"We are working tirelessly to ensure that easyJet continues to be well positioned to overcome the challenges of coronavirus."

The words of easyJet CEO Johan Lundgren may be reassuring to travelers who hope to fly with the budget carrier after the COVID-19 pandemic becomes less serious, but others will say his words will bring little joy to the 4,000 UK-based crew who face uncertainty as the airline grounds its entire fleet.

Elsewhere, the price of oil continues to drop as producers keep pumping "black gold" out of their fields while demand crashes – and with airlines continuing to cut more flights, it seems unlikely demand will pick up again before the end of the coronavirus pandemic.

In the face of economic collapse seemingly wherever you look, the Swedish government has set out a plan to save large companies – which means buying large stakes in them, with taxpayers hopefully reaping rewards when revenues rise on the predicted recovery.

But smaller businesses are having to find more creative ways to stay afloat. This is also the case in Germany, as our correspondent Ira Spitzer found out. He discovered how Berlin nightclubs are streaming parties online to the country's isolated masses. You can watch his video below. It's already been a highlight of my Monday!

Happy reading,

Patrick Atack

Digital business correspondent

P.S. Did you know we sent this briefing out by email, too?

You can sign up to receive it each weekday here.

European budget airline easyJet has grounded its entire fleet of 331 planes for commercial flight, but said it "will continue to work with government bodies to operate additional rescue flights as requested."

The price of oil has continued to plummet and has now reached 18-year lows of just $20 per barrel, as lockdowns to stop the spread of COVID-19 limit demand.

China's central bank has pumped liquidity into the market through seven-day reverse repos, while cutting the interest rate by 20 basis points to lower lending costs and offset the economic shock of COVID-19. The injection is worth around $7 billion.

Japan's ruling Liberal party said it will introduce a stimulus bill, which would be worth as much as 17 percent of the country's GDP, if it is accepted by lawmakers.

Foxconn, which assembles iPhones for Apple in China, revealed a nearly 24 percent drop in profits in the last quarter of 2019. It announced a net profit of $1.5 billion, compared with $2.06 billion over the same period in 2018.

Swiss bank UBS has declined to follow advice from market supervisor FINMA to delay dividend payments while the economic impact of COVID-19 is felt. European lenders such as Allied Bank of Ireland have suspended payments, but UBS intends to pay $1.41 billion to shareholders nonetheless.

Swedish finance minister Magdalena Andersson said the government may increase its stakes in some "larger companies" if they need financial assistance during the crisis. "That is how we usually do things in Sweden. The taxpayer takes on a risk and should have the opportunity to be in on the recovery," she said.

The UK government has reached an agreement with several broadband internet suppliers to remove any data caps for customers and to offer "generous" new deals amid the crisis and near-lockdown in the country.

It's Saturday night, there's a COVID-19 lockdown, and you've got nowhere to go. Tune in to the sound of Berlin's notoriously hedonistic club world, as venues from the German capital livestream performances to save the city's endangered music scene.

02:47

Former chief economist at the Italian Finance Ministry, Lorenzo Codogno, spoke to CGTN Europe's weekly Agenda show and explained Italian and European efforts to manage the economic side of the COVID-19 pandemic.

The Italian economy wasn't the strongest in Europe before this pandemic. What effect is it having on the economy and what effect could it have?

The short answer is a massive impact, because keep in mind, as you mentioned, Italy was not in a very strong position before the crisis. Actually, there was a contraction already in the fourth quarter of last year. It was a quarter-on-quarter contraction by 0.3 percent.

Now, at the beginning of this year, there was some rebound, but then the crisis hit. The first impact came from the supply chain and was China, mainly China. Then you got the first cases in Italy and there was the first lock lockdown in the very specific areas in the country, 14 provinces. And that threat ended up in a kind of limited economic impact.

Then I think the next step was when the government decided to lock down the whole country, which was on 9 March. And then over the weekend, the government decided to tighten the mobility restrictions and closed down all companies, all factories or businesses that are perceived to be non-essential.

So, I think at this stage, we could expect a big chunk of the economy not to be functioning. And so the economic damage is going to be massive. I haven't published the forecast yet, but you can expect something in the range of between 8 percent and 9 and 10 percent contraction for the whole year. So it's going to be massive.

What is the government doing or saying to try to reassure people, not just about the current crisis, but also that there will be jobs to go back to when it's over?

Well, I think that the policy reaction, although there was a bit of confusion initially and a lack of clear responsibility in responding to the crisis, now I think there is a really clear line of command and the government is fully on board on the response. The response is twofold.

On the one hand, you have a domestic response, which is clearly purely fiscal. And the government already introduced the 25 billion euros of fiscal stimulus, which basically aims to protect the workers and the businesses that will inevitably suffer if there are at least a few months of disruptions. This package will likely increase because sometimes they finance only one or two months. And so there would be a need to refinance this package.

So, I'm expecting an overall bill, which is probably in excess of 50 billion euros. Secondly, you have the policy response by the ECB, which is also quite important because it provides liquidity and you provide support in the bond market.

So it makes sure that the conditions remain stable. And there is no major disruption in financial markets, but also for banks and therefore for credit to the companies. And then we are still waiting for the European response, which is not fully complete.

There has been criticism of the European response. You mentioned the European Central Bank has launched its so-called pandemic emergency purchase program. Does that go far enough? Is that enough?

Well, I think Christine Lagarde was a bit reluctant to go immediately for monetary policy because she wanted to put pressure on the government to deliver fiscal first. But then it wasn't particularly successful. So she tried to introduce a broad package initially, which to me was well designed, but it wasn't powerful enough. The initial amount of the asset purchase program was only for another 20 billion euros and it was time limited.

Then the ECB and Lagarde made the unfortunate comment on spreads. Then the ECB had to come back, and this time that package must be big... the ECB added 750 billion euros, which was without a clear time limit.

So... I think that the response by now is appropriate and sufficiently strong.

Even some conservative estimates believe this is going to cost at least a trillion dollars. Is there a reassuring element to that? Insofar as we are all in the same boat, we are all almost all in lockdown or shutting our economies down?

Yeah, I think the the big question mark here is how long it's going to last and not just in Italy, but globally. Because if it is just for two or three months, then the economy can bounce back and the damage on the supply side might be limited.

It's a more prolonged effect, then you might see problems because companies might start going under, there might be workers fired and then the economic problems would actually unfold. So I think it very much a call on the duration and extent of the of the crisis, which at the moment is still uncertain.

So we can make a reasonable kind of educated guess, say that it's going to last for another couple of months in terms of lockdown globally. And then you have maybe another one or two months of, you know, a kind of cooling period after the shock. And then in the second half of the year, we can expect some rebound. But, again, it's very uncertain at the moment.

One economist described Italy as Europe's canary in the coal mine. Is that is that how you see it?

Well, I think there is a deeper problem in terms of how Europe has responded to this crisis. As we mentioned at the beginning, there is still a problem in terms of proper fiscal response at European level. There is no safe asset that can kind of shield any tension in terms of government bond yields. There is no central fiscal capacity. These are still open issues. Now, there could be some surrogates that can allow Europe to have a lender of last resort

– which is, the ECB can have a big fiscal package loosely coordinated at European level.

But still, I think there are a number of things that need to be fixed at European level in order to allow the whole area, particularly the eurozone, to have a capacity to respond to shocks, economic shocks.

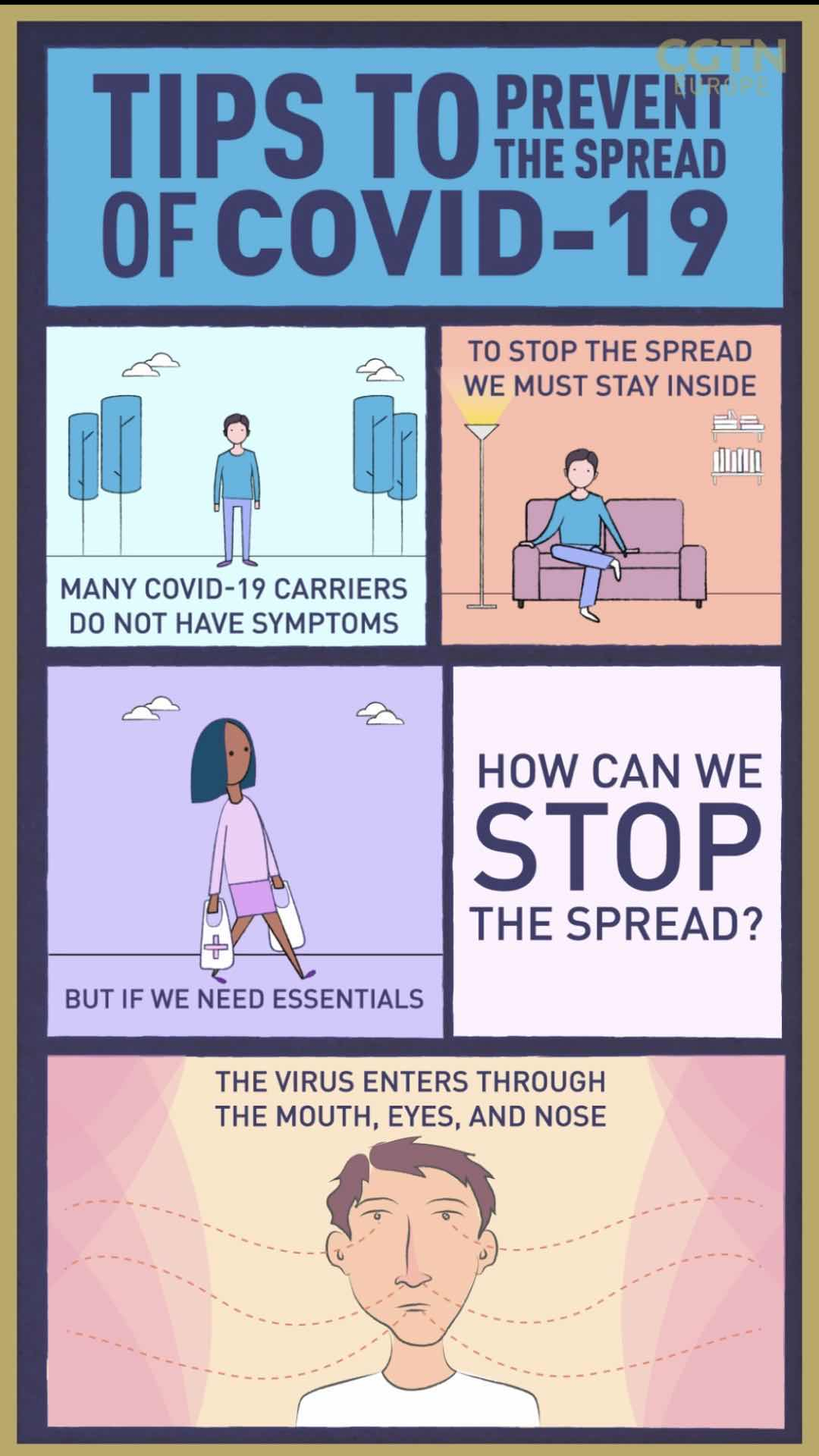

Over the weekend we produced a brilliant cartoon to show some of the ways isolating and generally being careful can help stop the spread of COVID-19. Below are a few examples, and

you can see the entire cartoon here.

For more dedicated news on the pandemic in Europe, remember you can subscribe to our daily bulletin here.

简体中文

简体中文