The euro zone is making another attempt at agreeing on new fiscal stimulus to deal with the coronavirus pandemic, after 16 hours of talks earlier this week failed to produce any outcome.

Europe is one of the hardest hit regions by COVID-19, with Italy and Spain seeing some of the highest numbers of infections and deaths worldwide. European economies are struggling to cope with the pandemic amid business closures and a lack of tourism.

The region — 19 countries which share the euro — has failed to come up with a joint stimulus plan to finance some of the costs of the pandemic. Euro zone finance ministers have been at loggerheads over whether to issue combined European securities, as well as the disbursement of new loans.

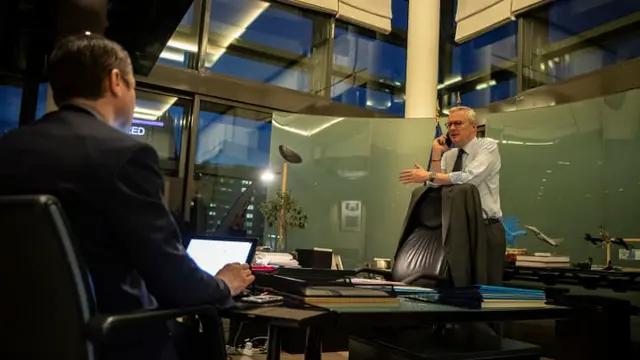

“A failure is inconceivable,” French Finance Minister Bruno Le Maire said Wednesday after no meaningful result during a meeting with his counterparts.

There’s pressure on the finance ministers to come up with a deal soon. Italian borrowing costs rose on Wednesday, after the failed discussions, and there are concerns that their division will fuel anti-EU sentiment across the region.

In addition, the French and German economies — the two largest in the region — are expected to experience deep recessions. Forecasts released Wednesday suggested Germany will shrink by almost 10% in the second quarter of 2020; and they also pointed to a 6% contraction in France during the first quarter of this year.

Dennis Shen, director at Scope Ratings, told CNBC’s “Squawk box Europe” that there will be a “severe downturn” in Europe.

Italy could contract “around 7.5%” and Spain “around 8%” this year, Shen added.

European governments have lifted fiscal targets and eased state aid rules in its initial reaction to the economic impact of the pandemic. Since then, they have also approved 37 billion euros ($40 billion) to support businesses. However, they are struggling to go further than that at the euro area-wide level.

Goldman Sachs said in a note Wednesday, that the measures taken so far are not enough to deal with the scale of the problem.

“The severity of the COVID-19 shock means it is unlikely to be able to be borne at the national level given the high starting level of debt for some member countries,” analysts at the investment bank said in a research note.

The European Central Bank (ECB) has also announced a massive stimulus package to support the euro area. The bank is buying 750 billion euros in bonds this year to reduce borrowing costs for euro governments.

“The ECB can manage volatility in the short run. But despite the flexibility of the ECB’s programs, they are only a temporary solution – without a more structural solution on fiscal risk-sharing, volatility in sovereign spreads will likely re-emerge,” Goldman Sachs also said.

The hardest hit nations are also the ones with some of the biggest debt piles. Italy has a debt-to-GDP (gross domestic product) ratio of around 130%, while Spain’s and France’s debt are close to 100% of their GDP.

“The Eurogroup’s lengthy delays and intense jostling will tarnish whatever measures are eventually agreed. Italian leaders, for instance, may be less than enthusiastic to sell the compromise to an already somewhat frustrated home audience,” Florian Hense, economist at Berenberg bank, said via email.

(CNBC)

简体中文

简体中文