Geely's headquarters in Hangzhou, east China's Zhejiang Province. /VCG

China's automobile manufacturer Geely on Friday denied market rumors that the group will acquire shares of debt-laden automaker Lifan, as the group's spokesman Yang Xueliang replied, "there is no such thing."

It was reported that Hangzhou-based Geely plans to inject fresh capital into Chongqing-based Lifan to become its top shareholder, according to people familiar with the matter. The price and size of the stake and the amount of fresh capital were not known.

Volvo owner Geely is also the biggest shareholder in Daimler AG, a German multinational automotive corporation. Lifan, founded in 1992, has seven overseas automobile manufacturing bases and nearly 500 marketing networks all over the world.

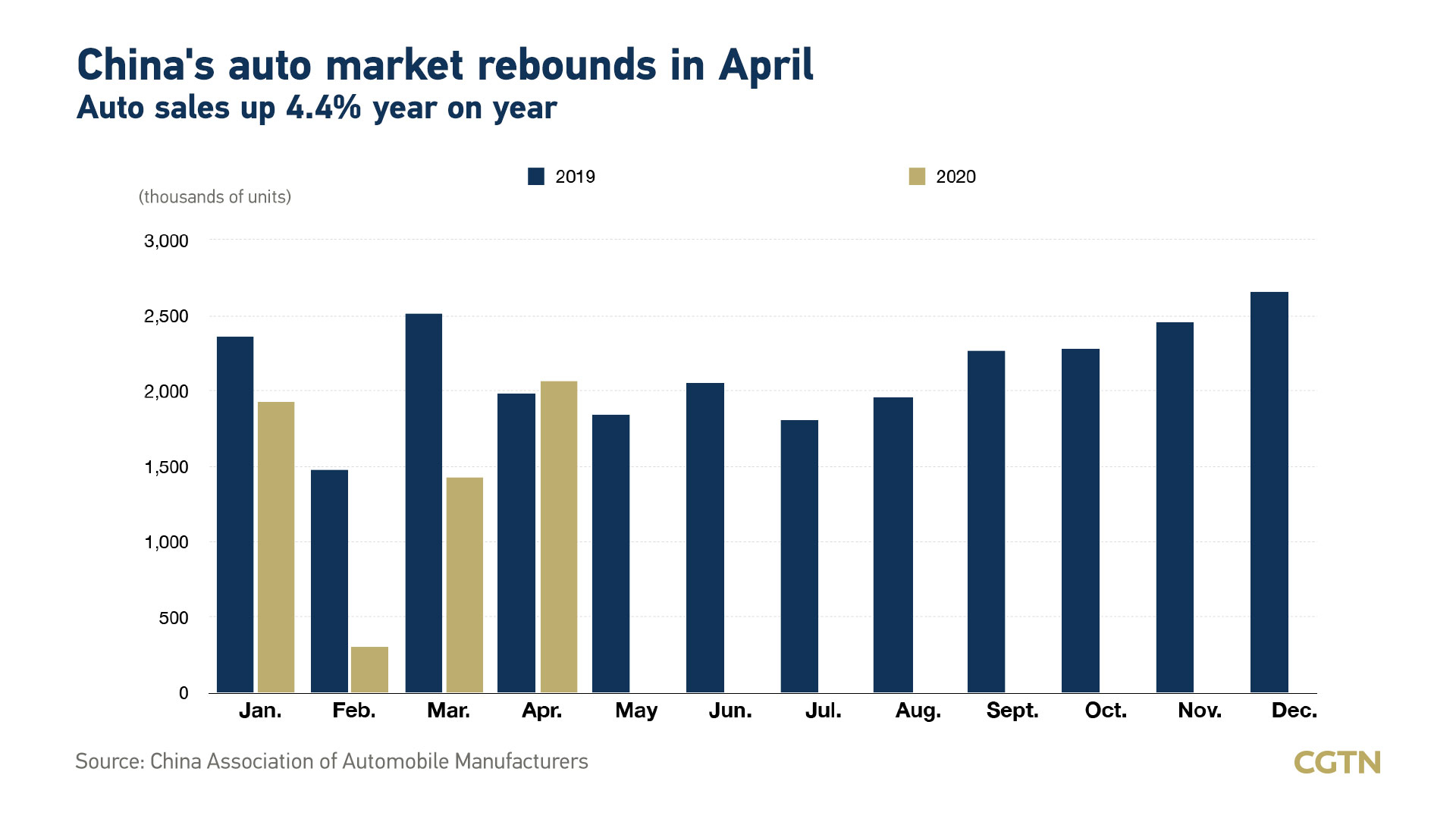

The reported takeover came as China's auto sales ended almost two years of decline in April, growing 4.4 percent compared to last year, with easing virus-related curbs releasing pent-up demand.

China car sales mark first rise in nearly two years, mainly due to heavy trucks

China's biggest automakers expected a changing landscape after the epidemic, with competition in the industry pushing smaller peers into restructuring or bankruptcy.

Lifan's share price lifted the daily trading limit on Friday, jumping to 5.5 yuan per share on the report, with turnover of nearly 400 million yuan (about 56.5 million U.S. dollars). The stock also rose 6.84 percent on Thursday.

The debt-laden automaker was battered by a prolonged sales decline due to the COVID-19 outbreak. Debt of the one-time motorcycle maker totaled 31 billion yuan (4.4 billion U.S. dollars) last June, with 60 percent due within this year, company filings showed.

Liquidity-starved Lifan will propose a debt restructuring to creditors on Saturday, including asset sales and debt-to-equity swaps, and plans to complete the restructuring as early as August, according to people with knowledge of the matter.

简体中文

简体中文