South Korean shares made a sharp decline on Monday on worries about earnings outlook for Samsung Electronics that decided to recall all of its newest flagship smartphone and geopolitical risks following the Democratic People' s Republic of Korea (DPRK)'s fifth nuclear test.

The benchmark Korea Composite Stock Price Index (KOSPI) dropped 46.39 points, or 2.28 percent, to settle at 1,991.48. Trading volume stood at 418.7 million shares worth 4.76 trillion won (4.28 billion U.S. dollars).

Samsung announced its decision on Sept. 2 to recall all of its Galaxy Note 7 phablets sold worldwide after tens of reports of faulty batteries that led to catching fire while charging.

Despite the halted sales and recall of 2.5 million units that had sold until the recall decision, recommendations were issued in 10 countries, including South Korea and the United States, to stop using the faulty Samsung phone on safety concerns.

Samsung shares tumbled 7 percent, and Samsung Electro-Mechanics and Samsung SDI, which supply electronic parts for Samsung Electronics, slumped 7.6 percent and 5.9 percent respectively.

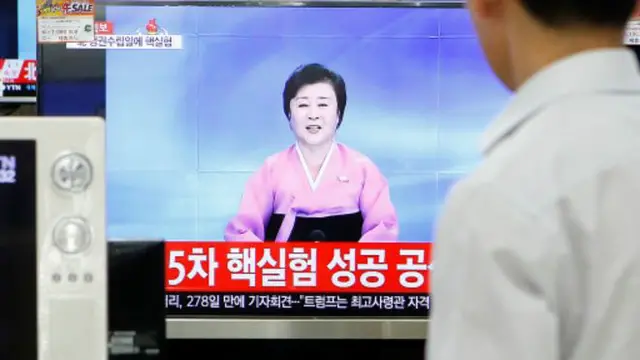

Following the DPRK's fifth nuclear detonation last week, concerns emerged that Pyongyang may conduct another test within this year. Seoul's defense ministry said the DPRK had already completed preparations for additional detonation in its main Punggye-ri nuclear test site.

Addition to the concerns, the U.S. Federal Reserve is widely expected to raise interest rates at least once within this year. The U.S. central bank is scheduled to hold its rate-setting meeting for two days through Sept. 21.

The KOSPI 200 volatility index, also dubbed fear index which reflects investors' anxiety about future stock moves, surged to 16. 47, up 42.5 percent from the previous session.

Investors also rushed to lock in recent profits ahead of the three-day holiday, called Chuseok, starting Wednesday.

Foreigners reduced stock holdings by 218 billion won, while institutional and individual investors bought shares worth 137 billion won and 87 billion won each.

Large-cap shares lost ground. The state-run power supplier Korea Electric Power Corp. retreated 1.3 percent, and top automaker Hyundai Motor lost 0.7 percent. The most-used search engine Naver shed 0.8 percent, and memory chip giant SK Hynix tumbled 5 percent.

South Korea's currency finished at 1,113.5 won against the greenback, down 15.1 won from Friday's close.

Bond prices ended lower. Yields on the liquid three-year treasury notes gained 2.8 basis points to 1.356 percent, and the return on the benchmark 10-year government bonds advanced 5.5 basis points to 1.567 percent.

(APD)

简体中文

简体中文