By APD writer Alice

The world is paying a high price for a technological war between the US and China, its two greatest economies. The conflict has dealt a blow to the telecommunications and semiconductor industries in both countries, but its consequences are spreading beyond.

In recent years, the US has continuously attacked Chinese technology firms, from ZTE, Huawei to most recently ByteDance, Tencent and SMIC. The administration of President Donald Trump has blocked leading Chinese companies from accessing the US market and prevented American companies from exporting to China. Companies estimated costs have increased by billions of dollars, for a variety of reasons ranging from losing business parners to finding replacements for Chinese telecom equipment.

The US-China tech war is clearly upsetting the two countries' technology industries, disrupting the operations of hardware giants, chip designers and even social media services. The telecom and semiconductor industries bear the heaviest consequences. The effects are also spreading as the actions of Beijing and Washington affect rural areas of America and Europe and many other corners of the world.

The consequences can also be more severe. For example, China may respond by increasing barriers to US tech firms like Apple and Qualcomm, which still see China as an important market.

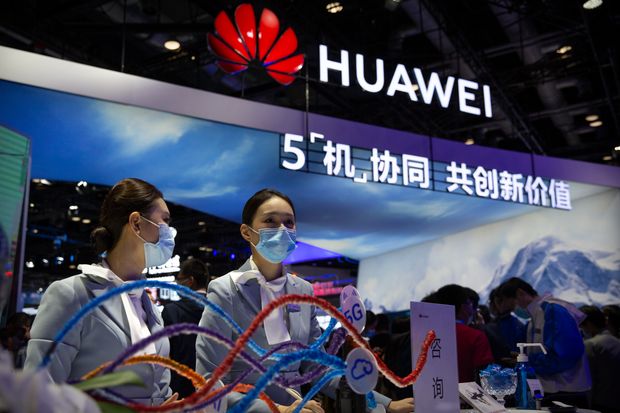

In the field of telecommunications, the biggest victim of this conflict is Huawei Technologies - the most successful Chinese company in the international market. The US export restriction has cut off much of Huawei's supply chain. Washington has also lobbied its allies in Europe and elsewhere to ban Huawei from joining 5G networks in these countries as it believes that Beijing could force Huawei to spy on or attack the networks.

With sales of $123 billion last year, Huawei is now the world's top telecom equipment producer and also one of the largest smartphone makers. However, its Vice Chairman Guo Ping recently said the firm’s goal is to "survive" after the US threatened the supply of chips using American technology that Huawei needs to make hardware.

Guo said the consumer segment (including smartphones) has been facing the biggest challenge. The telecommunications equipment segment is also in danger.

Of course, Huawei's problems don't just affect this firm only. Other companies in the US, Europe and Asia that design or manufacture chips for Huaweiare also affected. Huawei said it spends more than $11 billion a year on US components.

In the UK, the government said the US disrupting Huawei's supply chain makes it even more difficult to assess the level of security in Huawei devices. British officials are concerned that Huawei will buy components from new suppliers that pose a threat to national security. Officials therefore refuse to let telecom service providers buy Huawei's 5G equipment and have to replace the existing devices before 2027. BT Group said it will cost an additional $650 million for the replacement.

In Europe, many major telecom companies also began to shift their direction, not focusing on expanding coverage and building 5G networks anymore, but now replacing the Huaweiequipment they are using. The leaders of European firms for many years have warned that the continent is behind the US and Asia in terms of 5G network deployment. Embargo on Huawei could make this even more serious.

Without 5G, technology and manufacturing firms in Europe will lag behind in 5G-dependent technologies, such as self-driving cars and factories using robots. This will reduce capacity and cause companies to miss new business opportunities.

In the US, since 2012, major telecom service providers have been banned from using Huawei and ZTE equipment. However, these two Chinese companies have continued to supply devices to small, rural telecom operators. By June 2020, the US continued to ban small operators from using federal money to buy or maintain equipment of these companies.

Small operators often rely on federal subsidies. Therefore, the above decision forced them to replace suppliers in a few years. About 50 companies in rural areas of the US said this would cost them a total of $1.8 billion.

Pine Belt Communications - a network operator in Alabama plans to double its network’s capacity to reach 100,000 new customers, including children who need Internet connection for distance learning because of the pandemic. However, this plan can now take more than a year to implement, because the US Congress has not approved financial aid yet.

Meanwhile, American semiconductor companies that want to sell some products to China will have to apply for permission from the Department of Commerce. Currently, the industry is asking the government to increase transparency and consistency in the licensing process, as US companies are losing revenue.

In 2018, the US semiconductor industry generated revenue of $226 billion, accounting for 48% of the global market share, according to Boston Consulting Group’s March report. These figures are expected to decline in the coming years, due to increased competition from China. The US export restriction order could make the reduction even stronger.

Industry leaders say the revenue that should belong to American chipmakers will go to foreign competitors, leaving them with less money for R&D (research and development). This is important, because in order to maintain global dominance, the US needs to produce advanced chips for both military and commercial use.

The US moves are indirectly causing businesses to lose their business. The export restriction is also impacting foreign semiconductors, as they use US technology in the process of making products to sell to Huawei. Kioxia Holdings (Japan) had to cancel its IPO plan last month because the US export restriction on Huawei has affected its business.

(ASIA PACIFIC DAILY)

简体中文

简体中文