"If a second outbreak occurs triggering a return to lockdowns, world economic output is forecast to plummet 7.6 percent this year."

The Organisation for Economic Co-operation and Development (OECD) issued a grim warning as it weighed in on the COVID-19 crisis.

The Paris-based policy forum, in its latest report, said that with restrictions beginning to ease, the path to economic recovery remains highly uncertain and urged for measures to bolster healthcare systems and help businesses adapt to the " new normal ."

**OECD **chief economist Laurence Boone predicted that the global economy would suffer the biggest peacetime downturn in a century before recovering next year.

"By the end of 2021, the loss of income exceeds that of any previous recession over the last 100 years outside wartime , with dire and long-lasting consequences for people, firms and governments," he added.

Do scroll down the page to read our interview with Trevor Williams, former chief economist at Lloyds Bank as he explains why there is a sudden **appetite **for government bonds .

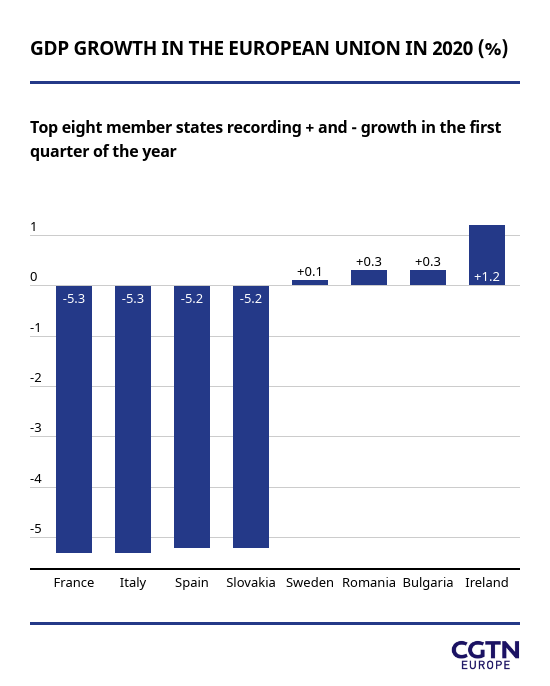

And our **graphic **today is on **EU GDP growth rates **covering the first quarter of 2020.

Happy reading,

Nilay Syam

Digital business correspondent

P.S. Did you know we send this briefing by email, too?

You can sign up to receive it here.

In its 2020 outlook, the** OECD** expects the U.S. economy to contract **7.3 percent **before growing 4.1 percent next year. The **euro area **is similarly heading for a downturn of 9.1 percent over the same period, followed by 6.5 percent growth in 2021. The **UK **will be the worst hit with its economy shrinking 11.5 percent and recovering nine percent next year. However, a second outbreak will make matters worse, the report said. The Chinese economy will most likely drop by 2.6 percent .

The European Commission will recommend** EU** member states to **reopen external borders **to travelers from outside the bloc from 1 July , top envoy Josep Borrell said. He added that, while the final call would rest with national capitals, Brussels would encourage "a gradual and partial lifting" of the ban.

Crude prices fell more than two percent towards** $40** a barrel after a report from the American Petroleum Institute, an industry group, indicated a rise in U.S. inventories, triggering concern about oversupply and weak demand . Brent crude was down 70 cents, or 1.7 percent, to $40.48 a barrel while U.S. West Texas Intermediate retreated 84 cents, or 2.2 percent, to $38.10.

**China's producer prices **weakened drastically after the coronavirus crisis reduced trade flows and global demand. The producer price index (PPI) in May dropped 3.7 percent from a year earlier, the National Bureau of Statistics (NBS) said in a statement, the sharpest decline since March 2016.

Malaysia allowed the reopening of hair salons and****shopping malls and lifted curbs on interstate **travel **in a further relaxation of stringent restrictions as the Southeast Asian country entered a new recovery period until 31 August , followed by a normalization phase until a vaccine is available.

Automobile giants Ford Motor and Volkswagen revealed they would produce eight million medium pick-up **trucks **and commercial **vans **as part of a tie-up announced in 2019. Ford will also work on a new Europe-focused **electric vehicle **by 2023, built on Volkswagen's modular electric drive toolkit.

Mizuho Financial Group has seen COVID-19-related loan****requests reach **$155 billion **and expects demand to spike from businesses battling to survive. "As clients face liquidity problems, we will help with financing as appropriate," CEO Tatsufumi Sakai said.

Scott Petty, Vodafone UK's chief technology officer, warned that Britain's aspiration to lead the world in 5G technology will suffer a major blow if it obstructs China's **Huawei **from building critical infrastructure needed for the initiative.

Emirates cut more **pilot and cabin crew jobs **in a second day of redundancies that began on Tuesday, company sources said. The Dubai-based airlines let go of hundreds of pilots and cabin crew members in a desperate bid to avoid a cash crunch caused by the pandemic.

**Hyperloop **technology linking Amsterdam's **Schiphol **airport to **European cities **could be a viable low-emissions alternative to short-haul flights, according to a study by the Royal Schiphol Group, which owns and operates the airport, and Dutch company Hardt Hyperloop.

Huawei has gone on a charm offensive in the UK, emphasizing it is a private company with operations in 170 states to show it can be trusted with sensitive data while building the country's 5G network.

03:12

Trevor Williams, former chief economist at Lloyds Bank, shared his thoughts on the recent popularity among investors for government bonds and the reasons behind such a trend.

What is currently propeling the appetite for government bonds?

It's partly the fact that there is an economic slowdown going on and so investors want to go for safety and they will always want to buy government stock in situations where there is an inherent instability. And also, of course, one of the biggest buyers out there for government bonds is the debt management office, as we call it in the UK, the arm of government which buys up and manages the stock of government debt.

To what extent do you think the bond market has been supported by central bank money?

Hugely supported. Something of the order of 30 percent of the bond market is government money. And to that extent, the pricing in the market is misleading insofar as without the government buying, the private sectors' buying and selling might have led to a different yield-curve outcome, but we won't know that because we have got government borrowing.

Do you think it's fair to say markets are now stabilized in the wake of pandemic?

They are stabilizing, undoubtedly. This has happened due the huge amount of government spending in terms of the bond-buying program, in terms of the announcement by Rishi Sunak, the chancellor of the exchequer in the UK on these support measures for workers, for businesses. And so the markets have stabilized because government intervention is on a massive scale and it's led to the outcome that they wanted.

Below is an infographic showing the first-quarter GDP growth of the top eight EU member states in 2020.

简体中文

简体中文