By APD writer Alice

Amidst the global COVID-19 pandemic that has been crippling the economies of many countries, China is emerging as the best haven for investors, as the epidemic is settling down in the country, allowing production, trade and service activities to gradually recover.

China's economy to recover from 2nd quarter

On March 19, China's National Health Commission said the previous day, there were 34 new COVID-19 infections in the country but all were "imported cases". This was the first time China had recorded no new domestically transmitted cases since the epidemic broke out in Wuhan city, Hubei province.

Now, China, where the coronavirus originated, suddenly becomes the best place for investors to take shelter amid the global economic slowdown.

There are many reasons to believe that the prospects of markets in China are more attractive than almost anywhere in the world, whether in terms of policy, macro factors or the power of some business sectors.

Last week, economists at JPMorgan Bank forecast that China's first quarter GDP will decline 40% from the previous quarter, the sharpest decline in 50 years. But in the second quarter, its GDP will recover quickly with a growth of 57%. This growth momentum will continue in the third and fourth quarters, helping China's economy expand 5.1% this year.

According to JPMorgan Bank, the US and Eurozone economies in Q1 will also suffer a big shock with a decline of 4% and 15% respectively. In the second quarter, their respective growth slowdown will be 14% and 22% when economic activities are paralyzed in the context of the dizzy spread of COVID-19.

JPMorgan economists said that although the growth of the US and the Eurozone is expected to recover in the second half of this year, for the whole year, their economic expansion will decline 1.9% and 0.1%, respectively.

One of the reasons to make analysts more optimistic about China's economic prospects is the rather cautious response of policymakers in Beijing as compared to those in the West. Earlier, the founder of a hedge fund in Hong Kong forecast that central banks in developed markets will soon run out of market stabilization tools, when most of them have brought interest rates close to 0% and all quantitative easing programmes have been implemented. On the contrary, China still has many options to support the economy.

According to Taimur Baig, chief economist at DBS Bank in Singapore, Chinese monetary policymakers seemed to be wise when keeping a cautious stance and not rushing to launch massive stimulus programmes.

Baig noted that the People's Bank of China (PBoC) should have been able to massively pump liquidity into the market to relieve all cash flow tensions. But such an action would not be in line with a debt-relieving campaign to promote growth that Beijing has consistently taken over the past years.

Instead, the PBOC took a more focused approach, such as encouraging banks to provide loans for small and medium enterprises to stabilize the labor market.

Despite allowing commercial banks to lower the required reserve ratio to boost lending while reducing lending rates, the central bank of China still maintains deposit rates. This allows Chinese households to still earn income from savings, unlike those in Japan, Europe or the United States.

JPMorgan Bank economists said if their judgment is correct, China is the first country to suffer losses from the COVID-19 but it will also be the first country to escape the pandemic’s impact. They noted that economic activity indicators which the bank monitors daily are recovering in China.

China’s markets are more stable than those outside

Analysts' optimism about China's economic prospects is partly based on the fact that real asset prices in China are more stable than many other markets. The CSI 300 Index, which represents the 300 largest A-class stocks on the Shanghai Stock Exchange and Shenzhen Stock Exchange, has dropped only 12% since the beginning of the year.

Meanwhile, the S&P 500, which represents the 500 stocks with the largest market capitalization on the New York Stock Exchange and the Nasdaq, plunged twice at 25.5%.

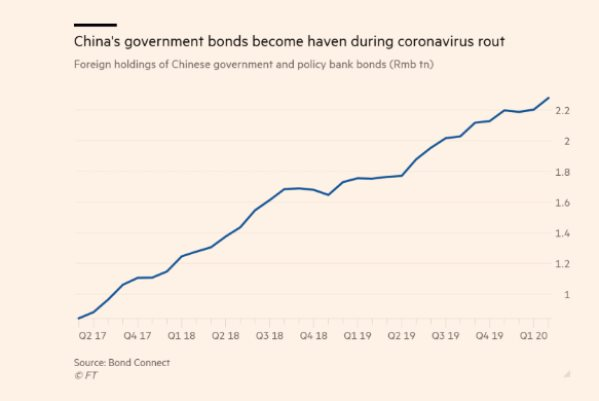

The Chinese yuan is still maintaining a reasonable volatility against the US dollar and the Chinese bond market is receiving record investment cash flows from foreign investors.

In February, through the Bond Connect programme in Hong Kong, foreign investors spent 75 billion yuan (US$10.8 billion) buying Chinese government and policy bank bonds.

The purchases increased total foreign ownership of sovereign renminbi bonds to a record 2.27 trillion yuan even as much of the country went into lockdown after the viral outbreak.

Zhang Yichen, Chairman and CEO of CITIC Capital Holdings Limited, a major investor in McDonald's restaurant chains in mainland China and Hong Kong, said 90% of McDonald's restaurants in these two markets have been reopened and sales have recovered 80%.

Meanwhile, in the US, on March 16, McDonald's was forced to close its dining spaces at all restaurants directly managed by the company. It now only serves customers to take away and order online.

Rebecca Chua, founder of investment company Premia Partners, said the economic impact of the COVID-19 pandemic has not yet peaked in many parts of the world but in China. “We are witnessing positive points and one of them is the digitization acceleration of the economy, partly due to the lockdown orders.

As more schools in China were closed, the number of users of Alibaba's free online chat platform Ding Talk skyrocketed as most of teaching activities were made online. Many businesses in China also allowed employees to work from home via Tencent's WeChat Enterprise platform and Ding Talk, where they could share documents and discuss online.

(ASIA PACIFIC DAILY)

简体中文

简体中文