"As containment measures are gradually lifted, these scenarios foresee a recovery in economic activity although its speed and scale remain highly uncertain."

It might not strike you as the most hopeful statement, but those words from the European Central Bank's head **Christine Lagarde **signal light at the end of the economic tunnel. Or, so she hopes.

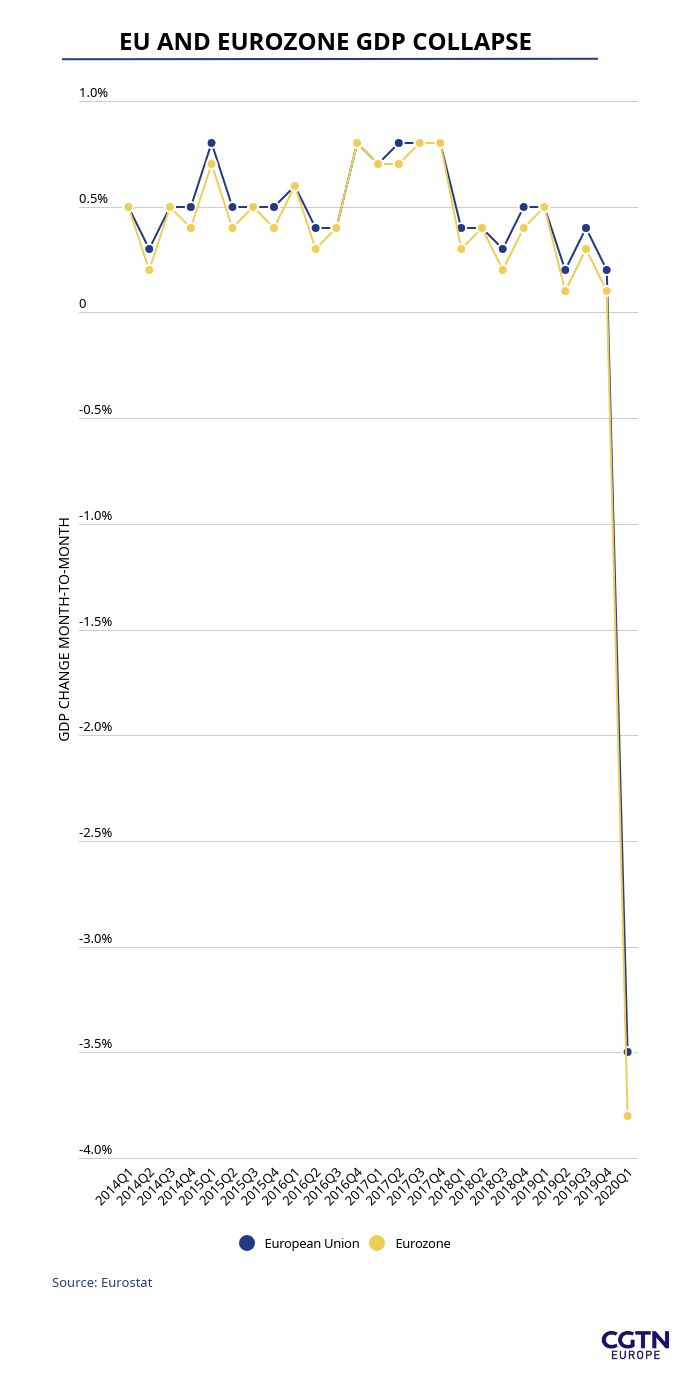

Lagarde chaired a press conference today after the ECB decided to leave its base interest rates as they were – and amid the announcement that Europe-wide GDP had crashed in the first three months of 2020. Although expected due to the lockdown, the scale of the economic contraction is extreme. You can see it in more detail in today's graphic.

**Lenders in Ireland **have also moved on the realization the lockdown will be longer than first expected, by expanding their mortgage and business loan "holiday" for a further three months.

And the subsequent drop in oil demand – as the global economy slows to walking pace – has led to Royal Dutch Shell implementing its first dividend cut since the 1940s . And at more than 60 percent, it's a significant cut for more than one reason.

Finally, after yesterday's interview with the head of IATA, today's interview features Tim Coombs, co-founder of Aviation Economic, who gives us a big-picture view of the industry and discusses whether the industry really is " struggling for survival ."

Happy reading,

Patrick Atack

Digital business correspondent

P.S. Did you know we send this briefing by e

mail, too? You can sign up to receive it here

.

Christine Lagarde, president of the European Central Bank, warned in a press conference today that GDP across the European Union could drop further, potentially as far as 12 percent in 2020. Lagarde said cooperation between governments was the key to the bloc's recovery, as she hinted the Bank's Pandemic Emergency Purchase Program could be extended as lockdowns continue.

European countries are heading into their deepest recessions since 1945 because of COVID-19, new GDP figures show. The EU economy shrank by more than three percent , while the eurozone slid by almost four percent.

Sticking with macro-economics for a while, the Federal Reserve , the U.S. central bank, ** decided not to change interest rates** , but its chairman, Jerome Powell, said it would act "forcefully, proactively and aggressively" if needed.

The International Labor Organization, the UN workers' body, has warned the economic fallout from the pandemic for those employed in the informal economy will be worse than at first thought. The ILO said 1.6 billion people could face "massive" upheaval .

The Financial Action Task Force has **warned the United Arab Emirates to close loopholes that allow money laundering **in the gold and property markets, among others. If it does not comply, it could be put on a blacklist with Syria and Zimbabwe – which have been identified as havens for illegal financial transactions.

Norway has reacted to the global drop-off in oil consumption by cutting production for the first time in 18 years . Norway's energy minister Tina Bru said the sector would cut output by 250,000 barrels of oil a day from June – 13 percent of current drilling.

The drop in demand for oil has also led Royal Dutch Shell to cut its dividend payment for the first time since World War II. Shareholders' earnings will plummet from 47 cents per share, to a meagre 16 cents . The global producer also revealed plans to cut output by almost 25 percent.

British pharma giant AstraZeneca has teamed up with researchers at Oxford University to develop, scale, and distribute a COVID-19 vaccine. "Our hope is that, by joining forces, we can accelerate the globalization of a vaccine to combat the virus," said AstraZeneca Chief Executive Pascal Soriot.

Ireland's banks and other lenders have agreed to ** extend their three-month repayment break to six months** , for the near-90,000 mortgages and business loans that have so far been suspended.

Relaxing its internal lockdown rules, China hopes to boost tourism ahead of the five-day May Day holiday . Flight bookings from Beijing Capital International Airport have already jumped to 15 times the level of recent months.

New Zealand's rugby governing body announced a $4.5 million loss for 2019 , having earlier this month expressed worries over the financial impact of the coronavirus pandemic. New Zealand won the 2011 and 2015 Rugby World Cups, but came third in 2019 in Japan.

01:46

Tim Coombs, Co-Founder of Aviation Economics spoke to CGTN Europe about the wider effect of the pandemic on the wider aviation industry, including how manufacturers such as Boeing and Airbus are dealing with the downturn.

With 15,000 job losses, 10% of the total workforce, I wonder what your thoughts are on the challenges now facing Boeing?

I suppose I'm not surprised by the numbers, given that between Boeing and Airbus, they're probably going to deliver nine aircraft in April, whereas both manufacturers were probably building pre-COVID-19, about 70 aircraft per month.

Then you'll see that the airline industry has come to a complete standstill. Airlines are trying to preserve cash as much as they can. So placing orders for new aircraft and indeed getting deliveries of new aircraft is suddenly a very low priority for them. So what we're seeing happening at Boeing is equally impacting Airbus as well at the moment.

We've heard from major industry figures over the past few days that it is going to be several years before travel returns to where it was. I wonder what that admission means for the immediate future, are we going to see more job losses? Airlines going bust?

I'm afraid we are. The aviation industry is probably one of the first industries to be impacted by COVID-19. And it's almost certainly going to be one of the last industries to exit the process.

So, with the collapse in demand for air travel, we're seeing forecasts by IATA that there's going to be a $252 billion shortfall in terms of revenues this year. I think that's probably an underestimate. And, therefore, we are going to see airlines needing financial support from governments. There are very few of them that have got enough cash on their balance sheets that they are going to be able to survive without having external financial support.

What does this mean for the ordinary traveler. Because the IATA CEO has been pretty dismissive of planes flying profitably with social distancing. Does that suggest the age of cheap air travel has ended?

Probably not first class fares, but certainly the industry is forced to remove effectively being able to sell that middle seat. Then you're flying effectively with a third of the capacity removed and they will need to increase their fares accordingly by about that amount, which will necessarily reduce the demand for air travel if it's more expensive. But I think first class fares might be too high. But, certainly, the age of cheap travel is going to pass.

There's one other consideration the airlines are thinking of at the moment, which is: if they're going to have to do a deep clean on the aircraft every time they land at an airport. Then the sort of business model in the past of having fast turnaround, sort of 30-minute turnaround at each airport, that might not be practical. So that's another thing that will add additional cost to the airline business model.

What do you make of the threat by the British law firm against Air France-KLM and Ryanair over the lack of refunds to customers whose flights were canceled because of the pandemic?

I think the airlines are in a really difficult position. Legally, I think that is a challenge, which I can understand why it's being made. But, at the same time, if the airlines actually give full refunds at the moment, then they will go bankrupt. So they're caught between a rock and a hard place at the moment.

简体中文

简体中文