China's ZTO Express (ZTO) started trading under the ticker symbol "ZTO" at the New York Stock Exchange (NYSE) Thursday, after raising over 1.4 billion U.S. dollars in its initial public offering (IPO) - the largest one in the U.S. so far this year.

ZTO announced Wednesday that it had priced its initial public offering of 72,100,000 American depositary shares (ADSs) at 19.50 dollars apiece for a total offering size of approximately 1.4 billion dollars, assuming the underwriters do not exercise their over-allotment option to purchase additional ADSs.

Each ADS represents one Class A ordinary share of ZTO. The Company has granted the underwriters a 30-day option to purchase up to 10,815,000 additional ADSs.

Morgan Stanley & Co. International plc, Goldman Sachs (Asia) L. L.C., China Renaissance Securities (Hong Kong) Limited, Citigroup Global Markets Inc., Credit Suisse Securities (USA) LLC, and J.P. Morgan Securities LLC acted as joint bookrunners for the offering.

Shares of ZTO tumbled 15.03 percent to 16.57 dollars apiece at the closing Thursday.

"The short-term volatility of ZTO's stocks won't affect my confidence in our company's long-term run. We believe that our business will keep growing at a fast pace relying on China's huge and rapidly expanding express service market as well as e-commerce market," said Meisong Lai, the founder and chairman of ZTO.

ZTO, a Shanghai-based express delivery company, provides express delivery service as well as other value-added logistics services through its extensive and reliable nationwide network in China, which covers over 96 percent of China's cities and counties as of June 30, 2016.

According to the iResearch, ZTO is one of the largest express delivery companies globally, in terms of total parcel volume in 2015.

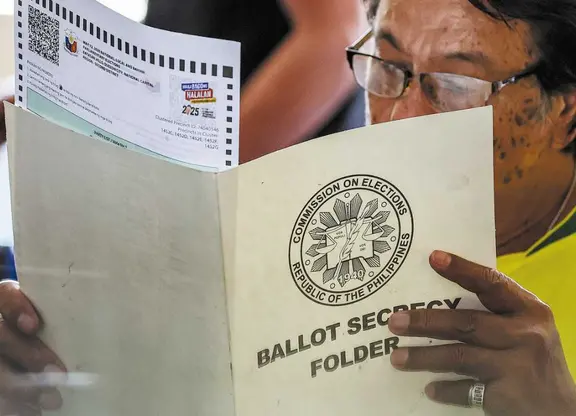

A delivery by ZTO Express in Beijing on Thursday. China’s delivery market is cutthroat, with an estimated 8,000 companies competing for business.Photo/Reuters

ZTO is both a key enabler and a direct beneficiary of China' s fast-growing e-commerce market, and has established itself as one of the largest express delivery service providers for millions of online merchants and consumers transacting on leading Chinese e-commerce platforms, such as Alibaba and JD.com.

"ZTO' s business model grants us a unique advantage in market competition, which allows ZTO to achieve strong operating leverage by minimizing fixed costs and capital requirements," Meisong Lai told Xinhua.

ZTO operates a highly scalable network partner model, which the firm believes is best suited to support the significant growth of e-commerce in China. ZTO leverages its network partners to provide pickup and last-mile delivery services, while controlling the mission-critical line-haul transportation and sorting network within the express delivery service value chain, said the ZTO profile.

ZTO's IPO surpasses the 1.1 billion dollars IPO of Japanese messaging company Line and makes it the biggest Chinese company IPO in the U.S. since Alibaba, which made history with its 25 billion dollars blockbuster IPO in 2014, according to the Forbes.

ZTO Express is expected to raise $1.2 billion to make it the second-largest Chinese IPO since Alibaba in 2014.

Being as one of four Chinese delivery companies, ZTO has ferried a bit more than half of all packages in China. The companies, known as the Tongda Operators, share similar names, business models and origins, and all of the founders hail from Tonglu County, about 50 miles south of Alibaba’s headquarters in Hangzhou, in the eastern province of Zhejiang. Proximity to Alibaba has been a boon for business; Alibaba’s online shops accounted for about 77 percent of ZTO’s business in 2015, according to the company’s I.P.O. prospectus.

“To Xinjiang, Beijing, anywhere in China, all the Tongda Operators are about the same price,” said Liu Song, who runs the Sweet Lisa Flagship Store, which sells women’s apparel on Alibaba’s Tmall online shopping platform. From China’s southern city of Guangzhou, Mr. Liu ships about 3,000 dresses, blouses and skirts each month, for roughly 53 cents a parcel. In 2011, he paid $1.20 a parcel to ship to Beijing.

“Every year the price is going down,” Mr. Liu said. “I don’t think it can go down any more.”

Though ZTO depends heavily on the legions of delivery people who zip around Chinese cities delivering makeup, clothes and gadgets, it doesn’t employ them. The Tongda Operators run only the sorting and long-haul transportation network, leaving last-mile delivery — traditionally the most costly link in the chain — to partners who ferry packages from hubs to homes.

That has helped ZTO maintain profit margins as prices charged to customers decline. ZTO earned a net income of $115 million on revenue of $639 million in the first six months of this year.

“As the market cost leader, we are not afraid of a price war,” said James Guo, ZTO’s chief financial officer, while also noting that the decline in parcel weight and the introduction of digital waybills explained some of the falling prices. “In the case of the price war, we can actually benefit from that and gain market share.”

Almost anyone can open a delivery outlet by paying a fee and signing a contract with ZTO or one of its partners. Then come logos, three-wheeled carts and delivery personnel to start carrying packages. These partners set the prices charged to senders and are the ones being squeezed by a price war.

Though the Tongda Operators are the biggest, China’s delivery market is fragmented and cutthroat. It has an estimated 8,000 companies, according to 2015 figures from the China E-Commerce Research Center. No single courier holds more than 15 percent market share by volume, according to iResearch. Deutsche Post DHL pulled out of the domestic delivery market entirely in 2011; FedEx and UPS have a tiny share.

ZTO’s business model is particular to China, with its densely populated cities and its online shopping boom. It is a business model probably unsuited for many other countries, so the bet for investors is on growth in China’s e-commerce market and eventual consolidation in the delivery space.

An American initial public offering like ZTO’s is unusual among China’s express delivery companies. ZTO’s immediate peers — YTO Express, STO Express and Yunda Express, as well as the premium competitor SF Express — are going public in mainland China using what are called reverse mergers, in which the company pours its operations into an existing company that has publicly traded shares.

(APD)

简体中文

简体中文