**Editor's note: **COVID-19: Economic Analysis is a series of articles comprising experts' views on developing micro and macroeconomic situations around the globe amid the COVID-19 pandemic.

China's economy shrank the first time in history due to the coronavirus pandemic's effect on production and consumption.

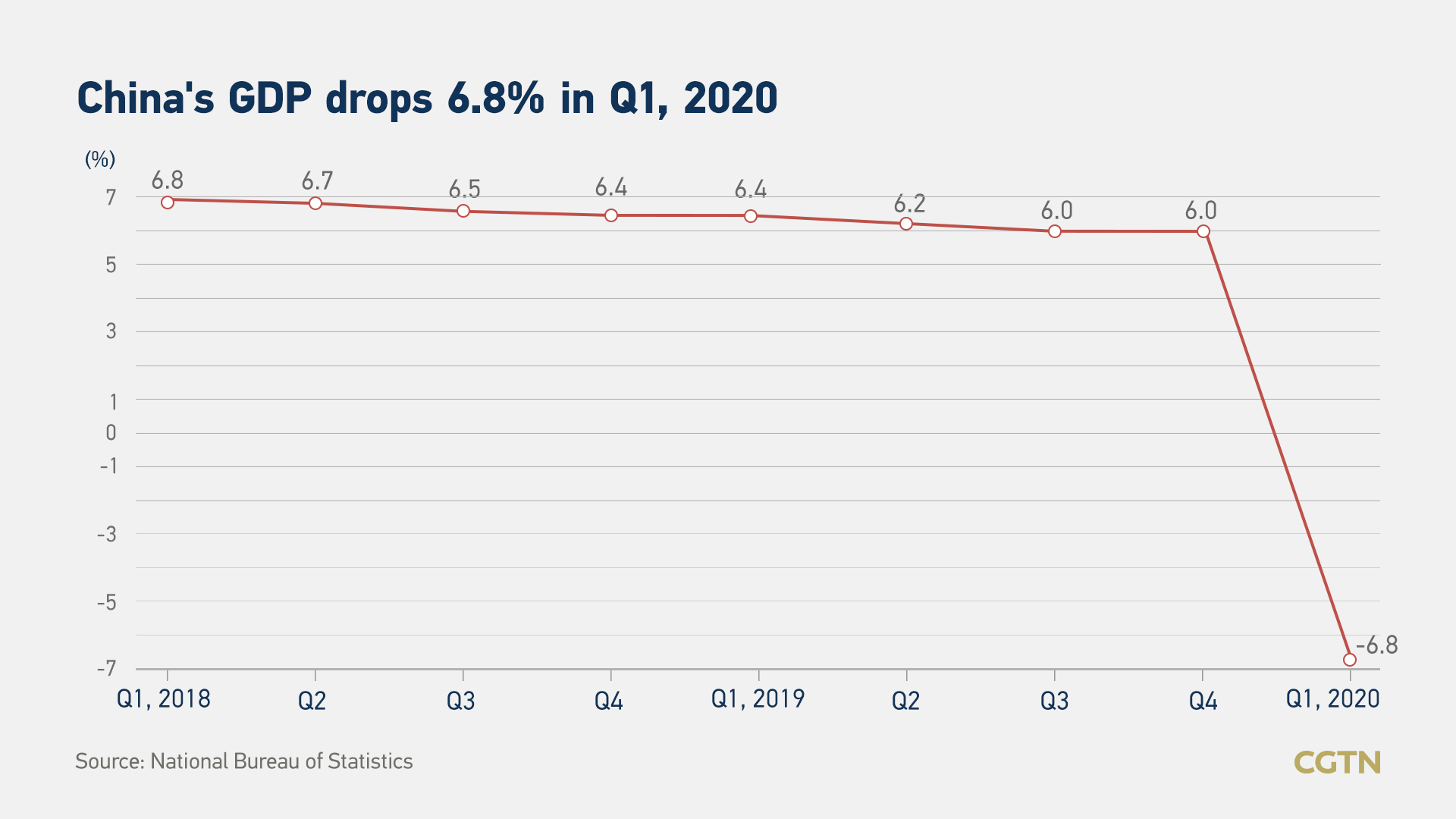

The world's second largest economy's gross domestic product (GDP) contracted 6.8 percent year-on-year in the first quarter of 2020, the National Bureau of Statistics (NBS) announcedon Friday.

The bureau also released a slew of economic data in March, from which analysts have seen bright points and V-shaped signs, giving the market confidence of recovery as the country is working hard on resuming production.

CGTN talked to three economists from major banks in China to get a sense of where the country's economy is going.

Negative 6.8% growth is expected

Though the 6.8 percent contraction made the weakest report since 1992, when the country started to use the GDP measure, the market seems not surprised.

"It is within the expectations," said Hong Hao, head of research and chief strategist at BOCOM International, in a telephonic interview with CGTN. "Because the expectations before the data released were very volatile."

The latest Reuters poll trimmed China's GDP growth forecast for Q1 from more than three percent to negative 6.5 percent, while Goldman Sachs' forecasted that the world's second largest economy is set to record a nine percent plunge.

"The forecasts of economic growth in our country had been very contrasting," said Lu Zhengwei, the chief economist of Industrial and Commercial Bank of China, echoing Hong's views that the drop was in line with expectations.

CHECK OUT LU'S FULL INTERVIEW WITH CGTN

04:40

Something warmed up in March

Looking at the data in March and comparing it with the two previous months, the economists believed China's economy was gradually getting back on track.

"With the resumption of work and production, data showed a month-on-month improvement in March," said Zhang Wenlang, the chief macro analyst at Everbright Securities, in an email-basedinterview with CGTN.

Both Zhang and Lu mentioned the significant rebound in industrial production in March, only 1.1 percent lower than a year ago, and the downturn narrowed 12.4 percent than the January-February period.

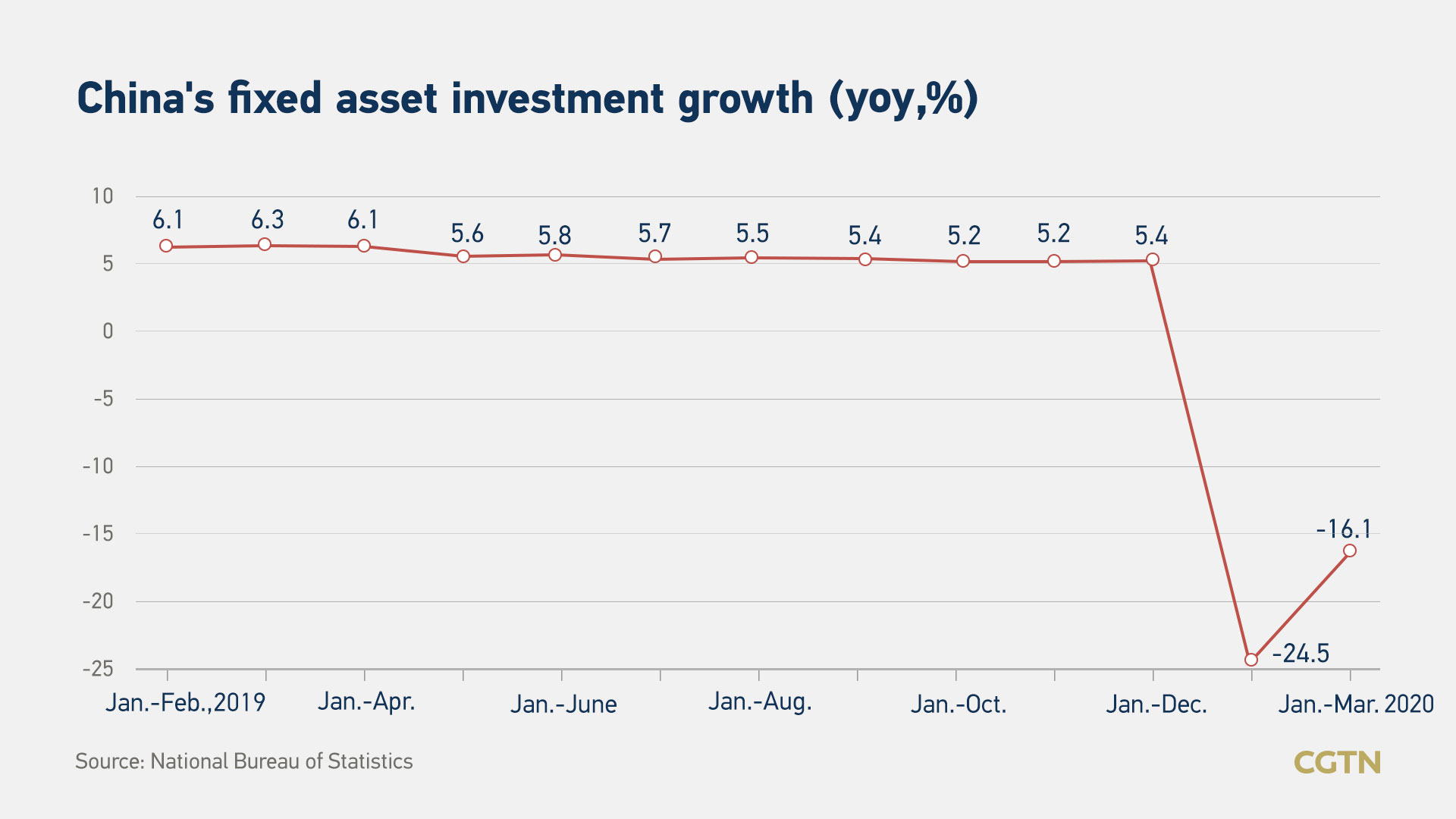

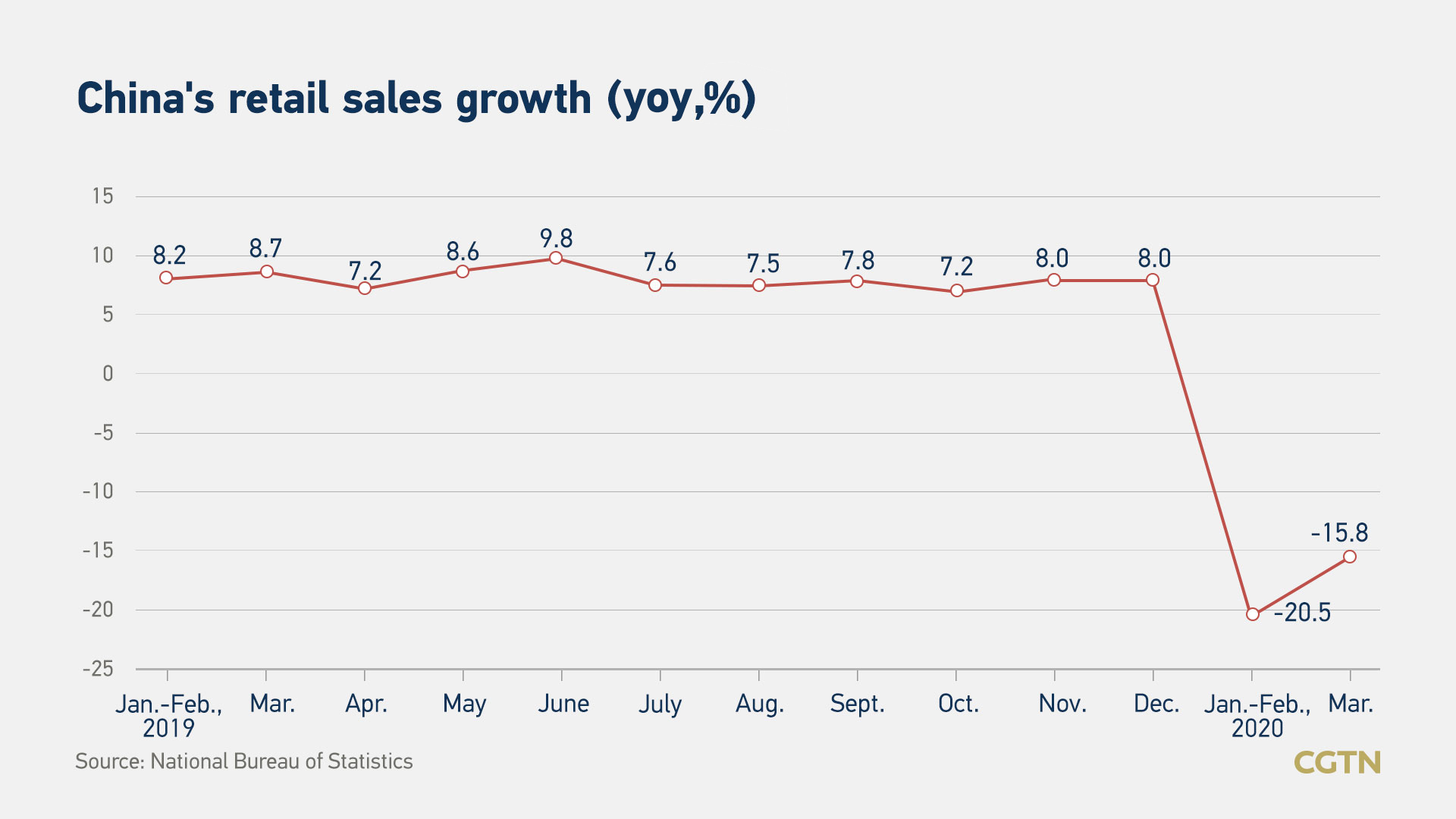

The drop also narrowed in Marchin consumption and investment, which Hong called "key areas that we will be looking at."

"We are seeing some marginal improvements in retail sales and investment sector," said Hong, adding that he hopes the investment "can go on a bit more" in Q2.

According to NBS, fixed investment saw a solid rebound and narrowed the quarterly fall to 16.1 percent, compared to a fall of 24.5 percent during January-February period, according to NBS.

Retail sales in the month were 15.8 percent lower year-on-year, compared to the 20.5 percent fall in previous two months.

"The entire economy has passed the bottom of the V-shape, beginning to enter the stage on the right side of the shape," Lu told CGTN. He personally thought China's economy has recovered between 85 and 90 percent.

IT industry resilient but services requiring human contact recover slowly

In the first quarter, the tertiary industry suffered less than the whole economy's downturn, only dropping by 5.2 percent.

In the services sector, information transmission revenue rose by 13.2 percent, while that of software and information services rose by six percent. The investment in e-commerce increased by 39.6 percent, while that in the special technology services went up by 36.7 percent.

"These means (sectors) tightly integrated with automation and digitalization have shown greater resilience (amid the pandemic)," stressed Lu.

However, personal consumption, especially for those that require personal contact suffered the most. For example, the catering industry's revenue fell by 46.8 percent in March.

"Industry is better than services (amid pandemic)," Zhang told CGTN. "The life services which depend on personal contact will be stressful, such as catering, retail, tourism, etc."

Lu holds the same opinion as Zhang. He said anything that requires human contact or gathering will recover slower.

External demand is next thing to worry, but whole year's economy will turn positive

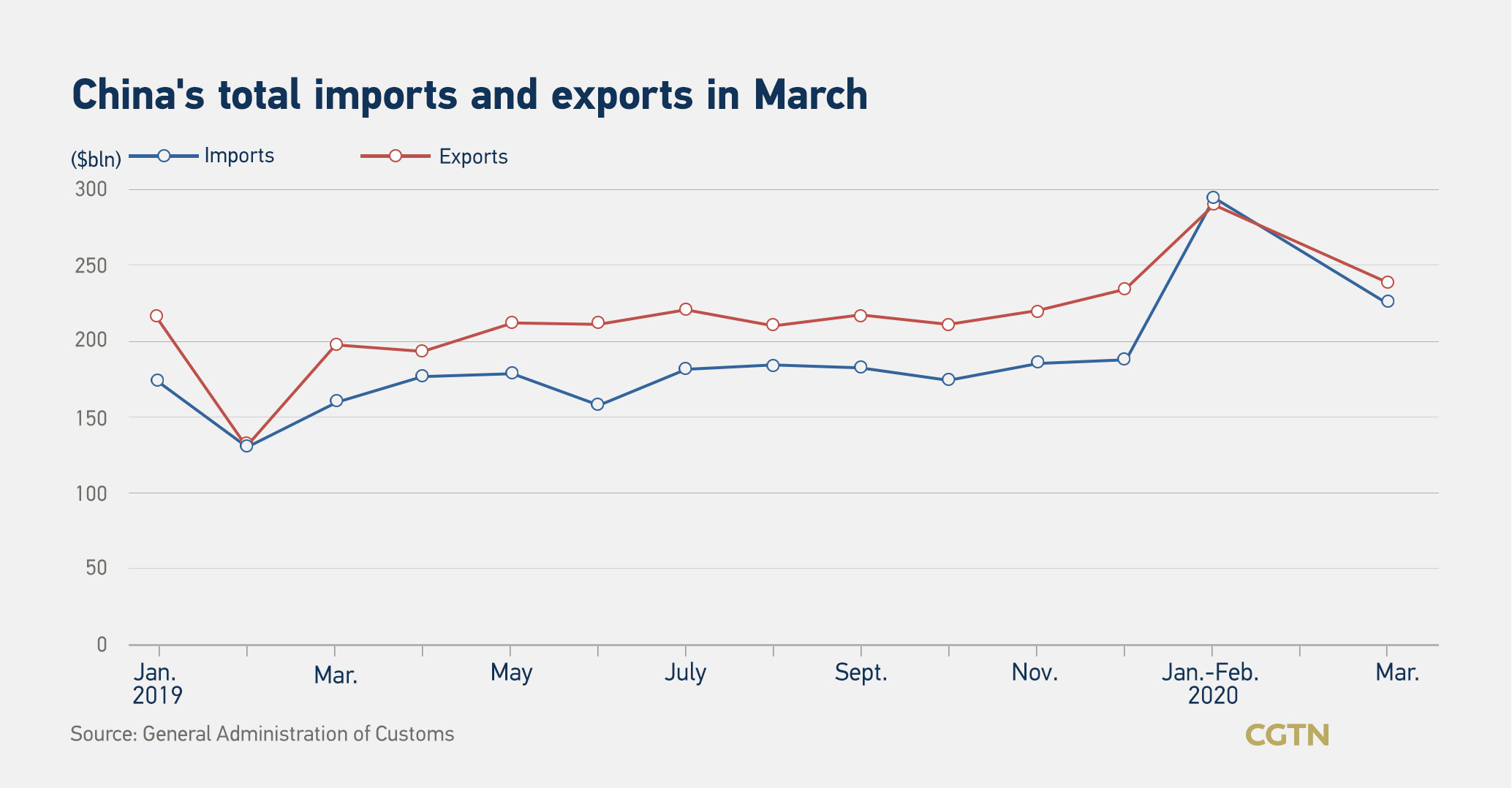

"The next thing we have to worry about is external demand," said Lu. With no end to the pandemic in sight yet, Lu is concerned the "external demand may have an increasing impact on the Chinese economy."

Zhang and Hong has the same concern as Lu. Since the western countries are still going through what China has been through in around February, how the COVID-19 will affect their economies and market demands from China is the next question.

In the long term, all the three economists believed, the country's economic performance of the whole year will turn positive. Hong specifically expected that it would be around 1 to 2 percent growth.

However, for the second quarter, Lu and Hong hold different views. Lu said the GDP of Q2 will be positive since the resumption of production is going well in China, and the related stimulus policies have already been issued. But Hong believed the second quarter will be relative to the first quarter, since the country is "still dealing with collecting the extent of demand" and it needs time for the consumption to go back to its previous levels.

(Video edited by Xie Runjia)

简体中文

简体中文