By APD writer Alice

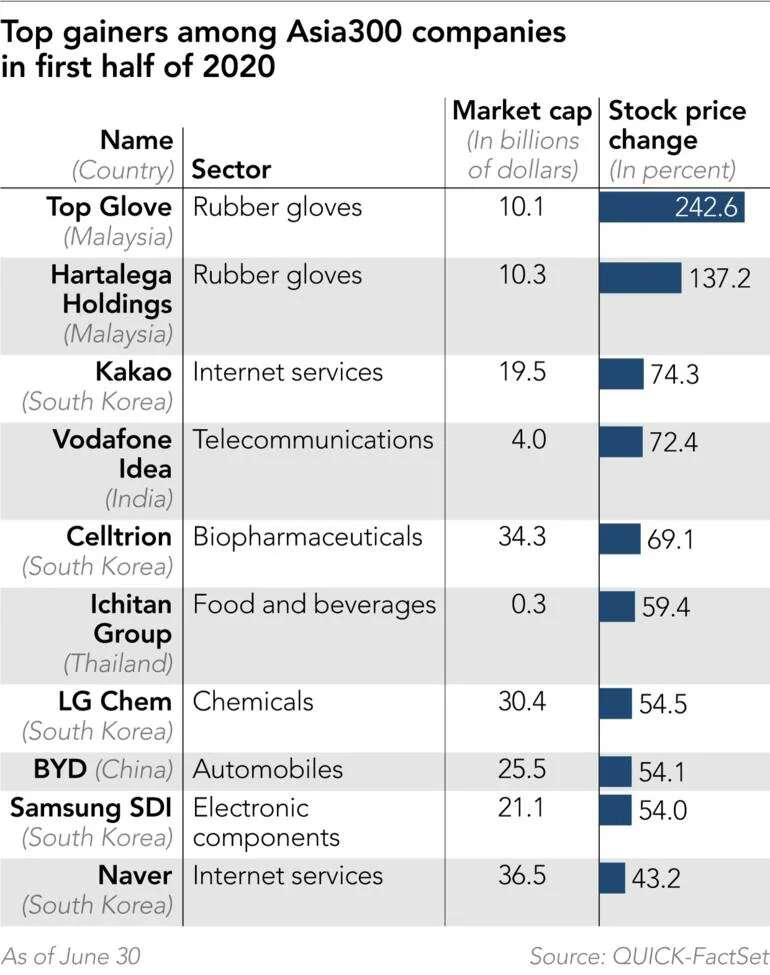

Glove manufactures, Internet service providers, pharmaceutical and chemical firms were top gainers among Nikkei Asia300 companies in the first half of 2020 despite the ravaging COVID-19 pandemic.

Malaysian glove makers topped the list of gainers as Asia demands higher standards of public hygiene amid the pandemic.

Malaysia's two big glove makers Top Glove and Hartalega Holdings both saw triple-digit rises in their share prices for the six months ending June. Top Glove was the biggest winner on the local stock exchange, with shares skyrocketing 242.6% in the last six months thanks to investors’ increasing appetite fueled by surging demand for medical gloves.

It earned a net profit of 575 million ringgit ($134 million) in the nine months through May, nearly double the figure for the same period the previous year.

Top Glove’s rival Hartalega Holdings has also benefited from extra demand arising from the pandemic. Its stock price increased 147.2 percent during the first half.

South Korea had five stocks named among the top 10 gainers in Asia. Internet services company Kakao saw its shares jump 74.3% in the six-month period, as the company benefitted from people stuck at home reading its webtoon online comics, playing its games and using its internet banking services in greater numbers.

Biopharmaceutical company Celltrion reported its shares climbing 69.1%, amid rising hopes for a possible COVID-19 treatment. Celltrion announced in early June that it succeeded in the first phase of animal testing for a COVID-19 antibody treatment developed in collaboration with Chungbuk National University College of Medicine.

LG Chem, which specializes in producing chemicals, saw a 54.5 percent hike in stock price, while electronic component producer Samsung SDI and Internet service provider Naver enjoyed respective rises of 54 percent and 43.2 percent.

Also on the list of top 10 gainers are telecom service supplier Vodafone Idea of India (up 72.4 percent), Ichitan Group of Thailand (59.4 percent), and Chinese automobile manufacturer BYD (54.1 percent).

(ASIA PACIFIC DAILY)

简体中文

简体中文