It seems the demand for

Safaricom’s

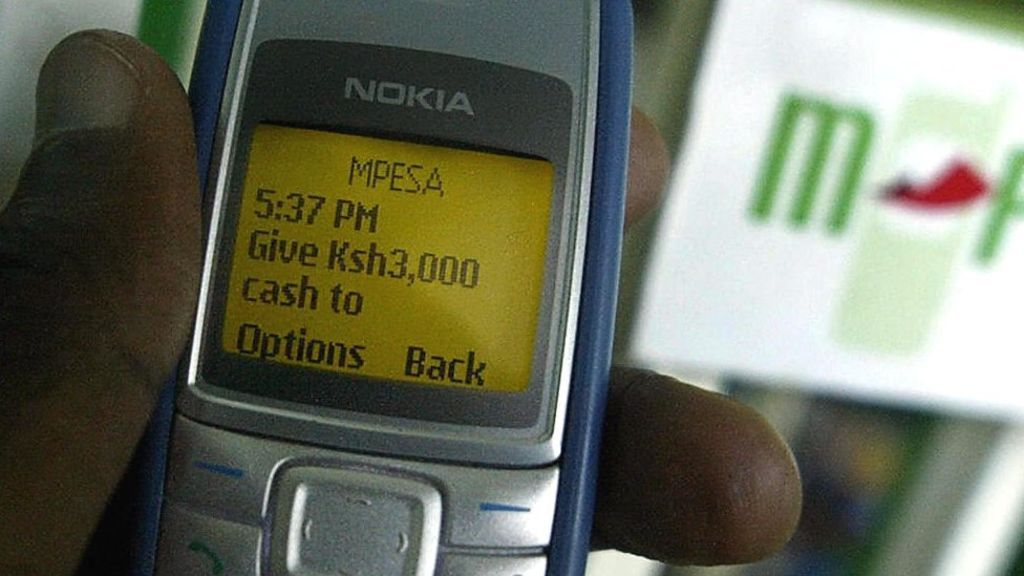

M-Pesa

payment product never eases. Since its 2007 launch in Kenya, the fintech app has commanded over 70% of the mobile money market in that country. When COVID-19 hit the East African nation of 53 million in March, the Kenyan

Central Bank turned to M-Pesa

as a public health tool to reduce use of cash.

And last month, one of the world’s financial services giants —

Visa

— connected M-Pesa to its global network.

Visa

and Safaricom

— which is Kenya’s largest telecom and operator of M-Pesa — announced a partnership on payments and tech.

The arrangement opens up

M-Pesa’s

own extensive financial services network in East Africa to Visa’s global merchant and card network across 200 countries.

The companies will also collaborate “on development of products that will support digital payments for

M-Pesa

customers.” The partnership is still subject to regulatory approval.

The details remain vague, but the payment providers also said they will use the collaboration to facilitate e-commerce.

Images Credits: Getty Images

On a continent that is still home to

the largest

share of the world’s unbanked population, Kenya has one of the highest mobile-money penetration rates in the world. This is largely due to the dominance of M-Pesa

in the country, which has 24.5 million customers

and a network of 176,000 agents.

As we

detailed in ExtraCrunch

, Visa has been on a VC and partnership spree with African fintech companies. The global financial services giant has named working with the continent’s payments startups as core to its Africa expansion strategy.

Visa and Kenya’s Safaricom partner on M-Pesa, payments and tech

One of those fintech ventures Visa has teamed up with,

Flutterwave,

launched an e-commerce product in April. The San Francisco and Lagos-based B2B payments company announced Flutterwave Store

, a portal for African merchants to create digital shops to sell online.

The product is less

Amazon

and more eBay — with no inventory or warehouse requirements. Flutterwave insists the move doesn’t represent any shift away from its core payments business.

The company accelerated the development of Flutterwave Store in response to COVID-19, which has brought restrictive measures to SMEs and traders operating in Africa’s largest economies.

After creating a profile, users can showcase inventory and link up to a payment option. For pickup and delivery, Flutterwave Store operates through existing third party logistics providers, such as

Sendy

in Kenya and Sendbox

in Nigeria.

The service will start in 15 African countries and the only fees Flutterwave will charge (for now) are on payments. Otherwise, it’s free for SMEs to create an online storefront and for buyers and sellers to transact goods.

While the initiative is born out of the spread of

coronavirus cases in Africa

, it will continue beyond the pandemic. And Flutterwave’s CEO Olugbenga Agboola

— aka GB — is adamant Flutterwave Store is not a pivot for the Y-Cominator backed

fintech company.

“It’s not a direction change. We’re still a B2B payment infrastructure company. We are not moving into becoming an online retailer, and no we’re not looking to become Jumia,” he told

TechCrunch

.

African fintech firm Flutterwave launches SME e-commerce portal

In early stage startup activity, a relatively new company — Okra — has created a unique platform that allows it to generate revenue on both sides of the fintech aisle.

Founded in June 2019 by Nigerians

Fara Ashiru Jituboh

and David Peterside, the company refers to itself as a “super-connector API” with a platform that links bank accounts to third party applications.

Okra’s clients include fintech startups and large financial institutions in Nigeria. The company got the attention of TLcom Capital — a $71 million Africa focused VC firm —that backed Okra with $1 million in pre-seed funding. The Nigerian startup is using the funds to hire and expand to new markets in Africa, most likely

Kenya

.

Nigeria’s Okra raises $1M from TLcom connecting bank accounts to apps

More Africa-related stories @

**TechCrunch **

-

Visa’s Africa strategy banks on startup partnerships

-

African genomics startup 54gene raises $15M led by Adjuvant Capital

-

In Nigeria, PalmPay waives fees and creates ₦100M COVID-19 payout fund

-

WHO Africa hosts hackathons, offers seed funds to fight COVID-19

African tech around the ‘net

-

Iyin Aboyeji’s Future Africa Fund might be the future of fundraising in Africa

-

Kenya Finally Approves Drone Operations, Here is What You Need to Know

简体中文

简体中文