"The improvement has so far been tepid compared with the speed at which the indicators plummetedin the preceding months."

Christine Lagarde , head of the European Central Bank, was speaking to the media this afternoon to unveil a new$675 billion injection into its Emergency Purchase Program.

It marks an extension of the significant instruments the euro-bank has wielded, with the fund now standing at $1.5 trillion .

Elsewhere, Kenya's farmers are hoping the gradual easing of lockdowns in Europe will soften the blow to its produce export sector, which was hit heavily by the pandemic, and is estimated to be losing a million dollars a day.

And the recovery appears to be faster than expected, in some sectors at least, as **Nissan **reported higher sales in China than seen in May 2019. Sportswear brands have also reported growth, even as other global markets continue to suffer.

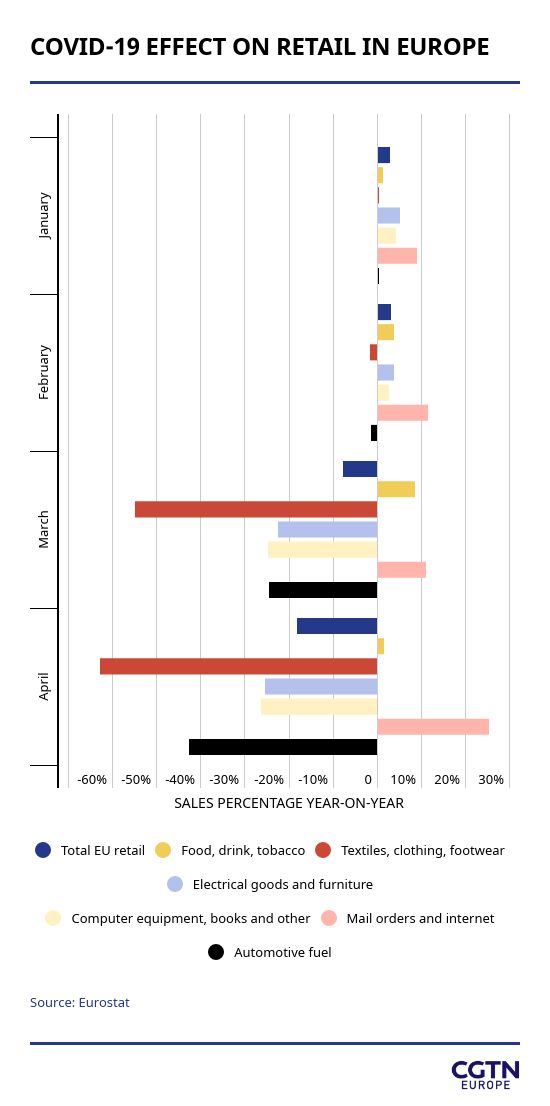

We look at one measure of that suffering in our graph , at the bottom of today's briefing: EU-wide retail sales by sector, since the start of 2020 and compared to the first four months of 2019.

Happy reading,

Patrick Atack

Digital business correspondent

**PS: Did you know we send this briefing by email too? **

You can sign up to receive it here.

The German government has agreed a new stimulus package between its constituent parties . The $146 billion bundle included a VAT rate cut, and a $337 one-off child credit boost to families, but there is no combustion engine car scrappage scheme as Germany implemented in 2008.

The farming industry that contributes 26 percent of Kenya's GDP is under immense pressure , with suppliers losing as much as $1 million per day according to the Fresh Produce Exporters Association of Kenya. The bulk of exports to Europe (which make up 80 percent of the sector's exports) have been grounded by the pandemic and lockdown.

Sportswear firm Adidas has revealed sales in China have sparked an "earlier-than-expected return to growth" for the firm, which now ** expects to return to pre-pandemic levels as early as the second quarter** . China has quickly turned into a bellwether retail market during the COVID-19 pandemic.

Virgin Atlantic is the latest airline to set a date for its return to the skies for five routes from its London Heathrow base. Flights to Hong Kong, Orlando, New York, Shanghai and Los Angeles will restart in the week of 20 July . More flights are expected to be announced from August onwards.

The European Central Bank is pumping an additional $675 billion into its Pandemic Emergency Purchase Program as it tries to cushion the economic and financial fallout from the coronavirus pandemic. That's more money than most economists were expecting and brings the fund's total to over $1.5 trillion.

LVMH, the luxury umbrella-firm which owns Louis Vuitton among other brands, has declined to buy Tiffany shares on the open market, leading to speculation the company may be re-thinking its November agreement to buy the famous jewelers .

An internal investigation at Australian bank Westpac concluded 23 million payments that violated anti-money laundering protocols – including many related to child exploitation – were down to "faults of omission" rather than intentional wrongdoing.

According to new sales figures from Nissan, the Chinese car sector is not only recovering to pre-pandemic levels, but actually growing year-on-year. The Japanese car maker said its China sales were up more than six percent in May, compared to May 2019.

General Motors is to work "very closely" with Chinese electric vehicle battery maker Contemporary Amperex Technology , according to Julian Blissett, GM's China president. Earlier in the year GM said it would invest $20 billion into EV production to catch up with Tesla.

Alberto Garzon, Spain's minister for consumer protections, said the government would launch an investigation into airlines reportedly breaching EU laws by not offering cash refunds to passengers affected by the global coronavirus measures. He did not name the airlines included in the probe.

French spirits producer **Remy Cointreau said while it expects its mid-year operating profits to fall by 45-50 percent **on 2019 levels, it sees Chinese and U.S. markets as ripe for returns in the second half of 2020. The cognac and triple sec producer said the second quarter decline was expected to be "more moderate" than the first quarter.

Hungary's tourism industry has been hit hard by the travel and movement restrictions imposed as a result of COVID-19 and the country's winemakers have not been immune to the impact.

Winery owners in the region of Etyek, near Budapest, are hoping for a return in visitor numbers after months of empty tables.

01:40

Emma McCarkin is CEO of the British Beer and Pub Association, and former member of the European Parliament. She spoke to CGTN Europe about how the hospitality sector in the UK is struggling amid the COVID-19 lockdown, and what help the industry needs from the government.

In a nutshell, what is the impact of COVID-19 on the beer and pup sector?

Well, the pandemic has been devastating for the beer and pub sector. We closed our doors overnight, of our 47,000 pubs, and the tap was turned off for all our brewers overnight as well. And we are surviving through this period of closure with government support, but we won't be able to sustain that for a prolonged period of time. So we're really looking now for the pathway back to reopening. And we're hoping to do so in July.

You talk about that pathway to reopening: some landlords have been managing to keep things ticking over, reaching out to their communities, takeaways and things like that... How are they keeping going?

Well, we are all missing the great British pub here in the UK, but our pubs are still trying to find ways to adapt, to keep serving their communities. We are part of the fabric of our culture here in the UK and they are turning into takeaway deliveries, offering off [-premises] sales.

They are in villages turned into rural shops where there is no other convenience within a long distance. And so they've really trying to still be part of their community. We're hoping that they'll be able to get back to doing what they do best in reopening the pubs later this year.

Your sector has had its ups and downs. Have you ever faced something like this? How adaptable is it as a business?

Well, the business model is around socializing. This is what makes it extremely difficult. The pub is the original social network, it's where we go to connect with our friends. And so it does provide significant challenges when it comes to social distancing. And that is one of the bigger obstacles that we have.

At the moment in the UK, we have two-meter social distancing and that would only bring into play about 30 percent of pubs in the United Kingdom. If that was reduced to the WHO standard of one meter, you're opening up 75 percent, which is a significant portion of the pub sector and the economy. So we're really hoping that we'll be able to create a safe socializing environment there, within a safe parameter.

Speaking of safe, what are the issues with being able to open up safely, social distancing aside?

Well, we're looking at the pub environment, what we can do to change that. But there are no two pubs that are the same. We all go to pubs because they have character. They are sometimes in Grade II-listed buildings of heritage with little nooks and crannies – it does make social distancing extremely difficult.

But we are looking at doing a risk assessment in each individual premises. Looking at the layout, the one-directional flows if we can create that, reducing the time that people will spend the bar, looking more at table service, to begin with. And, of course, maximizing our outdoor space. So we're doing everything that we can with the government to create a safe socializing environment. So not only our customers can feel safe, but also our staff as well.

You said you're doing everything you can working with the government, what do you need in terms of government help?

We need the pubs to be supported throughout whatever period of closure that may be. If social distancing restrictions remain extremely heavy at two meters, it will be many, many more pubs that are [not] viable to open, they physically won't be able to open their doors. They need that support to continue, to support their staff for furloughing, through giving more grants to keep them sustained.

But what we really need is that pathway back. And the one thing the government could do that would make a fundamental difference would be to reduce social distancing from two meters to one, bringing in and opening up the possibility for over 75 percent of the sector to open.

And that would give us a chance to reestablish our businesses... Businesses that are struggling to survive, make no mistake about it. We have done a survey of our members and 40 percent said they would not be able to survive till September. That is a stark statistic and we need to make sure we can find the pathway to open up pubs so that we don't lose those pubs forever.

Is this the end of the pub as we know it?

Oh, well, we all love the great British pub. It is a top-three thing to do for visitors when they come to the UK. And so I greatly hope that having survived two world wars, a global recession, that we will be able to find a way to survive this global pandemic and reestablish ourselves again at the heart of our communities and on our high streets up and down the country.

They've already had to face some changes – we've see lots of evolutions in the pub industry, from the smoking ban to the move to food. So where would you rate this on the on the scale of pub evolutions and can the sector deal with it, and keep pubs at the beating heart of British culture?

We have faced many crises in the past and we've had to adapt and change and flex as an industry. But be under no illusions, this is the biggest crisis to ever face our industry in its history.

We are doing all we can to survive ourselves, to put ourselves on hold in the deep freeze, but we won't be able to do that for much longer. And what we do in the coming weeks, not months, is going to make the difference is if we can survive.

Today's graph shows the year-on-year change in retail sales by sector in the EU, from the start of the year. As you can see (and might expect) sales of non-essential lockdown items like clothing and footwear have dropped off significantly.

Others like car fuel and electrical goods have also been hit hard, though less severely than fashion. And the mail-order and internet shopping sector has seen upwards of 20 percent growth.

简体中文

简体中文