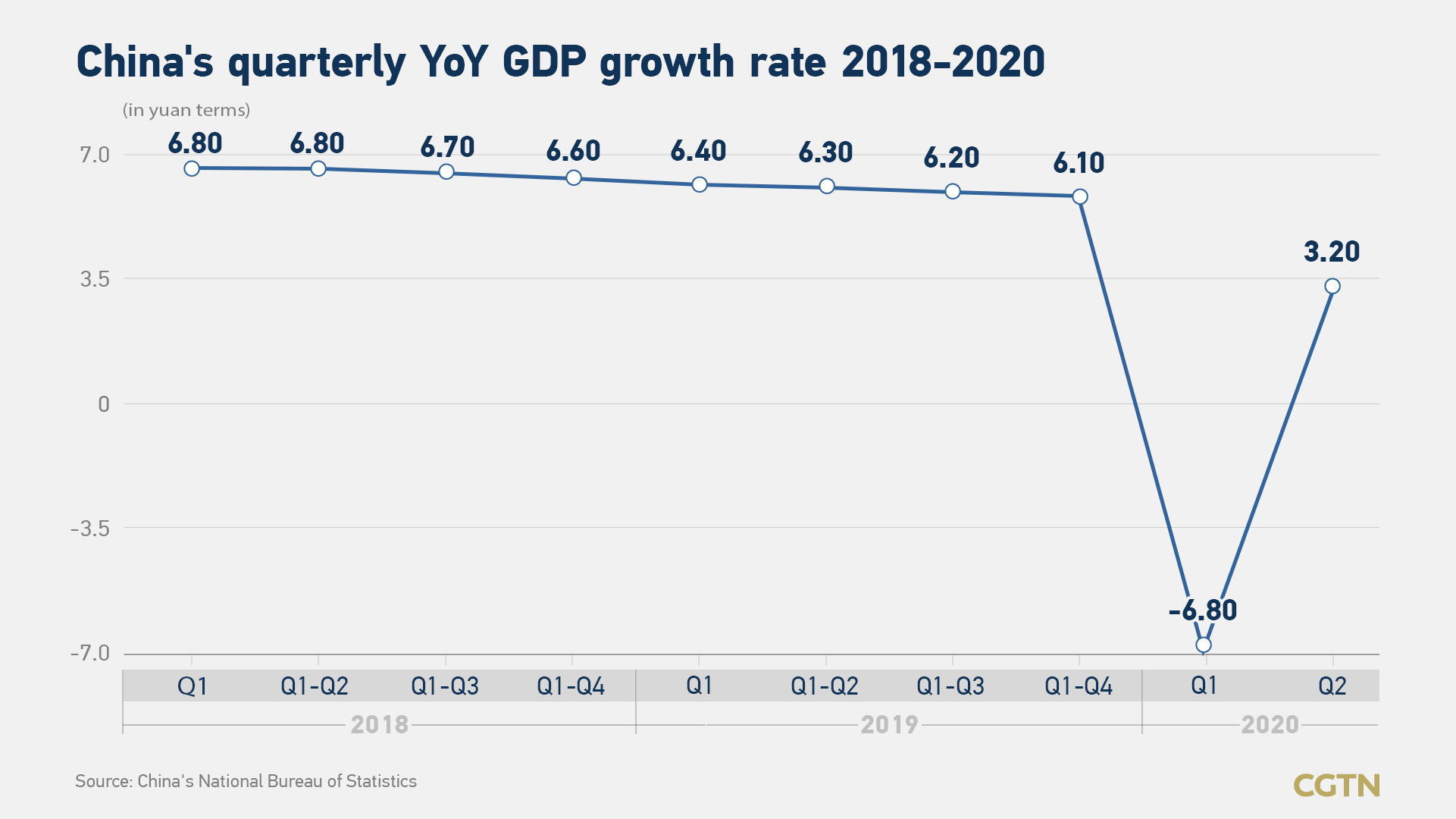

The world's second-largest economy grew by 3.2 percent in April-June from a year earlier, reversing a 6.8-percent decline in the first quarter – the first contraction since at least 1992 when official quarterly gross domestic product (GDP) records started.

In the first half of 2020, China's economy declined by 1.6 percent year on year.

简体中文

简体中文