Pedestrians pass by a closed restaurant in New York, the United States, March 15, 2020. (Photo by Michael Nagle/Xinhua)

**We could see a 30 percent contraction in the U.S. economy in the second quarter. The COVID-19 pandemic will also have ripple effects across the world, and will be especially damaging for emerging economies that rely on export markets in the advanced countries, said a renowned U.S. expert. **

WASHINGTON, March 23 (Xinhua) -- The spreading COVID-19 pandemic that has made 100 million Americans stay at home will have a "catastrophic short-term impact" on the U.S. economy, a renowned U.S. expert said on Monday.

"We could see a 30 percent contraction in the economy in the second quarter. The length of the recovery will depend both on the progress of the virus, and on whether many businesses are driven into bankruptcy over the next few months," Edward Alden, Bernard L. Schwartz Senior Fellow at the Council on Foreign Relations, told Xinhua via email.

The U.S. economy is driven mostly by consumer spending for goods, restaurants, conventions, hotels, gyms, sporting events, concerts etc., "much of this has been shut down," said Alden.

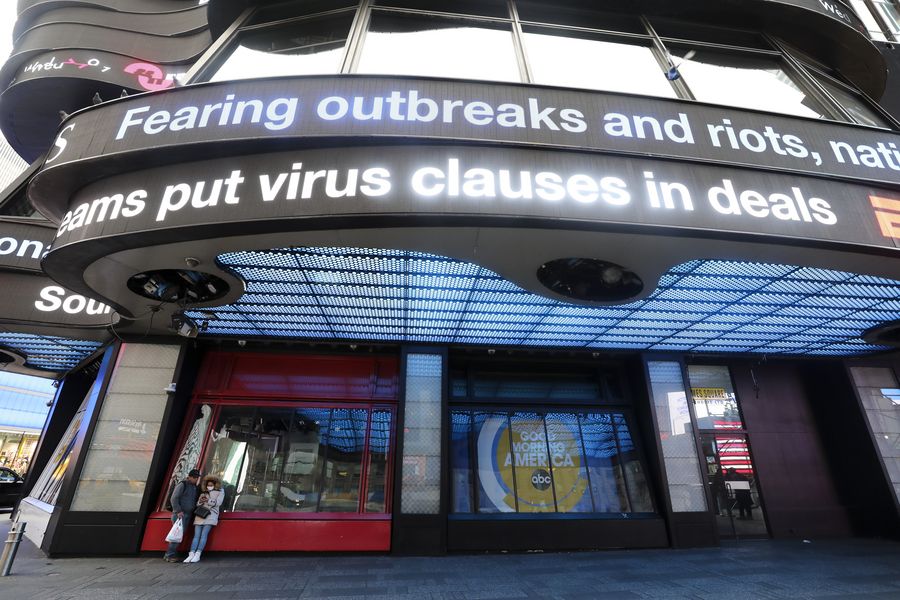

Tourists have a rest under an electronic news bulletin on Times Square in New York City, the United States, March 19, 2020. (Xinhua/Wang Ying)

The outbreak is "equally damaging" for the world economy, he said. "Despite warnings, the world was not well-prepared for this. And we will all pay a high price."

"With few exceptions, Japan, South Korea, perhaps China if it keeps containing the virus," all the major economies are relying on the strategy of shutting down their economies to prevent the spread of the virus, Alden said.

"This will have ripple effects across the world, and will be especially damaging for emerging economies that rely on export markets in the advanced countries. It is quite possible that this will tip over into an emerging markets financial crisis," he said.

The U.S. Federal Reserve (Fed) announced on Monday a plan to purchase U.S. treasuries and agency mortgage-backed securities with no limit to help markets function more efficiently amid coronavirus uncertainty.

The Fed is "doing everything within its ability" to shore up the economy and stave off deeper financial problems, Alden said.

People walk past a closed broadway theatre near Times Square in New York, the United States, March 21, 2020. (Xinhua/Wang Ying)

"It has behaved with an appropriate urgency that comes from learning the lessons of the 2008 financial crisis -- that there is far more danger in under-reacting than in over-reacting," he said.

It is "encouraging" to see the Congress is discussing a large economic stimulus package, "which is desperately needed," he said.

"But the Senate at the moment has its priorities backwards, focusing far more on bailouts for large companies -- which are best able to weather this storm-- and less on far more urgent needs, including expanded unemployment insurance, guaranteeing sick leave for workers, ensuring that health care workers have the tools they need to stay safe, and getting money quickly into the hands of Americans who need it," he said.

A total of 573 people have died from novel coronavirus in the United States, where there are 41,511 confirmed cases, by 3:30 p.m. U.S. Eastern Time (1930 GMT) on Monday, according to the Center for Systems Science and Engineering (CSSE) at Johns Hopkins University.

By Wednesday, when all 12 current state orders take effect, more than 126.8 million people, or 39 percent of the U.S. population, will be officially urged to stay home, reported CNN on Monday. ■

简体中文

简体中文