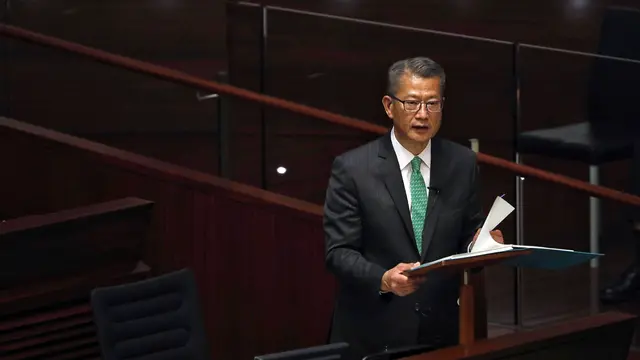

Paul Chan Mo-po, Hong Kong's financial secretary, delivers his budget speech in Hong Kong, China, February 24, 2021. /CFP

Supporting the financing and certification of green projects can help Hong Kong's financial industry to stay at the forefront of international trends and further diversify growth, wrote the city's Financial Secretary Paul Chan Mo-po in a blog on Saturday.

He pledged that policies will bolster the city's low-carbon transformation and enhance its status and competitiveness as a green financial center in the Greater Bay Area.

The Special Administrative Region is pushing through its emissions reduction goal in reaching carbon neutrality by 2050, 10 years ahead of the national goal.

The city's 2021- 2022 budget doubled the borrowing ceiling of its green bond program to HK$200 billion ($25.8 billion), allowing it to issue a further HK$175.5 billion of green bonds over the next five years according to market conditions.

The total amount of green bonds issued in Hong Kong exceeded $38 billion from 2015 to the end of 2020, data from Climate Bonds Initiative, a non-profit organization, showed last week. The global green bonds offering hit a record $290 billion last year.

In 2020 alone, the total amount of green bonds and loans arranged and issued in Hong Kong reached US$12 billion, Paul revealed. He added that issuers from the Chinese mainland accounted for 60 percent of the total issuance last year.

Hong Kong has slightly revised up its first-quarter

economic growth

rate to 7.9 percent, while the unemployment rate dropped from the previous historical high of 7.2 percent to 6.8 percent during the same period. Paul said the green economy can support sustainable growth and also provide more job opportunities.

He also called for Hong Kong residents to actively participate in the vaccination program as the improvement of the economy and the job market largely depend on the effective control of the COVID-19 epidemic.

简体中文

简体中文