03:09

The demand for medical waste disposal has surged in China during the coronavirus outbreak. Analysts say the pandemic could spur opportunities for the country's broader hazardous waste treatment sector, but investors should think twice before buying in.

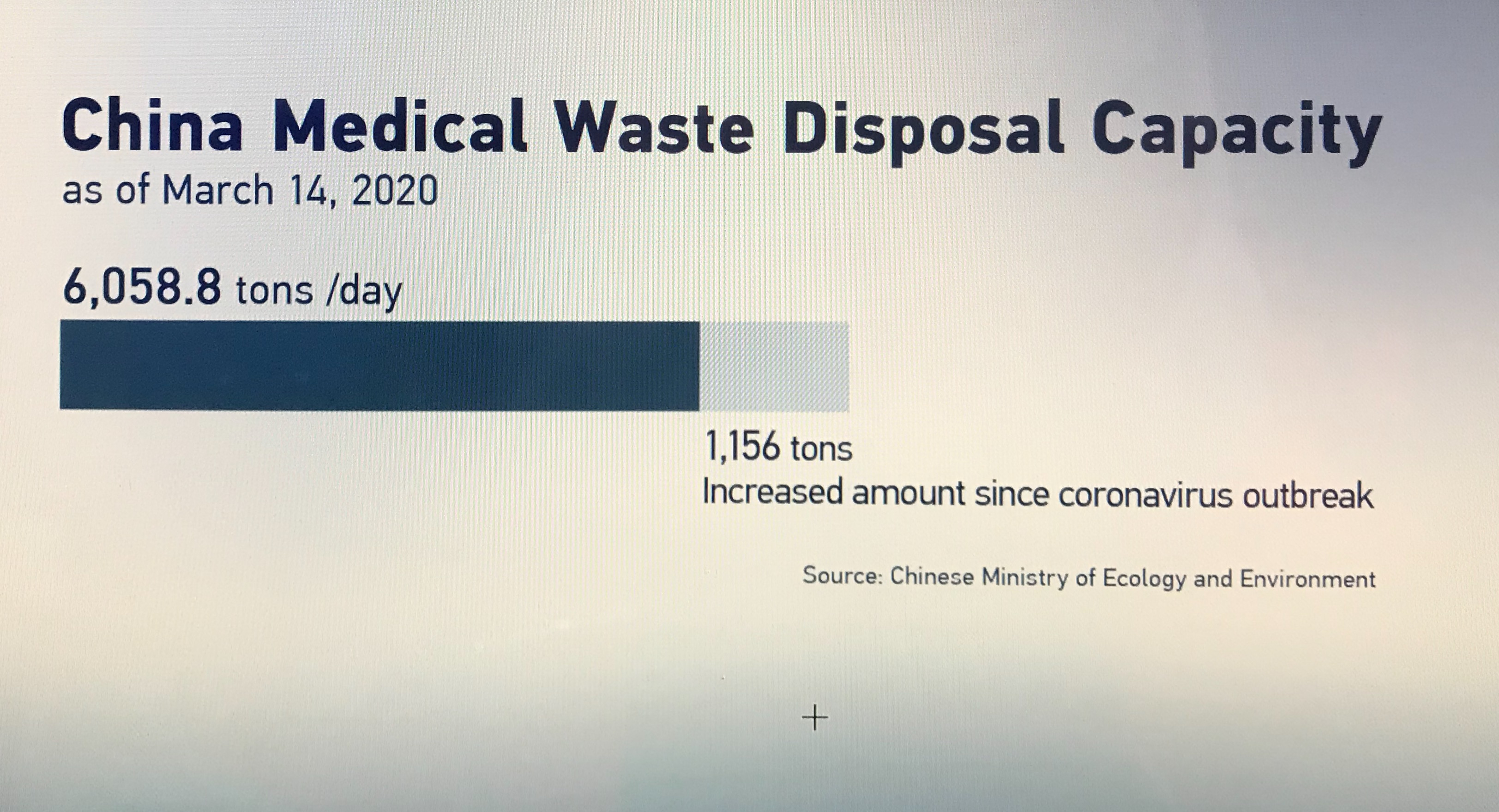

China currently can process over 6,000 tons of medical waste a day, according to the Ministry of Ecology and Environment. Nearly 1/5 of that capacity was developed in urgent demand to cope with the coronavirus outbreak. Meanwhile, many environmental companies have sent teams to the pandemic epicenter of Hubei Province to help improve the waste disposal systems there.

CGTN screenshot

"The existing medical waste treatment facilities we built since the SARS outbreak in 2003 are basically enough for emergencies like this. But such problems as a lack of regulations and capacity shortages remain in certain areas," said Li Yaojian, the Deputy Chief Engineer China Tianying, an international environmental management corporation headquartered in Jiangsu province.

That's why Chinese authorities have required all cities to each build at least one qualified medical waste treatment center by the end of the year. Every county should also have a medical waste collecting and shipping system as of June 2020, according to the requirements.

Those new policies point to not only larger capacity, but also some opportunities for China's hazardous waste treatment industry.

Yin Zhongshu, a chief environmental analyst with Everbright Securities suggest that companies should focus on quality growth and safety, as the waste disposal industry will become more regulated after the epidemic.

Professionals dumping medical waste in an incinerator in Wuhan, Hubei province. /Xinhua

The mainstream medical waste treatment methods so far in China include Autoclaves, Microwaves and Chemical Disinfection. They are comparatively easy but could generate secondary waste to be buried or incinerated. The final step is also adding to costs.

Meanwhile, traditional waste incinerators usually can't mass process and are not stable or clean enough.

Yin sees investment opportunities in high tech, like big data tracking systems and digital collecting technology, which are effective ways to improve safety.

China Tianying is also looking at AI shipping networks and other cutting-edge technologies. The company uses its self-developed plasma gasification technology to dispose of medical waste in HaiAn, Jiangsu province during the epidemic. The whole process is engineered.

But even in critical moments like this, the A-share prices of the waste disposal sector still fluctuate, instead of outperforming. Analysts remind investors to stay rational about the industry that is still in recovery from the 2018 de-leveraging process.

Yin also mentioned that many companies saw the surging demand for hazardous waste treatment, and raised large funds to expand. But they had overlooked the fact that this is somewhat a public cause, which can't turn a profit very quickly. That's why many of them ran into debt problems after China's de-leveraging in 2018.

Analysts say the coronavirus outbreak also made people realize that they need to share more responsibility in environmental protection – maybe by paying for waste treatment services. A fee-based waste treatment system may help environment companies prosper in the future.

简体中文

简体中文