"The chief business of the American people is business."

I usually start this briefing with a quote from one of the day's top stories and one of its protagonists. But the day's biggest story is the U.S. presidential election - and we've frankly all heard enough from both the candidates.

So that's ** U.S. President Cavin Coolidge, speaking in 1925** . Arguably, he's still right. From stockbrokers to CEOs, the business world will be watching eagerly around the world tonight and tomorrow to see who wins.

Now, to today's news – the major story is that Ant Group , which has been preparing to launch a historic IPO on the Shanghai and Hong Kong stock markets has cancelled its listing. According to the firm, it was told today it did not meet new listing rules.

In Germany, the former chief financial officer of Wirecard has been released on bail after three months in custody – but at least three key figures from the firm are still in jail.

In today's video, we take a look into a new plastic "museum" an artist has created to show how plastic bags have changed.

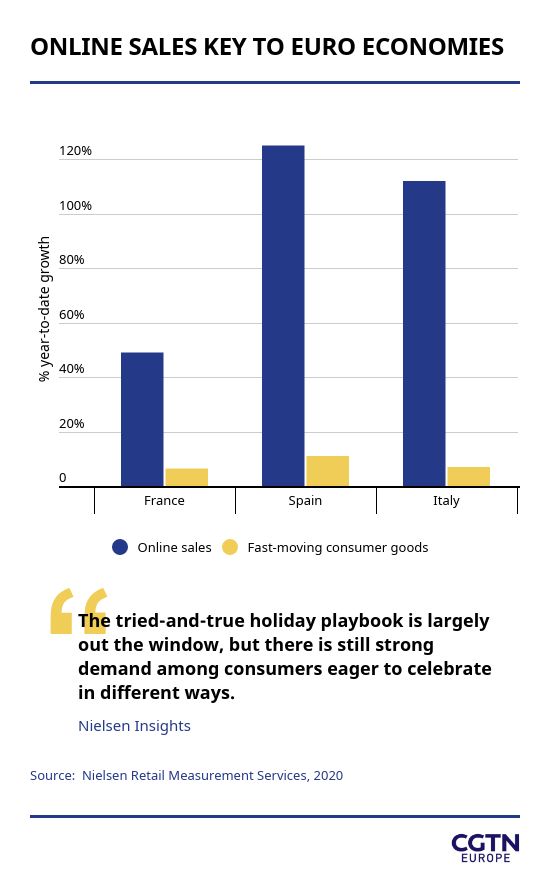

Finally, how have our shopping habits changed since March ? Scroll down to the graph to find out.

Happy reading,

Patrick Atack

Digital business correspondent

P.S. Did someone forward this to you?

Sign up here

Shanghai Stock Exchange announced the

postponement of Ant Group's listing on the Nasdaq-style STAR Market, which was scheduled for Thursday

. Ant Group reported major changes, including joint talks the company had with regulators and the changes of regulation on the fintech industry, mean the firm may fail to meet IPO standards or information disclosure requirements.

AMC Entertainment, which is the largest global cinema group, registered a $906 million loss in the quarter to September, with revenues down 91 percent to $120 million . In October, the group reopened 539 of its 600 U.S. cinemas, but limited capacity and few movie releases have hit the company.

The CFO of disgraced German payment firm ** Wirecard, Burkhard Ley, has been released from police custody after three months of investigation** . He is still on bail. Former CEO Markus Braun and two others remain in prison. Prosecutors said the investigation revealed most criminal activity happened after Ley left the firm.

Meanwhile, the European Union's Securities and Markets Authority has issued a damning verdict on German regulator BaFin over its handling of the Wirecard scandal . BaFin's internal controls failed to pick up that some of its own employees were buying and selling Wirecard shares, the report highlighted.

"Keep Spending (Wisely)" was the slightly surprising message from the International Monetary Fund this week. In a blog published this week, the IMF said $11 trillion in support from G20 countries had stopped an even deeper depression, but the organization said support to poorer countries needs to continue as long as the pandemic does.

Chinese-backed social media sensation TikTok has signed a deal with Sony Music Entertainment to expand the in-app music library users can choose from to soundtrack their videos. In return Sony will be able to promote its musicians on the popular platform.

Two large U.S. fast-food chains will operate under the same umbrella after ** Inspire Brands Inc agreed to buy Dunkin' Brands Group for $8.76 billion** . Dunkin' owns Dunkin Donuts and Baskin-Robbins ice cream parlors, and will add a sweeter edge for the Inspire group which owns Arby's, Buffalo Wild Wings and Sonic Drive-In.

Malaysia's state energy firm Petronas is to pay $1.5 billion to the government as a dividend this year, despite losing $5 billion between April and June. It was the company's first quarterly loss in five years. The news was packaged as part of the Kuala Lumpur government's new budget measures.

Global eyewear group** EssilorLuxottica said its quarterly sales figures showed shoots of recovery,** but the Oakley and Ray-Ban maker said it would wait until at least December before deciding if it is in a strong enough position to pay a dividend at the end of the year.

Hungarian-British ** low-cost airline Wizz said its passenger numbers were still 69 percent lower in October than in the same month in 2019** , despite

running flights through the summer

. The announcement came days ahead of the company's expected half-year filing on Thursday.

Tobacco majors continue to search for diversification, with giant British American Tobacco among those announcing new acquisitions. Today BAT bought the nicotine pouch business of U.S.-based firm Dryft Sciences. That takes BAT's product line from four oral products to 28, as the Scandinavian method of nicotine delivery enjoys a burst of popularity.

Chinese computing firm Lenovo posted a quarterly profit that beat analysts' expectations, as it benefits from the "new normal" of home working and leisure**. "Last quarter was what I would call a perfect quarter for Lenovo,"company chairman Yang Yuanqing said.**

Saudi Aramco, Saudi Arabia's state oil and energy company, said its third-quarter profit slumped by 44 percent as the pandemic continued to choke demand, prices, and production. Smaller margins on refining and chemical sales knocked quarterly net profit down to $11 billion.

German fashion house Hugo Boss said its online business was recovering, with sales mainly driven by Chinese customers and benefitting from a pivot to more casual wear, as working from home dominates many markets.** The company returned to a $17 million profit on the quarter, which CEO Yves Mueller said showed the benefit in selling "a lot more … than the classical suit."**

Daddybaby is one of China's dominant nappy and sanitary towel producers and has now been approved by the EU to manufacturer personal protective equipment – which it has been producing** at the rate of 4.5 million masks per day since the beginning of the pandemic.**

After lines were seen outside many European shops this weekend ahead of widening and stricter lockdown rules, Kimberly-Clark, the maker of Andrex toilet roll and other products said it had "prepped for stockpiling." The firm said it had 100 million rolls waiting, and it hoped that would be enough to stop it being caught short.

CLICK: BELGIUM'S KNUFFELCONTACT SYSTEM AIMS TO ALLEVIATE ANXIETY DURING COVID-19

Watch: A 24-year-old Scot has been collecting vintage plastic carrier bags for the past two years and now is showing her collection to the world. ♻️

01:54

Matthew Oxenford is an analyst focusing on Europe for The Economist Intelligence Unit. After the UK's business leaders pleaded for government help, CGTN Europe talked to him about the challenges facing the UK economy.

The CBI talked about a "triple threat" to the UK economy ** – how do you see the next three months for business owners?**

Businesses are going to have to adjust to an exceptional shock from the Brexit transition period with very little time to adjust. On top of this pandemic, it's made Brexit a very difficult transition at a very difficult time.

Should this business landscape be seen as an opportunity for firms to restructure?

I think a lot's going to depend on what the government does in 2021. They've been very focused on delivering Brexit and also dealing with damage from the coronavirus in a very reactionary way.

I think the government has been very reluctant to do a lot of what they've been doing in terms of this lockdown's pandemic and you can see how reluctant some members of the Conservative Party have been to lock down. The key issue is whether or not businesses will be supported through this, how much the government is willing to spend to make sure that businesses survive.

Is the real "double whammy" going to be a second wave and a "no deal" Brexit?

I think the second wave and even the pandemic in the first place has made the stakes for the government of actually reaching a trade deal incredibly high.

简体中文

简体中文