"They said they could not endorse Dr Ngozi. I don't know the reasons for that."

That was World Trade Organization spokesperson Keith Rockwell , reacting to the U.S. delegation choosing not to back the former Nigerian finance minister, but instead put out a statement backing South Korean Yoo Myung-hee as a "bona fide trade expert."

It was a better day for e-commerce sites like eBay and Shopify , though, with a big increase in user numbers and those all-important dollar figures, too.

A final story to point you towards is what looks like a full

detente

between luxury brand group LVMH and Tiffany, the New York jeweler. Last week the deal looked to be going anything but lightly

, but now with a small yet valuable revision to the price it was announced the marriage would go ahead.

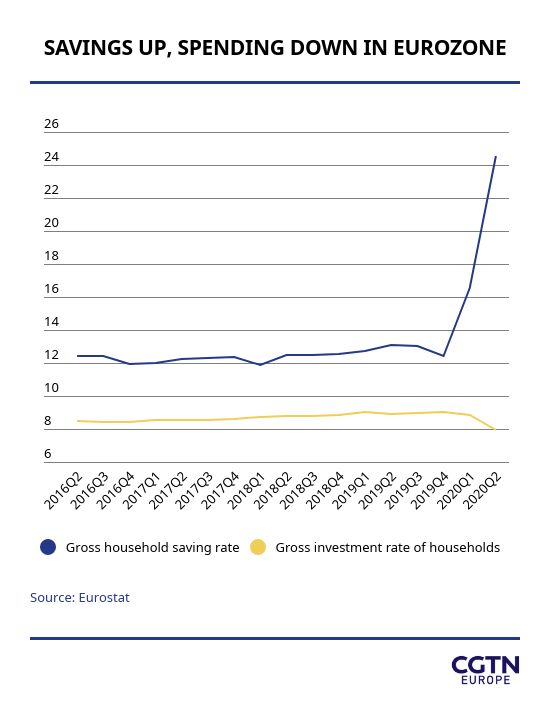

**Today's graph **shows how households have reacted to the pandemic through the latest stats available from the euro zone. Perhaps it's not surprising that people are saving more, but seeing that jump in comparison with the drop in investments is stark.

Happy reading,

Patrick Atack

Digital business correspondent

**P.S. Did someone forward this to you? **

Sign up here

The U.S. has opposed the nomination of Nigeria's ex-finance minister, Ngozi Okonjo-Iweala, for the WTO director-general role despite the WTO nominations committee recommendation to appoint her.Okonjo-Iweala, who would be the first African to lead the organization, is running against South Korean Yoo Myung-hee. The appointment process will continue this week.

E-commerce is booming, with new user figures bolstering increased profits reported by the likes of eBay, Shopify and Etsy. **Shopify said in a statement that sales in the quarter to September were up 96 percent **on the same months in 2019. Etsy said its revenue was up 126 percent on the year.

European plane manufacturer **Airbus said it expects to stop its pandemic cash burn in the fourth quarter. **COVID-19 has put the brakes on the plane maker's deliveries, but that key metric is now on an upwards trajectory – though a heavy backlog of 135 aircraft remains. In the latest period Airbus's revenue fell 27 percent to $13 billion.

Luxury group LVMH has made peace with New York-based jeweler Tiffany and agreed to follow through with its acquisition of the brand, though for a slightly smaller price than previously agreed, LVMH will now pay $131.50 a share, totalling $15.8 billion. That's down from $135 per share.

**Anheuser-Busch InBev, now the world's largest brewing group, has decided not to pay its interim dividend **despite signs that sales of Budweiser, Stella Artois, and Brahma in Brazil are recovering better than expected in the third quarter. The company said the decision was made in order to relieve its debt burden of $87 billion.

Royal Dutch Shell's third quarter earnings fell 80 percent to $955 million . But the company said it outperformed analysts forecasts of a $146 million profit. Along with the revenue drop, Shell said it would cut back on its refining operations, and consolidate it with its chemicals business.

The U.S. economy grew at historic pace in the last quarter, with growth of 33 percent only outstripped by the country's wartime economy. However, the headline figure does not tell the full story, as despite the fast growth, the** overall production is still lower than pre-pandemic levels, and 10.7 million more people are unemployed now.**

German car maker Volkswagen said it returned to profit in the third quarter, mainly thanks to sales in China as its economy reopened after pandemic lockdowns. Although** overall vehicle deliveries were down more than 1 percent, Chinese demand for luxury cars balanced out the bottom line.**

Nokia has cut its full-year profit forecast and new CEO Pekka Lundmark said the Finnish telecoms firm would change tack in its bid to win the 5G infrastructure race. "We need to further increase RD investments to ensure leadership in 5G," Lundmark said, adding that the company would "do whatever it takes" to beat Swedish rival Ericsson.

Ford Motor Company has posted a better third quarter profit than expected, **after a boost to sales of SUVs and pickup trucks in the U.S. market. **The firm said it now expects full-year pretax profits of between $600 million and $1.1 billion.

French telecoms brand Orange has struck deals to open up its network to rivals, in order to balance its losses caused by the pandemic. Although quarterly profit only grew by 0.4 percent , it would have been much worse without the deals, as the network lost $174 million in core operating profit in the same period.

Institutional investors worth $10.2 trillion have written to the boards of global mining companies to better understand their engagement with First Nations people, in the wake of Rio Tinto's destruction of Australian rockshelters, despite community outrage. The group of 64 investors and their representatives, including the Church of England Pensions Board and the Australian Council of Superannuation Investors wrote to highlight their concerns.

Toy maker Hornby has enjoyed a sales surge of 33 percent in the six months to the end of September, as more people took up hobbies in lockdown. The brand is well known for its lifelike (not lifesize) model railway sets but also owns Corgi model cars and Scalextric racing kits.

**CLICK: **

WHY THE ALPS FACE AN UNCERTAIN FUTURE

WATCH: Chances are your teabag it isn't actually 100 percent biodegradable. It may contain a thin plastic seal, and experts worry about the environmental impact of these microplastics.

03:33

To discuss the latest news from Airbus, we spoke to airline analyst John Strickland.

Is this just the pandemic playing havoc or is there more at play here?

I think it's fair to say that both these leading global manufacturers have their share of problems. Airbus had to cancel its prestigious A380 large wide-body aircraft program; that meant a financial hit. Boeing, of course, has been wrestling with trying to get back to service its Boeing 737 Max, which has been grounded well over a year now.

Recovery of global air travel is much slower than anticipated. What does that mean for the wider sector?

I think survival of the fittest is probably the right way to put it. I'll be surprised if we get through the coming winter without one or two high-profile airlines disappearing from the landscape simply because the market is so tough.

How do companies restructure to stay afloat?

The most effective airlines have taken a scalpel – or even a carving knife – to their fat, and cut costs and try to protect their liquidity. But even an airline which is grounded is hemorrhaging millions of dollars a day because you still have to employ a certain amount of your workforce. You still have to look after those aircraft which are grounded. I think things such as digitalization, more automation of processes is going to be a way forward.

简体中文

简体中文