Headquarters of the People's Bank of China in Beijing. /VCG

China's macro leverage ratio has increased in the first quarter as the country stepped up credit support to mitigate the impact of COVID-19, the country's central bank said Tuesday.

The latest central bank data showed that China's new yuan-denominated loans continued to climb in April, hitting 1.7 trillion yuan (about 240 billion U.S. dollars) last month, 682 billion yuan higher than a year ago.

The data is better than market expectation but largely in line with predictions by Bloomberg at 1.3 trillion yuan and by UBS at 1.6 trillion yuan.

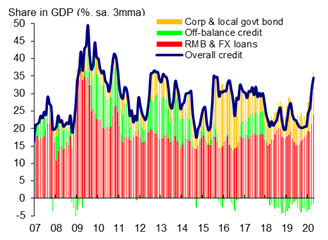

April new total social financing (TSF) beat gross estimates due to stronger bank loans, corporate bonds and shadow credit (y/y). /CEIC, UBS estimates

Stronger corporate lending again

Stronger new corporate loans stood at 956 billion yuan, with year-on-year growth of 609 billion yuan, leading the strength again.

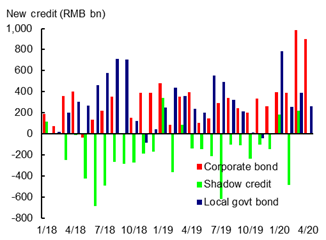

Corporate bonds stay strong, shadow credit improved y/y, LG bonds softened. /CEIC, UBS estimates

The rise in leverage is a result of counter-cyclical policies aimed at supporting the resumption of work by companies, the central bank said in an online statement.

Such strength is likely boosted by the central bank's special re-lending and re-discount facilities at 1.8 trillion yuan between February and April, government's explicit guidance to support SMEs and infrastructure with more forbearance, and continued release of pent-up credit demand in light of economic normalization, according to UBS.

Household loans improved a bit to 667 billion yuan, of which medium and long-term loans largely stabilized at 439 billion yuan, reflecting recentrecovering property sales.

Credit growth accelerated further

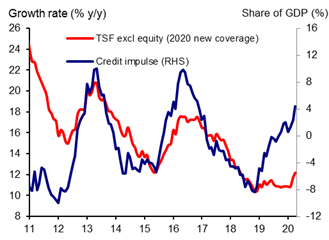

Credit growth picks up further to 12.2 percent y/y, while credit impulse continues to rebound. /CEIC, UBS estimates

In the first four months, China's new yuan-denominated loans totaled 8.8 trillion yuan and new total social financing recorded 14.2 trillion, already 52-55 percent of the new credit in the full year of 2019, according to the UBS.

The ratio has climbed notably in the first quarter affected by the novel coronavirus outbreak. However, the macro leverage ratio has remained generally stable since 2017, with a decline seen in 2018 and a mild increase registered in 2019.

The M2, a broad measure of money supply that covers cash in circulation and all deposits, rose by 11.1 percent year on year in April, 1 percentage point higher than that at the end of March and 2.6 percentage points higher from a year ago, showing the effect of monetary policies, the central bank said.

M2 growth jumps further to 11.1 percent y/y thanks to a big increase in deposits, while M1 growth edges up. /CEIC, UBS estimates

By the end of April, outstanding social financing, a measurement of funds that individuals and non-financial firms receive from the financial system, increased by 12 percent year on year to the highest level since June 2018, according to the central bank.

Policy easing to continue

The central bank added that the credit increase is only temporary and will eventually trend down after companies resume operation.

Analysts from the UBS expect the credit growth rebound to continue in the coming months thanks to ongoing policy easing. They expect more policy easing to come, with additional 50bps RRR cuts and 10-20bps policy rate cuts.

However, they also stressed that the strong momentum of credit growth acceleration may not last into late Q3 and Q4, as the government may re-assess the strength of policy stimulus when the economy fully comes back to normal and global demand recovers.

The UBS also forecast the country's GDP sequential growth to rebound sharply in Q2 after a sharp decline in Q1.

But the expected Q2 recovery faces headwinds, including external demand decline due to expected recession in G3 and some emerging markets, lingering unemployment pressure and income losses, cautious consumer sentiment and potential global supply chain disruptions, according to the UBS.

(With input from Xinhua)

简体中文

简体中文