"It's a five star luxury hotel, so they are not in squalid conditions at all, but they are required to keep themselves to themselves."

That's the situation facing holidaymakers who have been quarantined in Tenerife , according to local journalist Janet Anscombe. She spoke to CGTN Europe after a hotel was put on lockdown when a visiting Italian doctor tested positive for COVID-19.

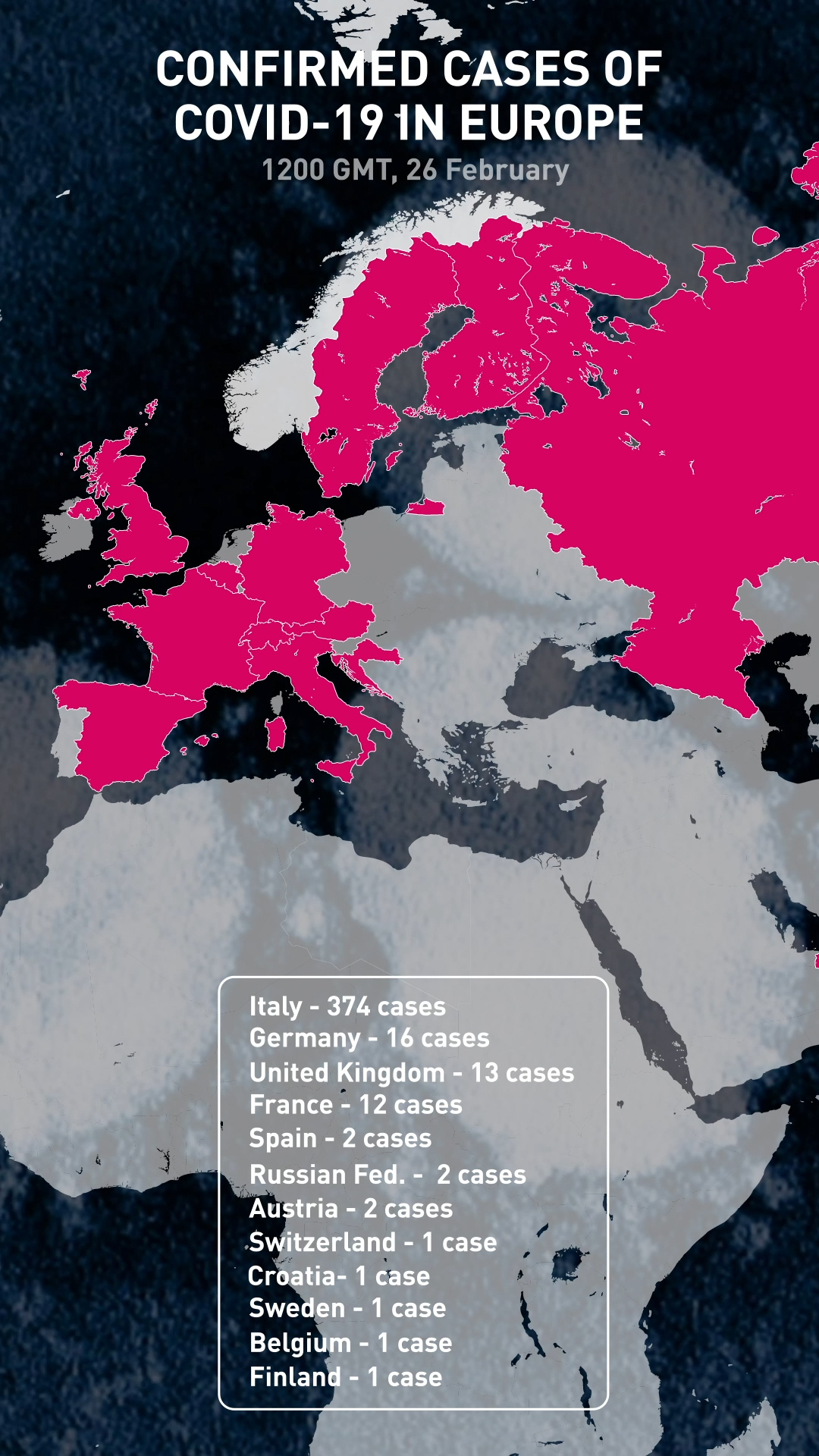

You can see how the virus is spreading across Europe with the help of our map at the bottom of today's email , and CGTN took an in-depth look at the effect on the Italian economy as the country confirmed its death toll has risen to at least 12.

You can watch **Natalie Carney's report from Milan **via the usual link, and our interview today is with former director of the Italian Treasury, Lorenzo Codogno. He warned that recession is "almost a certainty" now. You can read that full interview below.

Elsewhere, Virgin Galactic said it has seen increased demand for tickets, despite the first tourist space flight being months away. It not blast off yet, though – the firm also recorded** losses of $73m** in the last quarter of 2019.

And finally, Disney is getting a new CEO. Robert Iger said the firm's recent growth meant Disney Parks chief Bob Chapek was more suited to the role. Iger won't leave the company, however, and **will remain Chapek's boss **as executive chairman.

Happy reading,

Patrick Atack

Digital business correspondent

P.S. Remember you can get Global Business Daily direct to your inbox, for free.

Sign up here

.

Diageo, the firm behind global drinks brands such as Guinness and Johnnie Walker whisky , has warned its shareholders its profits could be hit by $200 million due to the COVID-19 outbreak and resulting market conditions, especially in Asia. The closure of bars and restaurants has hit sales, as has reduced travel, which has affected airport sales.

Another company affected by the coronavirus outbreak is Anglo-Australian mining giant Rio Tinto , which warned the epidemic is threatening its supply chain. The company said order books are full and its products were continuing to reach customers, but it was seeking ways to adjust to the impact of the virus on demand for commodities globally. It reported a 41 percent decline in annual net profit in 2019.

Meanwhile, shipments of smartphones in China dropped nearly 40 percent in January to 20.81 million units, due to COVID-19, official data showed. China Academy of Information and Communications Technology statistics also revealed iPhone sales in the country fell 28 percent in January, compared with the previous month.

Elsewhere, U.S. energy giant Chevron has sent at least 300 of its London-based staff home , after one employee reported flu-like symptoms. The firm said the staff members affected would work from home until tests on the sick employee were completed.

In news away from COVID-19, Virgin Galactic , Richard Branson's space travel venture, has recorded a leap in demand for its $250,000-per person fights. However, it has also revealed a loss of $73 million in the fourth quarter of 2019.

Embattled** Metro Bank **has posted a significant loss of $169 million after a torrid 2019, during which it faced several regulatory inquiries and lost 90 percent of its share price. It says it will cut planned branch openings to 24 from 71, but it will not cut any jobs.

German airline Lufthansa has followed Singapore Airlines and put a freeze on hiring in an effort to limit losses after COVID-19 forced flight cancellations. It will also offer unpaid leave and part-time hours. It said 13 of its aircraft have been grounded by the outbreak.

Hermes International is seeing a " potential normalization" in China , though it's too early to predict when the market will recover from the coronavirus outbreak that is hammering luxury spending, CEO Axel Dumas said.

Hong Kong's finance secretary announced a **$1,283 handout for residents **to boost local consumption following months of protests and the hit to the economy from coronavirus. In his budget on Wednesday, Paul Chan said the government would give permanent residents over the age of 18 the funds to relieve financial burdens.

China Eastern Airlines unveiled its new subsidiary in Shanghai, saying it would only operate Chinese aircraft. China Eastern said OTT Airlines would be the first carrier to operate Commercial Aircraft Corp of China's COMAC C919.

Walt Disney's CEO Robert Iger will step down , handing the reins to Disney Parks head Bob Chapek, the company said. Iger will become executive chairman of the global entertainment brand, meaning Chapek will still report to the former CEO.

CGTN's Natalie Carney sent this report from Milan, as the Italian city in the country's industrial heartland begins to feel the effects of COVID-19.

02:57

Lorenzo Codogno is the formerchiefeconomistoftheItalianTreasury, and spoke to CGTN Europe about the current and likely future effects of the COVID-19 outbreak in the north of the country.

What impact will this outbreak have on Italy?

Well, politically, everything is on hold right now. Clearly, political parties decided to kind of put a brake on political bickering. And so, for now, it's over. On the economy, the impact would be sizable. Keep in mind that we were already starting to record the impact of the outbreak of coronavirus in China, with the disruption of the supply chain internationally. And now with the outbreak in Italy, clearly, the situation is going to get worse.

The first impact is going to go through tourism and transport and some other services. And this is gonna be pretty much immediate. As you know, many conferences, events in Italy have been canceled. People are canceling their stay in hotels, restaurants and so forth. So that effect is almost immediate.

Then you have a second effect, which will be kind of delayed, which would be further disruption in the supply chain.

And that is, I would say, inevitable as well. But it will take a while to fully show up.

All in all, I think there is a very high chance that Italy will enter a recession again. Keep in mind that Italy was already fragile and vulnerable, in the fourth quarter last year, GDP contracted by 0.3 percent quarter on quarter.

I wouldn't be surprised to see something in the range of half a percentage point to one percentage point contraction in the first quarter of this year, which basically means that most likely the whole year will be in negative territory and probably also significantly in negative territory. I think at the moment I have something close to minus one percent.

The two regions currently in lockdown, Veneto and Lombardy, are the richest in Italy. What effect does that have?

You're absolutely right. The two regions that are most affected, where the lockdown areas are located are Lombardy, which is by far the richest and more productive region in Italy, with 22 percent of GDP and Veneto, at 9 percent of GDP.

Keep in mind, however, that the areas that are involved in lockdown are relatively small. They involve only 50,000 people. So, again, the rest of the economy is still working. Though there are disruptions, clearly Milan is the most affected because of the travel and because of the many connections, airports and so forth, so many companies decided to close down, reduce business activity, and therefore inevitably there will be some impact.

Italy is on the brink of a recession. Do you think COVID-19 will tip it over the edge?

I think it's almost a certainty by now. Again, it didn't take much for Italy to go underwater in the fourth quarter last year as a result of the slowdown in the global activity.

And in the first quarter it's going to start with the wrong footing, so to speak, and probably we'll see another big negative number. So, the year is already compromised in terms of GDP growth.

You were previously director of Italy's Treasury Department. If this had happened during your time there, what would you have done?

Well, let me say that there are some silver linings, if you wish. And because in 2011, Italy went through a severe shock, which was related to the sovereign debt crisis, the sharp reduction of liquidity in financial markets and the banking shock. There are some similarities because one of the measures that the government will put in place very quickly and the facilities and the experience is already there

–to kind of extend the payment of mortgages and some kind of grace period for loans and stuff like that; injection of liquidity with the agreement of the banks, so that that there is no liquidity crisis for any company. That's the big point in the near term. And, again, Italy has the experience. The banks have IT facilities for doing it. So it will be easy to implement that very quickly. And that's the only silver lining I can see it at the moment.

简体中文

简体中文