Some good news for a quiet year of deal-making in Silicon Valley: Microsoft will purchase LinkedIn in an all-cash $26.2 billion sale,the companies announced Monday. Microsoft C.E.O.Satya Nadellahas agreed to pay $196 per share for the business-oriented social networking giant, which has more than 400 million members.

The timing is particularly good for LinkedIn, which has been having a tough few months. In February, the public company had its worst day ever, with shares of its stockplunging as much as 44 percentafter it released weaker-than-expected earnings guidance. Then, LinkedIn suffered a huge data breach, in which 117 million passwords were hacked and put up for sale on the black market. The effects were wide-ranging, affecting high-profile users includingFacebook C.E.O.Mark Zuckerberg.

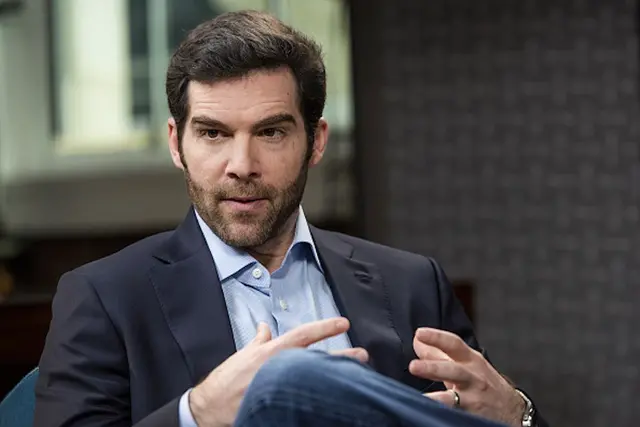

Microsoft has some interesting ideas for how it could integrate its own products with LinkedIn, whose stock jumped about 50 percent on the news. “The LinkedIn team has grown a fantastic business centered on connecting the world’s professionals,” Nadella saidin a statement. Moving forward, the C.E.O. said, his vision is for Microsoft’s Office software to combine with LinkedIn’s network. For example, LinkedIn’s newsfeed could offer you an article based on a project you’re working on in Microsoft Word or PowerPoint, or Microsoft Office could suggest an expert source for you on LinkedIn to help you complete an assignment. LinkedIn founderReid Hoffmanhas approved of the deal, though it’s not clear what his role will be at LinkedIn moving forward. LinkedIn C.E.O.Jeff Weinerwill stay in his current role and report to Nadella. LinkedIn will continue to operate as an “independent brand,” the companies said in their announcement Monday.

The acquisition—the largest-ever M&A deal for an Internet company—is good news for Twitter, another embattled public tech company. Twitter has struggled to entice new users and sell ads on its platform, even after the heralded return of co-founderJack Dorseyas C.E.O. For the better part of the past year, criticshave said an acquisitioncould be one way for Twitter to solve its problems. But dealmaking has been slow in Silicon Valley this year. In the first three months of 2016,according to Ernst & Young, the aggregate value of tech deals done was $66.7 billion—down 14 percent year-over-year, and 65 percent sequentially (the last three months of 2015 had the second-highest quarterly tech M&A value of all time, EY reports).

Private-market tech companies have been slow to go public this year, too, though that’s been picking up recently. Japanese messaging platform Line just filed for an I.P.O. in both Tokyo and New York, and $2 billion meal-kit service Blue Apron isalso said to be seeking new funding, possibly in the form of a public offering. It’s still unclear who would purchase Twitter—as Nick Bilton reports, Google’sLarry Pagedoesn’t seem very interested, and while Facebook’s Zuckerberg has tried twice to buy Twitter, he probably wouldn’t want to get into a bidding war to do it now, especially now that he’s taking on live news on his own platform. Still, the multibillion-dollar purchase of LinkedIn could mark a turning point for tech M&A, and Twitter stands to be next. After Microsoft released its news, Twitter shares spiked by as much as seven percent.

(VANITY FAIR)

简体中文

简体中文