"The structure of the company is outdated . We didn't get a bloody nose in 2018 to now kick the can down the road for a few more years."

This is what Nils Andersen, chairman of Unilever , told reporters about the announced unification of the company's Anglo-Dutch dual legal structure into a single holding company based in Britain , two years after the idea to move the company's headquarters to the Netherlands was shut down by shareholders.

The move is designed to give the company more flexibility in acquisitions and reduce business complexity, which Unilever has described as the 'best tactical option,' considering it expects COVID-19 to create a more dynamic business environment.

Although Unilever's Dutch partners were disappointed, others received worse news today: Lufthansa has announced it will cut up to 26,000 jobs in Germany to save costs amid the crisis in the sector caused by the pandemic, and British Gas owner Centrica said that 5,000 jobs will have to go to make up for the company's recent losses.

Scroll down the page to read our interview with Alexandre de Juniac, director general and CEO of the International Air Transport Association (IATA) about the future of aviation .

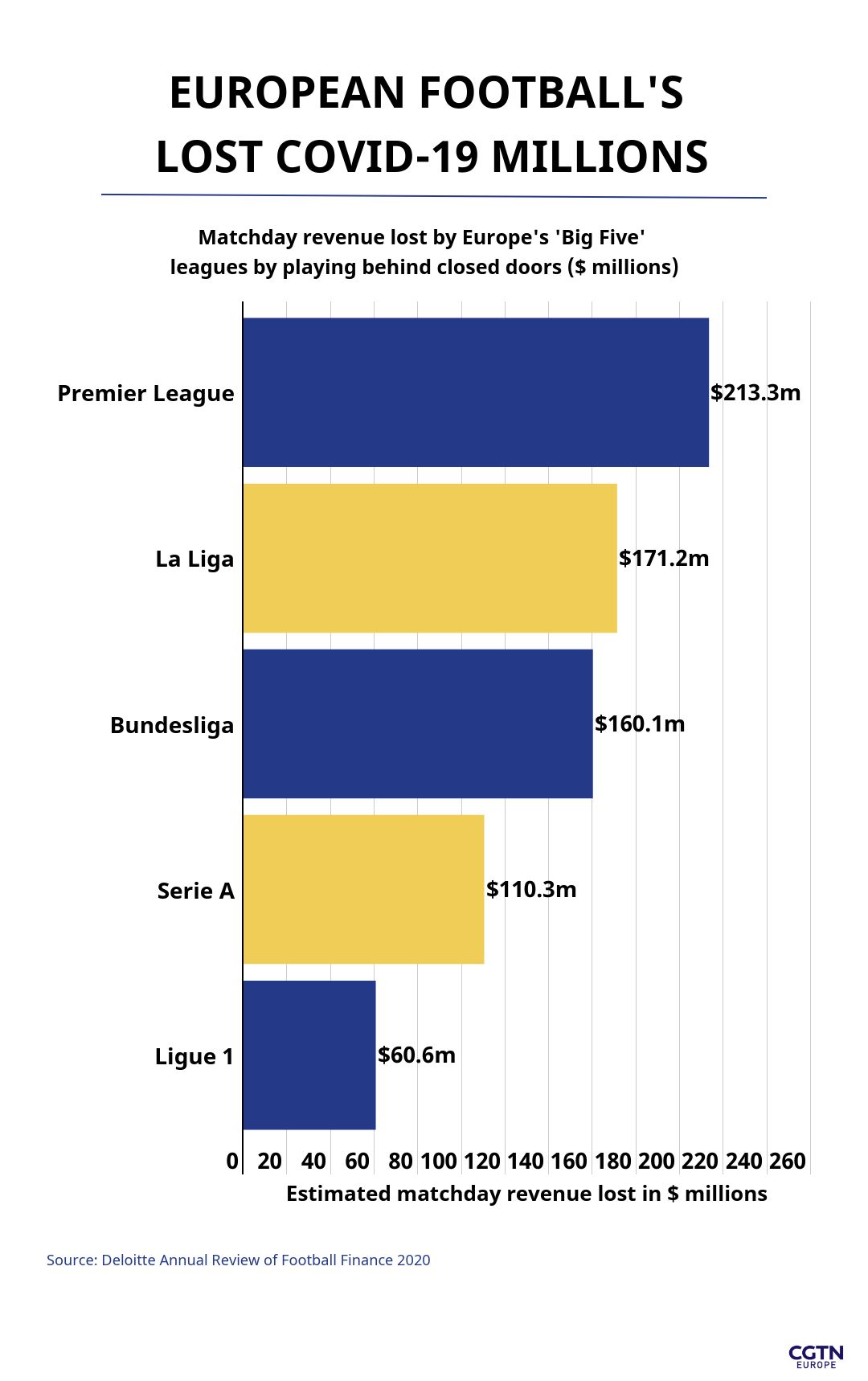

And as Europe's major football leagues gradually restart, ourgraphictoday looks at the cost of lockdown measures on the sport in terms of clubs' lost matchday revenues in 2020.

Happy reading,

Giulia Carbonaro

Digital correspondent

P.S. Did you know we send this briefing by email, too?

You can sign up to receive it here.

Lufthansa announced it will cut up to 26,000 jobs in Germany as a result of the crisis created by the pandemic. The German airline employs more than 135,000 people worldwide, half of them in its home country.

Amazon is banning U.S. police from using its facial recognition software, Rekognition, for a year . The measure comes after Black Lives Matter protests have shaken the world following the killing of George Floyd in Minnesota, and civil rights activists have raised concerns about potential racial bias in this technology.

British Gas owner Centrica will cut up to 5,000 jobs to make up for the losses suffered as a result of falling gas prices, the energy price cap, and the pandemic.

Just Eat Takeaway has agreed to buy GrubHub, a U.S. rival food delivery company, for $7.3 billion . The merging of the European app with the U.S. one will create the biggest food delivery company outside China.

Lloyds Bank has been fined $81 million (£64 million) for unfair treatment of mortgage customers struggling with payments.

Fashion company Zara will close up to 1,200 stores around the world as a result of the pandemic, while planning to boost its online sales. Closures will involve brands owned by the Spanish company including Bershka, Pull Bear, and Massimo Dutti.

**British Airways will sell at least 10 artworks from its collection, **with the aim of raising millions of dollars to bolster its balance sheet amid the ongoing crisis in the aviation sector.

Anglo-Dutch company Unilever has announced it will merge its dual legal structure under a single Britain-based parent company . The move, which should reduce business complexity, comes only two years after Unilever was planning to move its headquarters in the Netherlands – a plan that was scrapped amid criticism from shareholders.

Plane and train manufacturer Bombardier announced it will cut 400 jobs in Northern Ireland , after announcing last week it would reduce its global workforce by 2,500 employees.

Marmite let itscustomers know through a tweet that the company is only able to produce small 250g jars . A knock-on effect of the lockdown and the closure of pubs and restaurants is brewers pausing beer production – and that's left fans of the yeast-based spread wanting, as the company has been forced to stop all but limited production.

From suppliers to restaurants, the entire food chain has been disrupted by the coronavirus pandemic. In the UK, the impact has been strongly felt by wholesalers ** – the businesses that supply food to restaurants and the public sector. A major new British government survey suggests almost half of them could fold by the end of the year without extra support.**

02:35

Alexandre de Juniac, director general and CEO of the International Air Transport Association (IATA) shared his thoughts on the future of the aviation industry on CGTN Europe's show The Agenda.

First of all, can you describe the impact of this pandemic on the aviation industry?

You know, this pandemic has had an unprecedented impact. We are losing more than half of our revenues for 2020, something above $310 billion. We will burn cash at a level that is very damaging for the industry for the second quarter. It's over $60 billion. And the number of jobs that could be impacted by the COVID-19 crisis on the air transport sector

– jobs that are directly and indirectly linked to our industry

– is around 25 million worldwide. So, these numbers, I think, illustrate the unprecedented magnitude of this crisis.

And which areas are hurting the most? Which airlines?

I think everybody is suffering everywhere in the world. It started in Asia with the pandemic and then moved to Europe and now it is in the Americas. Everybody has suffered. No one has been protected. The historic and full-service airline, the new-model airline, the low-cost... because, you know, the main impact has come from the travel restrictions and border closures that have been decided by governments. And so the whole fleet or almost the whole fleet of passenger aircraft is being grounded everywhere for all companies, no one has been protected.

But the pain is not being shared equally, isn't it? Because some governments are putting in a great deal of money to shore up their national airlines?

Yes, it's true that we have strongly advocated in favor of a public support

– using public money to support the airline industry. Because we think that, first of all, we are absolutely key for economic development. And secondly, that we are also critical to allow a strong and quick recovery when the crisis will be over. So we have asked governments to put together rescue packages and strong financial support. We have had a pretty open and supportive attitude from many governments all over the world, in Asia, in the Middle East.

But is that fair on the private airlines?

We haven't advocated in favor of anyone particularly. We asked governments to support the sector and then to define the appropriate package adapted to the situation of their country or their airline. So, slowly, a kind of customized approach. But with a strong injection of cash, because we were dying of cash shortage. So we said, if governments want to have a strong airline sector that will survive this crisis, you have to inject cash, by any means.

You've got to persuade passengers, first of all, to get on planes again. And, secondly, are you going to tell airlines that they have to practice social distancing on a plane?

What we are doing is we are working within the ICAO framework and under the ICAO umbrella in this task force that set up with groups, not only industry, so also us, but also at the airport and the air traffic controllers, but also WHO, plus the governments, which are members of the ICAO council, and they are working on the sanitary check and health control process, so that we minimize the risk of contamination onboard and that we minimize the risk of dissemination of the virus from one country to another.

You've already said this crisis is unprecedented. Therefore, is it an unprecedented opportunity to change the aviation industry for the better?

One point that has to be thought of is that the crisis we are facing is not a result of a particular weakness or default of the business model. It is completely an external crisis coming from outside. From the virus, from the consequence of the pandemic and the decisions made by governments to restrict travel and close borders. So I'm not sure that in the future the business models of the airline industry will be significantly different. Perhaps we will see slightly fewer actors, because, unfortunately, there will be bankruptcies.

Below is an infographic showing what European football clubs lost in matchday revenues in 2020 because of the COVID-19 pandemic.

简体中文

简体中文