Chinese Internet giant Tencent Holdings Ltd. warned of possible challenges to its advertising business due to China’s economic slowdown, even though it posted strong earnings growth for the first quarter thanks to solid revenue from mobile games and ads.

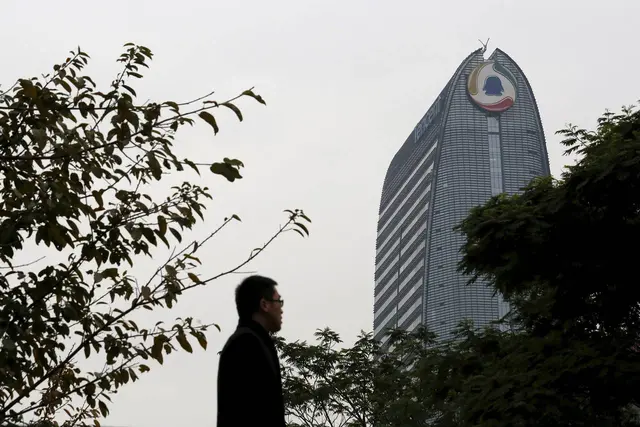

The Shenzhen-based company, which operates the WeChat and QQ messaging and social-networking applications, said Wednesday that its net profit for the three months through March rose 33% to 9.18 billion yuan ($1.41 billion) from 6.88 billion yuan a year earlier. Its revenue rose 43% to 32 billion yuan.

Tencent’s advertising revenue in the quarter jumped 73% to 4.7 billion yuan. About 80% of the ad revenue was generated by mobile platforms, the company said. The rate of growth, however, slowed from the fourth quarter, when ad revenue more than doubled from the previous year.

Tencent said in its earnings release that its brand-advertising business “could face near-term challenges due to the uncertainties of [the] macroeconomic environment in China.”

During a conference call with analysts after the earnings release, Tencent President Martin Lau said that the company’s statement about the possible challenges is based on “a general feeling” it is getting from its ad sales staff. Negotiations for some ad contracts are taking a little longer than before, while some advertisers are keeping more of the budget for later in the year, Mr. Lau said.

Fresh concerns about the outlook for the ad business come as analysts and investors are counting on advertising to be the engine for Tencent’s revenue growth this year.

In the first quarter, Tencent’s revenue from online games—its biggest source of revenue—grew 28% to 17.09 billion yuan, boosted by smartphone games such as the mobile version of “CrossFire,” a top-grossing game previously released for personal computers. Tencent’s games are free to play; they generate revenue by charging players for better virtual weapons and other additional features.

While games are still Tencent’s bread and butter, the company has been expanding its advertising business on its social networks over the past year to create a new source of revenue growth,following in the footstepsofFacebook Inc., which has built a successful ad platform. For example, Tencent last year started placing brand ads in WeChat’s Moments section, where users post photos and updates.

On the conference call Wednesday, Tencent’s senior executives tried to manage analysts’ high expectations for Tencent’s advertising revenue growth.

“Our ad business is becoming quite large,” said Chief Strategy Officer James Mitchell. “While we still believe it will grow, the percentage growth may slow down,” he added.

Mr. Lau said that there needs to be a “reset” in people’s expectations for the rate of growth in advertising revenue this year, because last year was a “breakout year” for the ad business. “We really flexed our muscles” last year, he said. Tencent’s 2015 ad revenue more than doubled from a year earlier.

While Tencent will gradually increase the volume of ads on its social platforms, it also needs to make sure that the overall user experience won’t be negatively affected, Mr. Lau said. The company needs to sign up a wide range of high-quality advertisers and it needs to figure out the best ad formats that are most naturally suitable for the platforms, he said. “There is a lot of work for us to do.”

Despite the potential slowdown for the short term, advertising remains a major opportunity for Tencent, given that it hasn’t fully taken advantage of the popularity of its social platforms when it comes to hosting advertisers. The size of China’s overall online advertising market by revenue is expected to almost double to 410.5 billion yuan by 2018 from 209.7 billion yuan last year, according to forecasts from research firm iResearch.

Tencent’s business model relies on the ability of WeChat and QQ to retain their users, as those apps serve as platforms for games and ads. As of March, WeChat had 762 million monthly active users, up from697 million in December, the company said. Active users of QQ’s mobile app rose to 658 million from 642 million over the same period.

Tencent executives have said that the company is building an “ecosystem” by connecting WeChat and QQ with a wide range of services that cover online shopping to ride-hailing and food deliveries. So far, Tencent has invested in a number of Chinese companies, includingride-sharing appDidi Chuxing Technology Co. andgroup-buying serviceMeituan-Dianping, linking their services with its apps.

(THE WALL STREET JOURNAL)

简体中文

简体中文