"Those other sectors, where they are inherently more difficult because people are mixing together and it's difficult to maintain the social distancing , we wouldn't be able to say that [they could reopen] at least until the 4 July."

The UK's foreign minister, **Dominic Raab, **gave an indication of the long road ahead as the UK takes its first steps to kick-start an economy ravaged by the coronavirus pandemic.

Britain , one of the worst-hit by COVID-19 in Europe, has been in **lockdown **since March and has announced a phased return-to-work road map for a select few sectors. Prime Minister Boris Johnson in a speech on Sunday unveiled a **"conditional plan," **saying people who cannot work from home can go back to their workplaces, provided they avoid taking public transport.

He said a new COVID alert system with five levels would decide how soon the stringent restrictions could be relaxed. Johnson also added that the next step "at the earliest by 1 June" would be the reopening of some primary schools and shops .

The hospitality businesses can hope for some relief around 1 July, only "if the numbers support it," the prime minister warned.

It's just not the UK, swathes of Europe have begun the arduous process of bringing their economies back on track, with** France, Germany and Spain **allowing members of the public to step out of their homes, albeit with stringent preconditions and caveats.

In a sobering reminder that a second wave of the virus cannot be ruled out, China's Wuhan city, from where the disease was first identified, has reported a spike in new infections .

Across the Atlantic, **the White house **has begun informal **discussions **with Republicans and Democrats in Congress about what to include in another round of coronavirus relief legislation , officials said, as they painted a grim picture of further U.S. job losses in the coming months.

**India, **which has one of the world's largest train networks will "gradually" resume rail operations from Tuesday. The South Asian giant is also easing its lockdown and restarting its economy .

Do scroll down the page to read our interview with Aman Wang, a UK partner and head of UK-China Business at KPMG, where he says that most investment between Chinese and European firms has been put on hold during the COVID-19 outbreak.

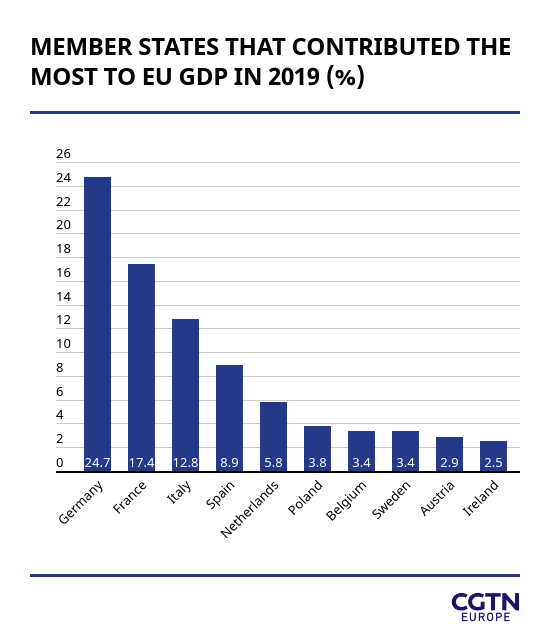

And our graphic today is on the top 10 member states of the EU that contributed the most to the bloc's GDP in 2019 .

Happy reading,

Nilay Syam

Digital business correspondent

P.S. Did you know we send this briefing by email, too?

You can sign up to receive it here.

Oil prices dropped as concerns grew over a second wave of the coronavirus and a persistent glut in demand. Brent crude was down 74 cents, or 2.4 percent, at $30.23 a barrel by 10:12 GMT, while U.S. West Texas Intermediate crude fell 55 cents, or 2.2 percent, to $24.19. New infections have been reported from China and Germany. South Korea also warned of a second wave of the virus on Sunday.

The aviation sector has been bleeding since most countries went into lockdown and passenger numbers plunged after a series of travel advisories from governments. British Airways said it would suffer fresh damage if the UK quarantines international arrivals. Qatar Airways' CEO warned that a full recovery of the airline could take up to four years. Franco-Italian planemaker ATR is expected to announce** production cuts **due to weak demand.

Germany's chancellor, Angela Merkel, said that a ruling by the country's constitutional court taking aim at an **ECB stimulus program **is "solvable" if the central bank explains the plan, according to officials. The court last week gave the ECB three months to justify bond purchases under the plan or risk losing the Bundesbank as a participant.

Saudi Arabia will hike value added tax (VAT) three times and suspend a cost of living allowance for state workers after it took a hit from l ow crude prices , the country's main export. The kingdom has posted a $9 billion budget deficit in the first quarter.

Indian Railways will be operating **limited services **on its giant network, despite the country witnessing its biggest single-day jump in cases. Prime Minister **Narendra Modi **has held discussions with state chief ministers to chart a course out of a nearly seven-week lockdown and open up some sections of the economy.

Global average commercial insurance prices jumped 14 percent in the first quarter, partly due to rises in property insurance rates, insurance broker Marsh said in a report. Pricing for property risks increased 15 percent, while financial and professional lines rose nearly 26 percent and casualty increased five percent, on average, worldwide, according to Dean Klisura, president, global placement and advisory services at Marsh.

Swedish** telecom equipment **maker Ericsson said it revised higher the global forecast for **5G **subscriptions to around 2.8 billion by 2025 from 2.6 billion as a fallout of the COVID-19 pandemic . The telecoms sector is one of the few industries to witness a **surge **in demand since more people are working remotely from home.

Japanese car maker Nissan's April **sales grew **by 1.1 percent in **China **from 2019 to 122,846 vehicles as the world's biggest auto market emerged from the virus outbreak. Data from the country's biggest auto industry body showed that overall auto sales rose 4.4 percent in April.

Exports and imports in South Korea , Asia's fourth largest economy, **declined **in the first 10 days of May, with global demand for goods and services almost grinding to a halt. Exports contracted an unprecedented 46.3 percent year-on-year in the period, while imports fell 37.2 percent, data from the Korea Customs Service showed.

Japan's central bank has appointed its first female executive director . Tokiko Shimizu , a 55-year-old career central banker, became the first woman to fill one of the Bank of Japan's six executive director posts. Just one woman serves on the BOJ's nine-member board that makes key policy decisions. Takako Masai is a former commercial banker. Only 13 percent of senior BOJ managerial posts are filled by women.

As countries across Europe begin easing their coronavirus lockdowns a key question facing governments is how to get their populations moving again without chaos on road and rail.

01:22

Aman Wang, UK partner and head of UK-China business at KPMG, discusses how investments between UK and Chinese firms have been put on hold as business sentiment suffers due to the coronavirus pandemic.

What is the current state of Chinese-Europe investments and how will COVID-19 change that?

In 2019, Chinese investments in the UK and Europe had already dropped to a five-year low. The peak time was between 2016-17 and that's the backdrop before COVID-19 hit us. As someone who has been dealing with cross-border investments on the ground, several transactions have either been postponed or put on hold. I think from the investor's point of view, they are worried about their credit lines from the banks; they are revisiting their investment strategies and rationales, the business case behind the investment and also revisiting the valuation of the target companies. Similar stories would also apply to the sale side, since they are concerned about the execution risk of those transactions. However, in the medium term, six to 18 months or so, there should be an arbitrage opportunity between the UK and China, driven mainly by China, which has shown early signs of recovery.

Do you think China has an edge in investment-related matters as it emerges from the worst phase of the outbreak, compared with other parts of the world?

I believe so, I think there is an opportunity in the medium term and there is probably a short-time window for investors to capture and capitalize on that opportunity. China has shown the early signs of recovery and business activity has reached 70-80 percent. This might lead to increased confidence in the capital market and hopefully raise liquidity levels in the domestic market. This is in contrast to where the UK and Europe are in the pandemic curve as the worst phase is yet to hit us.

Traditionally, the focus of Chinese investments has been on infrastructure, financial services and management. Do you think that will change now?

I think that in the short to medium term, major transactions in those sectors maybe less, given the increased level of risk. However, those are the fundamentals of UK-China trade and investments. In a post-COVID-19 world, when the dust settles, I believe interest in those sectors will pick up again.

Below is an infographic showing the 10 member states of the EU that have contributed the most to the bloc's economy in 2019.

简体中文

简体中文