China's economy showed signs of significant improvement in April from its COVID-19 lockdown as the coronavirus pandemic ebbs away in the country, with industrial output growing in the positive territory, according to data provided by the National Bureau of Statistics (NBS) on Friday.

Industrial output bounced back into positive territory in April as an overwhelming majority of factories across China start humming again amid nationwide efforts to resume production, with the total value added of major industrial firms climbing by 3.9 percent year on year.

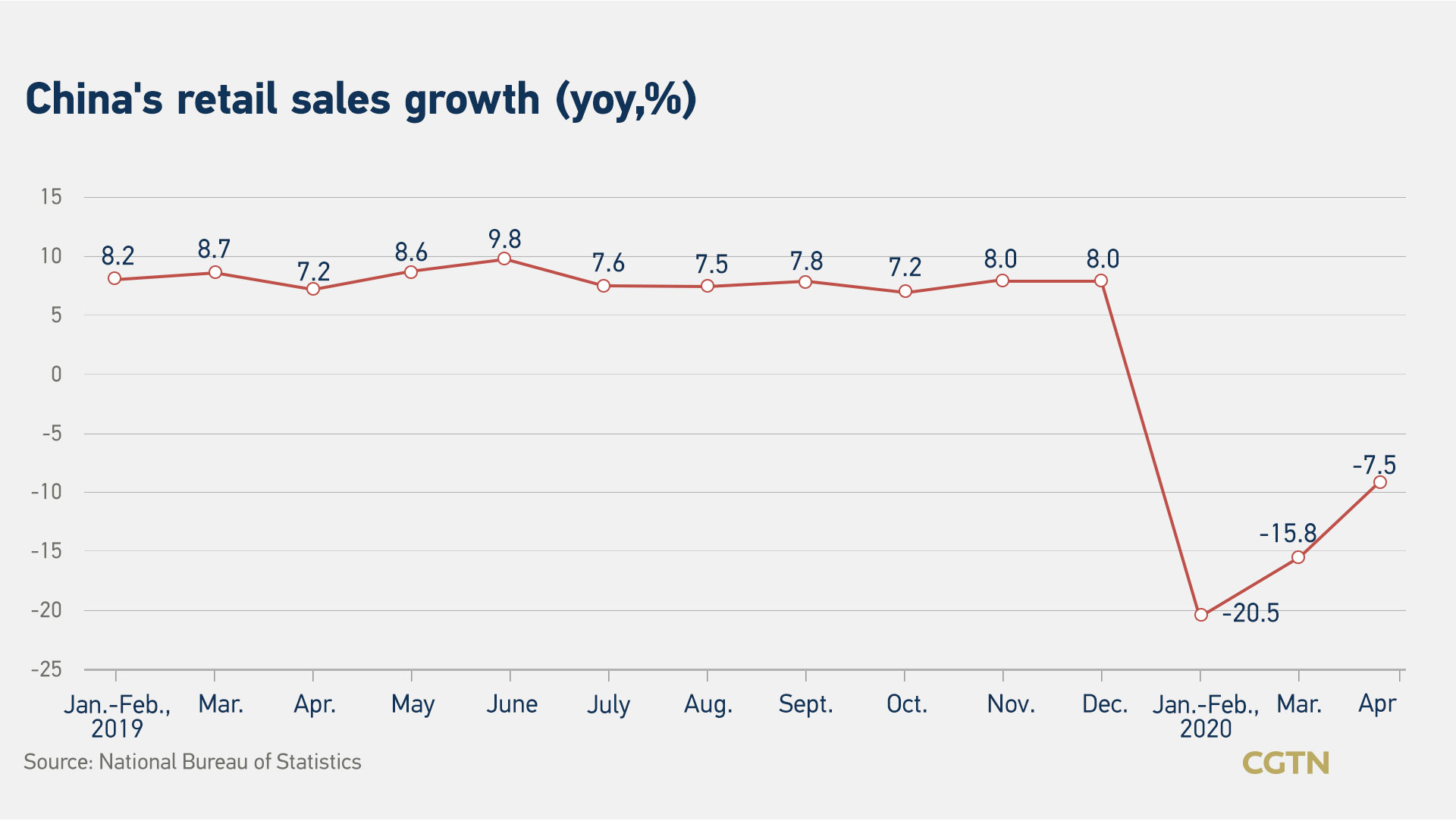

Consumption remained the overriding growth engine fueling the country's economy, with retail sales, a major indicator of consumption growth, edging down 7.5 percent in April compared to the same period last year and narrower from a 5.8 percent tumble in March, boosted by local voucher issuance programs that have helped release pent-up demand, NBS data showed.

From January through April, the nationwide online retail sales amounted to expanded 1.7 percent to 3.07 trillion yuan, versus a decrease of 0.8 percent from the January-March period. Among them, the online sales of physical goods increased by 8.6 percent, 2.7 percentage points higher than that of the first three months and accounting for 24.1 percent of total retail sales.

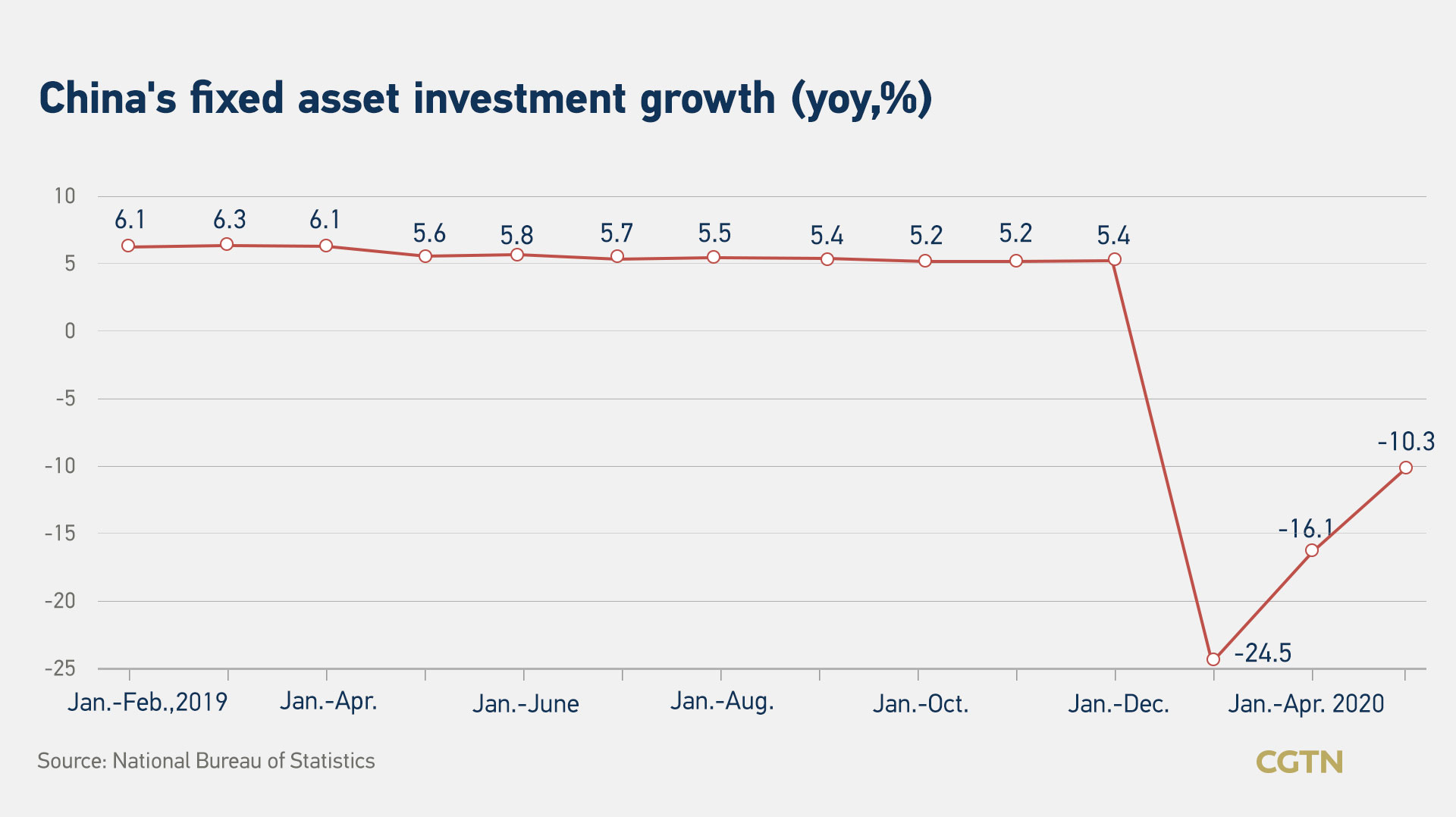

Weighed on by the flare-up of infections and uncertainties clouding overseas outbreaks, China's fixed-asset investment during the January-April period contracted by 10.3 percent, but it still pared a year-on-year decline of 16.1 percent in the first quarter of 2020.

The economic data released on Friday also showed foreign direct investment (FDI) into the Chinese mainland rebounding in April. Such a rise could attribute to the policy-added efforts nationwide to shore up the stability of foreign investment, with a FDI inflow, up 8.6 percent year on year to settle at 10.14 billion U.S. dollars.

During the January-April period this year, the FDI moved downward 6.1 percent from a year earlier to the tune of 286.55 billion yuan (41.3 billion U.S. dollars), dragged down on the quarantine and social distancing measures targeting the coronavirus pandemic.

The FDI inflow to information services, e-commerce services and professional technical services skyrocketed last month by 46.9 percent, 73.8 percent, and 99.6 percent respectively compared to the same period a year earlier.

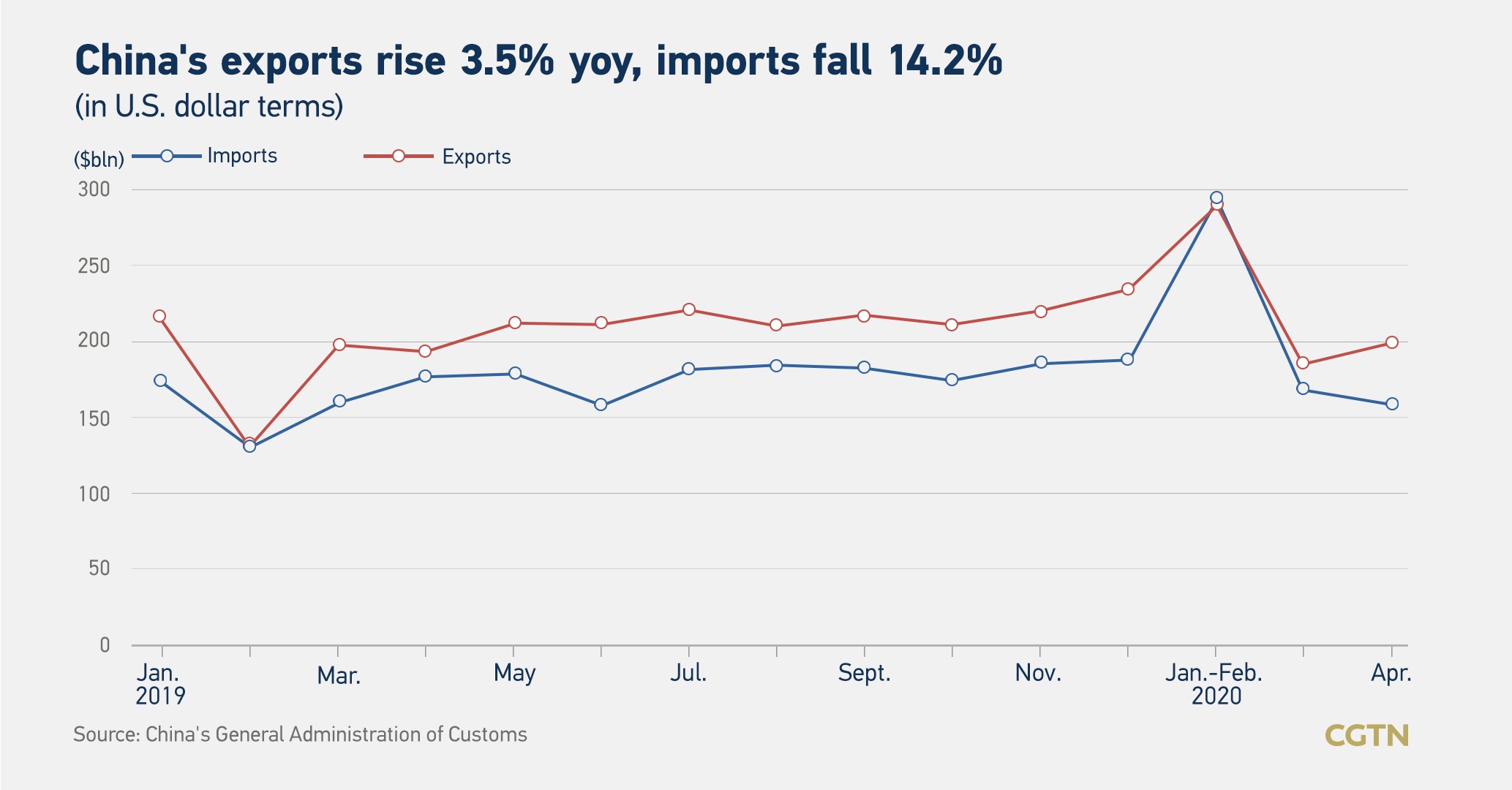

The country's exports notched up an unexpected gain of 3.5 percent in U.S. dollar terms for the month of April as factories and restaurants got back on track in the wake of eased restriction measures and social distancing, coupled with a 14.2 percent retracement in imports.

That is a far cry from a Reuters poll, which projected April imports and exports would suffer double-digit setbacks of 11.2 percent and 15.7 percent, respectively, following tentative tweaks in March, while Bloomberg forecast that the contraction in China's foreign trade is set to continue through the second quarter.

China's inflation further sailed into the slowdown territory in April, with its main gauge of the consumer price index (CPI) registering a year-on-year rise of 3.3 percent which is 0.9 percent narrower than in March, buoyed by a swift and violent sink of oil prices and pork prices.

Food prices remained the locomotive of consumer inflation last month though its increment speed bounced back from March's 18.3 percent to the current 14.8 percent, due in large part to pork price inflation descending to 96.9 percent as compared to 116.4 percent in the previous month.

China's job market remained stable in April, with the surveyed unemployment rate in urban areas standing at 6 percent, 0.1 percentage points higher than in March. A total of 3.54 million jobs were created in the first four months this year.

Liu Aihua, NBS spokesman, said that the national economic performance in April continued the recovery momentum obtained in March, but the improvement of these indicators has a nature of compensatory recovery, some major indexes are still in the downtrend range.

(ASIA PACIFIC DAILY)

简体中文

简体中文