"There is unfortunately still no evidence that you can simply turn on and off an economy like a light switch without causing more structural damage."

That's ** Carsten Brzeski** , an economist at ING, reacting to the news that European economies have shown signs of growth but are still faltering below pre-pandemic levels.

Along with GDP figures, today we look at the losses reported by Air France-KLM (and how a government bailout may save it), Ant Group's IPO progress, and a $31 million fine for global hotel chain Marriott.

My colleagues Giulia and Ben have put together a great video (click the link below) to explain geographical indicators and protectors as upheld in the new China-EU deal .

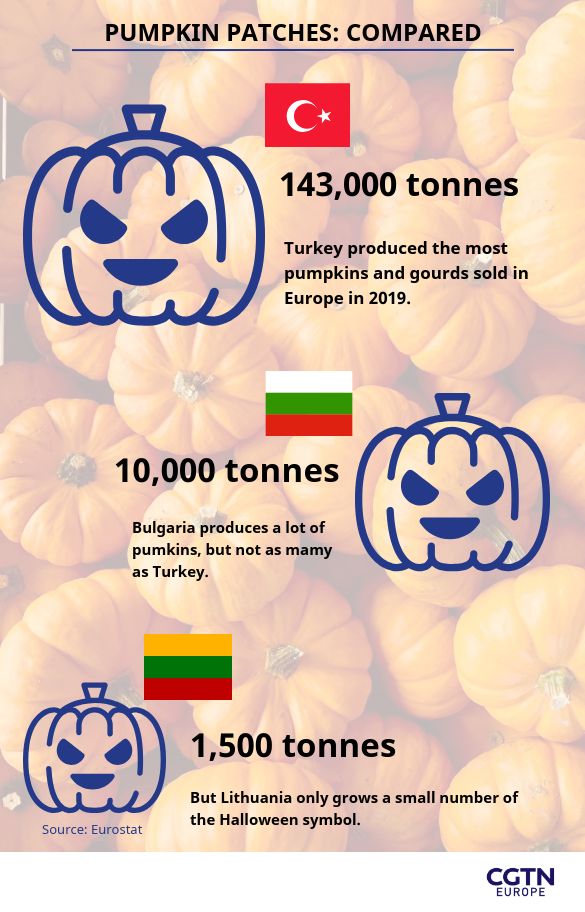

And as it's the final Global Business Daily before Halloween, I thought I'd take a look at the much overlooked European pumpkin sector. Scroll to the bottom for a count of ghoulish gourds .

Happy trick-or-treating (

as allowed under** your local COVID-19 rules**

),

Patrick Atack

Digital business correspondent

**P.S. Did someone forward this to you? **

Sign up here

The European economy showed record growth figures in the third quarter. Preliminary data shows GDP jumped more than expected, surging to nearly 13 percent, as companies reopened over the summer. The EU's largest economy, Germany, rebounded from a 10 percent loss in Q2 with an 8 percent growth-spurt ahead of a second national lockdown.

In France, Apple said it will close 17 of 20 stores due to the new lockdown , which has also seen an exodus from major cities like Paris and Lyon.

Air France-KLM has reported a $1.2 billion quarterly loss and warned the worst is yet to come as France and Germany enter a second lockdown. But Air France-KLM is not at risk of collapse like many airlines, thanks to $14.4 billion liquidity bolstered by a bailout from the French and Dutch government.

Retail investors have placed bids for a record ** $3 trillion of shares in Ant Group's initial public offering** . The Chinese payment platform's dual listing is set to be the world's biggest, whichhelped to push the fundraising total to almost $37 billion.

Mitsubishi Heavy Industries said it will pause development of its SpaceJet project as the pandemic squeezes finances and cancelled plans for Japan's first passenger aircraft in half a century. It comes as the company posted a 62 percent fall in its second quarter operating profit, adding that it wants to focus on other parts of its business.

Britain's data watchdog, the Information Commissioner's Office, has fined hotel chain Marriott International nearly $31 million for one of the largest data breaches in history. The cyber attack on the hotel chain began in 2014, and affected millions of guest records. The company is also facing a class action by former guests demanding compensation.

Swiss National Bank, the central bank and issuer of Swiss francs, has reported a $15.7 billion gain in the third quarter. The majority of that came from the bank's holdings in foreign currencies and gold, which both appreciated in value during the pandemic.

French oil major Total cut $1 billion from its investment target for 2020 , reducing the aim to $13 billion after losses mounted in the third quarter.

As we discussed earlier in the week when BP released its latest figures

, the fluctuating crude prices have caused oil firms to lose higher sums than might have been expected.

Juul Labs, which produces the Juul cigarette replacement vaping equipment, has wiped $2 billion off its valuation as the pandemic continues its run on various industries. Back in 2018 the firm was valued at $38 billion, as Marlboro took a 35 percent stake in the tobacco-challenger. Flavoring regulations placed to stop children vaping have hit the firm hard.

**Activision has adjusted upwards its annual sales forecast as it bets on stronger than usual sales of its new **

Call of Duty

** title,** with the pandemic increasing the amount of leisure time people are spending at home. The video game studio is expecting pre-tax revenues of $8.1 billion, with a 21 percent hike in global game sales, according to research firm NPD.

On the other side of the sector, French video game producer** Ubisoft has cut its outlook because the pandemic has delayed the release of its own blockbuster title **

Far Cry 6

. The firm, which also made Assassin's Creed

, says it will likely make $2.7 billion this calendar year.

Despite a continued decline in sales in the last quarter, Starbucks Corp said it expects to see a full recovery in 2021, with online business proving strong and customers gradually returning to stores. Still, in the latest period sales fell 9 percent compared to the 2019 quarter.

Tech's "Big Four" of Alphabet, Amazon, Apple and Facebook all posted hikes in revenue in the third quarter , with ecommerce and cloud computing accounting for many gains. Combined, the group's sales leapt 18 percent on the year, to $227 billion. Although the sector faces regulation and competition investigations next year, as one analyst told

The Financial Times

"the current juggernauts are really hard to stop."

**CLICK: **

MEET THE KRAMPUS, SANTA'S SCARY SIDEKICK

WATCH: Under a new EU-China trade deal, Greece's Feta, Portugal's Porto and Italy's Prosciutto di Parma are just three of the 100 European products that will be protected as geographical indications (GIs) in China.

02:36

After PSA Group made a return to growing revenues (despite a still tough sales environment), we spoke to Anna-Marie Baisden of Fitch Solutions to understand more about what this news means for the auto industry.

Is this as positive as it seems?

It certainly is positive if you consider at the halfway point of the year PSA was profitable because of its cost-cutting strategy, but its revenue is down, obviously because of the impact of COVID-19. And that was the same for all car makers.

It had particularly good growth in the Middle East and Africa region, which has been a key focus of its strategy, building up sales in that region.

Fiat-Chrysler and PSA have confirmed on Wednesday that they're making huge progress towards a full merger, which would create the world's fourth-largest car maker. What do you think that will mean for the auto industry?

It's a sign, really, of the increased cooperation that we're seeing currently and that we expect to see a lot more of in the future.

I know this has been a long-term goal for Fiat-Chrysler ever since Sergio Marchionne was CEO. He talked a lot about the future of the industry being consolidation, because you can achieve much more in the way of economies of scale, platform-sharing and capacity-sharing.

简体中文

简体中文