"Wine production is particularly impacted with a Chinese market that is becoming difficult to access"

The French wine industry is the latest to report trouble thanks to coronavirus. Finance minister Bruno Le Maire highlighted the sector among those feeling the pinch as Chinese consumers stay at home at the start of the year.

Today we heard from market analyst Michael Hewson, in London, who explained why the consumer downturn was more of a concern for him than supply chain issues experienced by many global firms.The interview is in the usual slot, below.

Following the COVID-19 outbreak and subsequent quarantines the IATA has said global airlines stand to lose as much as $30 billion.

Another industry feeling the knock-on effects of the outbreak is fashion. Next week CGTN Europe will have its own Fashion Week, bringing you stories from a fascinating sector as it kicks off a new decade. But today I'm giving you a sneak preview of what to expect - make sure you watch our look at how London Fashion Week dealt with a lack of Chinese talent, thanks to COVID-19.

You can follow the series from Monday on our

Faceboo

k, Twitter

and YouTube

- and of course on our website!

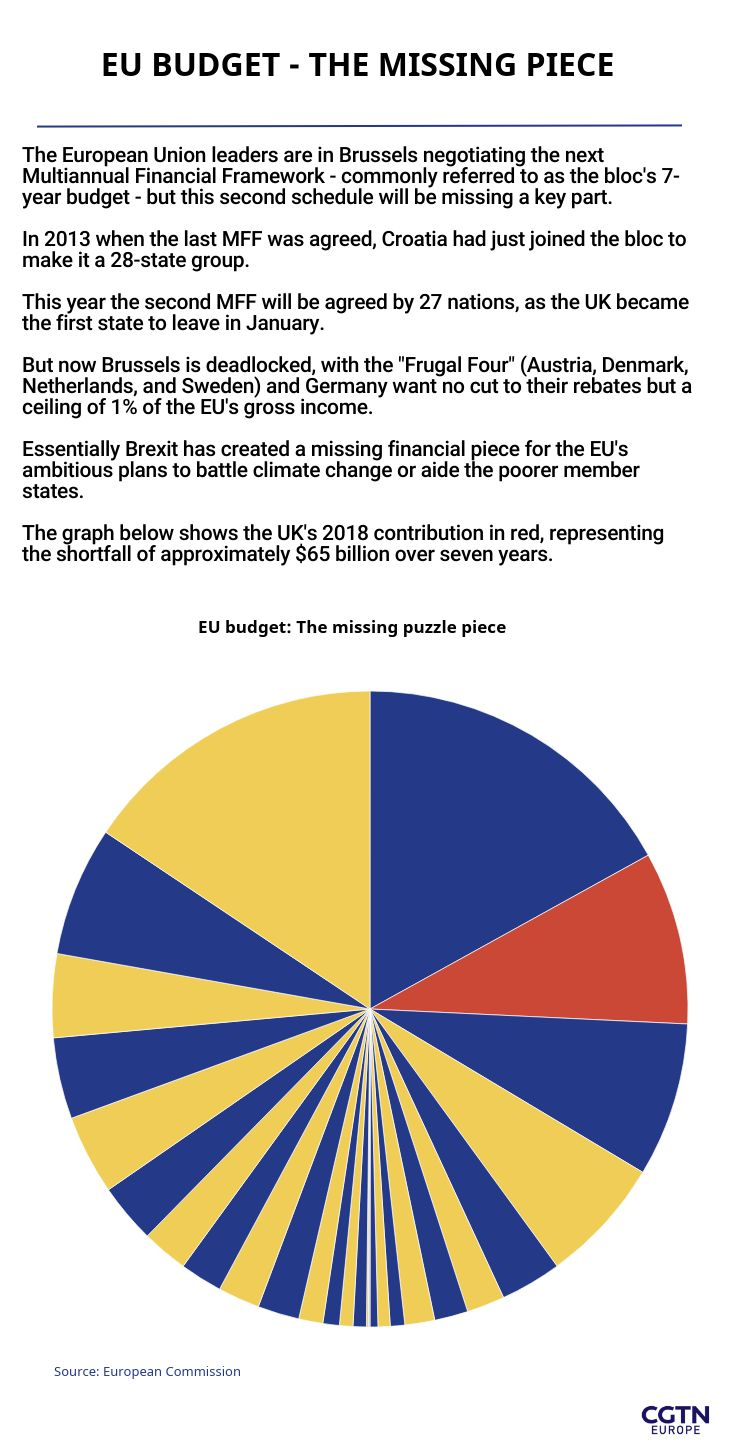

And finally, if all the talk of the new EU budget has got you in a spin, we've simplifed the issue with a handy chart showing exactly why there's such a big argument about cuts, rebates and missing pieces. Scroll to the bottom for more.

Happy reading,

Patrick Atack

Digital business correspondent

Toyota Motor Corp said it planned for all four of its vehicle assembly plants in China to reopen from next week after weeks of stoppages due to COVID-19. The Japanese auto maker said production at its vehicle assembly plant in Chengdu, Sichuan province would resume from Monday.

Honda Motor Co. said it has pushed back plans to restart operations at its plant in Wuhan, as the Beijing government has asked the firm to keep workers from attending the factory until at least 11 March. Other plants in China have started working again, the firm added.

Supply chains continue to be hit by the COVID-19 outbreak. Vietnam's Ministry of Industry and Trade warned the outbreak may slow telecoms firm Samsung's supply. Samsung is Vietnam's single largest foreign investor, but delays in parts deliveries from China means the South Korean firm is "considering using sea or air transport to import needed components," according to the Ministry.

Prime Minister of Czechia, Andrej Babis, threaten to "go home" if the so-called Frugal Four insist on a cut of approximately $81 billion from the EU budget.

Car sales in China are down by at least 92% in February, thanks to coronavirus fears, according to autmotive trade body the China Passenger Car Association. Dealers have started to open again after the elongated Spring Festival holiday, but CPCA secretary general Cui Dongshu said there were "barely any" customers visiting dealerships since the start of the month.

The International Air Transport Association says global airlines will lose nearly $30 billion in revenues due to the coronavirus outbreak and subsequent travel restrictions. The bulk of the loss, at least $20 billion, will be from airlines based in the Asia Pacific region, but global firms such as Qantas and Air France- KLM are also expecting losses.

China's Citic Bank and AIBank will loan hot pot chain Haidilao $298 million to help it weather the coronavirus outbreak, after the group temporarily shut its restaurants. AIBank is a joint venture between Citic Bank and technology company Baidu. Haidilao suspended operations in mainland China on 28 January. It said on 2 February that the suspension would continue to "support the epidemic prevention and control".

This year a shadow has fallen over what is traditionally a celebration of the fashion industry's finest creative talent, as the COVID-19 coronavirus means that the majority of Chinese participants have, for the first time, been obliged to stay away.

03:32

Michael Hewson, Chief Market Analyst at CMC Markets talked to CGTN about the businesses suffering from the coronavirus outbreak, with falling sales and adjusted profit expectations.

Can you explain why COVID-19 has disrupted supply chains? And how big a worry is this to markets?

You know, I think this is the problem with just-in-time supply chains, it really doesn't take much to disrupt them. But overall, I'm not overly concerned about them more than I'm concerned about consumer demand.

CGTN talked about concerns about airline seat capacity and the fact that some Chinese airlines are in trouble. And I think this more than anything is likely to dictate where we go to over the course of the next three to six months.

How has the timing affected sales?

Typically over Chinese New Year, you get an awful lot of travel, you get an awful lot of spending even here in the United Kingdom. Retail sales is a big part of the U.K. economy. We haven't had the Chinese tourists or the other tourists from Asia that we normally get at this time of year.

And that's likely to be felt. Not only I think, in terms of retailers who are already struggling, but certainly in terms of overall spending patterns for people within the UK economy and the global economy more broadly.

So in terms of a slowdown in supply chains, that's only a problem if spending and consuming and consuming maintains the level that we saw three to six months ago. If consumers slow down in their spending and it's not going to be so much of a problem, but it will be felt in terms of profit margins and revenues.

And that's why we saw that profits warning earlier this month from Apple.

You said you think that there's a danger that this kind of virus being used as an excuse. I mean, we've been looking at certain companies who are sort of voicing fears. Do you think it's hiding issues which they're blaming on Coronavirus?

I think there's certainly a case that you could make that argument. I mean, over the past two or three years, there's been a whole host of companies blaming Brexit for some of that, for some of their structural problems.

And certainly I think there is evidence that even before the current coronavirus became a problem in January, we were starting to see a slowdown in the European economy as judged by some of the data that we've been seeing coming out of particularly Germany, France and Italy in Q4. The French economy contracted, the Italian economy contracted and the German economy stagnated. So I think the big test, over the course of the next few weeks, is the latest PMI eyes that are due to come out later this week.

The Flash PMI is for February, coming out from Germany, from France and from the UK. If they show a slowdown in economic activity, then you could argue that this weakness is likely to continue for some time to come.

简体中文

简体中文